|

Put all

this against the background of “An Account at Martins Bank”, and you will

see that the Bank is not simply touting for business, it is trying to

persuade huge numbers of ordinary people that conducting a banking

account IS for them, and it

is also safe and easy to do…

Why you need a Banking account

It is not necessary to be

rich to have a banking account, but more and more people are beginning to appreciate the wisdom

of keeping their money in a bank where it is absolutely safe from loss.

Martins Bank offers you a first class banking service whether you are

wage-earning, salaried or of independent means. Let us tell you about it. It is not necessary to be

rich to have a banking account, but more and more people are beginning to appreciate the wisdom

of keeping their money in a bank where it is absolutely safe from loss.

Martins Bank offers you a first class banking service whether you are

wage-earning, salaried or of independent means. Let us tell you about it.

There

are two main ways in which a banking account can be of great help; in the

first place, as an orderly and systematic way of conducting your affairs,

and secondly as a means of saving. Similarly,

there are two main types of account you can open at a bank, a current

account and a deposit account. The first is the usual type of account into

which you can pay the money you receive and out of which you can draw cash

as you require it or pay your various outgoings by cheque. For instance,

you can pay in your salary cheque each month or arrange for it to be

credited direct, or you can pay in money from your weekly wages and any

other cheques or dividends you may receive; and all your outgoings such as

coal, gas, electricity, rent, rates, taxes, insurance premiums, hire

purchase instalments and so on can be paid by cheque. Or, if you are a

housewife, you can pay in your housekeeping allowance and settle your

accounts at the various shops by cheque. The bank keeps a proper statement

of the account and any time you wish to know your exact position you can

ask for this statement or it can be sent to you by post. In one column you

will see all the amounts paid in and in another all the amounts paid out,

the remaining balance being clearly shown. This enables you to have a

complete record of your financial affairs and to know where your money has

gone, and that is a big step towards saving some of it. You can, if you

wish, have a separate account for your savings which will earn interest:

this is a “deposit account” and you can, of course, open an

account of this kind even if you feel you do not need a current account.

There is no charge for keeping a deposit account.

In view of the work involved in operating a current account, the manager

may find it necessary to make a small charge in some cases, but he will be

glad to explain why, when you call upon him. If you call on, or write to, the Manager of any of the Bank's

branches, he will be pleased to give you full details and help you to

decide which type of account will suit your needs. There

are two main ways in which a banking account can be of great help; in the

first place, as an orderly and systematic way of conducting your affairs,

and secondly as a means of saving. Similarly,

there are two main types of account you can open at a bank, a current

account and a deposit account. The first is the usual type of account into

which you can pay the money you receive and out of which you can draw cash

as you require it or pay your various outgoings by cheque. For instance,

you can pay in your salary cheque each month or arrange for it to be

credited direct, or you can pay in money from your weekly wages and any

other cheques or dividends you may receive; and all your outgoings such as

coal, gas, electricity, rent, rates, taxes, insurance premiums, hire

purchase instalments and so on can be paid by cheque. Or, if you are a

housewife, you can pay in your housekeeping allowance and settle your

accounts at the various shops by cheque. The bank keeps a proper statement

of the account and any time you wish to know your exact position you can

ask for this statement or it can be sent to you by post. In one column you

will see all the amounts paid in and in another all the amounts paid out,

the remaining balance being clearly shown. This enables you to have a

complete record of your financial affairs and to know where your money has

gone, and that is a big step towards saving some of it. You can, if you

wish, have a separate account for your savings which will earn interest:

this is a “deposit account” and you can, of course, open an

account of this kind even if you feel you do not need a current account.

There is no charge for keeping a deposit account.

In view of the work involved in operating a current account, the manager

may find it necessary to make a small charge in some cases, but he will be

glad to explain why, when you call upon him. If you call on, or write to, the Manager of any of the Bank's

branches, he will be pleased to give you full details and help you to

decide which type of account will suit your needs.

Home Safe accounts

The Bank also opens

savings, or “Home Safe”

accounts. The “safe” is in the form of a little book into which odd coins

may be slipped. It can be emptied at the Bank and the amount entered into

the bank book. Such accounts bear a special rate of interest.

Your cheques cashed

The Bank will arrange for

you to cash your cheques anywhere in the country where there is a bank,

either at one of our branches or at a branch of one of the other banks.

Insurance premiums club

subscriptions

and other regular payments

Martins Bank will, if

desired, pay your insurance premiums, club subscriptions and other regular

payments when they become due.

Investment service

If you want help or advice

about investments, our Managers will gladly obtain for you advice from the

experts in such matters.

Foreign currency and Travellers' Cheques

If you go abroad the Bank

will supply foreign currency and travellers' cheques which can be exchanged

for foreign currency.

Your Income Tax

The Bank will also attend

to your Income Tax affairs.

Your Will

The Bank will act as

Executor or Trustee for you.

A reference supplied

They

will also supply a reference for you, a useful facility if you are applying

for a passport, or opening a shopping or credit account.

Your valuables guarded

The

Bank provides accommodation in their strong rooms and safes for your deeds,

share certificates, or other documents of value; and for locked boxes or

sealed parcels containing jewellery or other valuables. In all these

matters strict secrecy is observed and your affairs will not be divulged to

any other person, relation or otherwise, without your knowledge and

permission. The

Bank provides accommodation in their strong rooms and safes for your deeds,

share certificates, or other documents of value; and for locked boxes or

sealed parcels containing jewellery or other valuables. In all these

matters strict secrecy is observed and your affairs will not be divulged to

any other person, relation or otherwise, without your knowledge and

permission.

Personal

loans

Martins will grant personal

loans for important items of expenditure. Usually no security will be

required as the integrity and character of the borrower and ability to meet

the regular repayment instalments are the deciding factors. This is a

simple and advantageous way of raising a lump sum of money. Please ask for

a copy of our Personal Loans Leaflet, which gives full details of the

facilities. All these

advantages are yours as the possessor of a banking account, current or

deposit. In addition, at any time you may draw upon the experience and

knowledge of your bank manager and his friendly help and guidance without

obligation. All you need to do is make an appointment with him or write to

him.

A word about Martins

At

this point we ought to try to tell you something about ourselves. Martins

Bank operates over 600 branches throughout England, Wales, the Channel Isles

and the Isle of Man. The Bank started as the Bank of Liverpool over 125

years ago but the old private bank, Martin's Bank, London, which became

part of the larger bank in 1918, dates back to 1563—and the grasshopper in the Bank's coat of

arms is the emblem which Sir Thomas Gresham, the famous Elizabethan

financier, displayed outside his house in Lombard Street, where our

principal London office now stands, and where banking business has been done

without a break since the sixteenth century. Incidentally, the bird which

is prominently displayed on

our coat of arms is the Liver Bird of Liverpool. At

this point we ought to try to tell you something about ourselves. Martins

Bank operates over 600 branches throughout England, Wales, the Channel Isles

and the Isle of Man. The Bank started as the Bank of Liverpool over 125

years ago but the old private bank, Martin's Bank, London, which became

part of the larger bank in 1918, dates back to 1563—and the grasshopper in the Bank's coat of

arms is the emblem which Sir Thomas Gresham, the famous Elizabethan

financier, displayed outside his house in Lombard Street, where our

principal London office now stands, and where banking business has been done

without a break since the sixteenth century. Incidentally, the bird which

is prominently displayed on

our coat of arms is the Liver Bird of Liverpool.

The

constant aim of our managers and every member of our staff is the

maintenance of a friendly personal relationship with every customer, whose

presence in the bank is always welcomed whether he has £1 or £1,000 in his account. Again and again our customers tell us "Martins

Bank is such a friendly bank" and we train our staff in the tradition

of the family, all working together for what is, in many respects, a great

public service. It is also of interest to

note that in the course of our growth we have absorbed or amalgamated with

over thirty smaller banks, many of them family concerns steeped in the same

excellent tradition. We hope, after what

we have said, that you will feel that we have something to offer you and

you will now want to know how to set about opening your account and how to

conduct it. The

constant aim of our managers and every member of our staff is the

maintenance of a friendly personal relationship with every customer, whose

presence in the bank is always welcomed whether he has £1 or £1,000 in his account. Again and again our customers tell us "Martins

Bank is such a friendly bank" and we train our staff in the tradition

of the family, all working together for what is, in many respects, a great

public service. It is also of interest to

note that in the course of our growth we have absorbed or amalgamated with

over thirty smaller banks, many of them family concerns steeped in the same

excellent tradition. We hope, after what

we have said, that you will feel that we have something to offer you and

you will now want to know how to set about opening your account and how to

conduct it.

How to open an account

Any adult person can open

an account by walking into any branch and asking to see the Manager. If he

is not available, the cashier can handle the routine details equally well.

Accounts can also be opened for those who are not yet 21, students and

young people, maybe but not necessarily living away from home and who can

appreciate the responsibilities entailed in having a cheque book. The procedure is perfectly simple: you will be asked

for your full name and address, a reference, and a specimen of your signature

so that the officials of the bank may familiarise themselves with it and

have it available for comparison when necessary. The person to whom

reference may be made must be someone who knows you. This can be discussed

at the time of opening the account and the Manager will guide you as to who

is a suitable person. You will appreciate that asking for a reference is a

general safeguard of the banking system before a book is issued.

Paying money in

After

the formalities have been completed the thing to do is to place a sum of

money to the credit of the newly-opened account. The sum need only be a few

pounds, and indeed many of our customers start in a very small way. After

the formalities have been completed the thing to do is to place a sum of

money to the credit of the newly-opened account. The sum need only be a few

pounds, and indeed many of our customers start in a very small way.

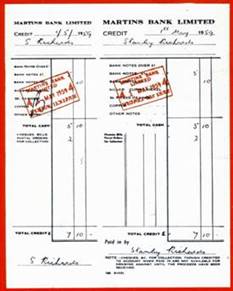

You can have a paying-in

book if you wish and, as counterfoils are provided, you can keep a record

of all sums you pay in and check them off against your statement of account

from time to time. Some people use the loose credit notes provided in the

boxes at the counter and these are supplied without counterfoils. Many people do not counterfoils but you

may prefer to have one which the cashier will stamp and return to you when

he receives your money.

You can pay in cheques,

money orders, orders and dividend warrants as well as cash, and you can pay

in at any branch of any bank as well as your own, so long as you remember

to put the name of your own bank and branch on the credit note in addition

to the name of the account to be credited. The receiving bank will send it

to your bank the same day.

The use of a cheque book

The

Bank makes no charge for a cheque book, but collects the value of the stamp

duty of 2d. to which each cheque is liable and hands it over to the Revenue

Authorities. Cheques for current accounts are made up in books of twelve

costing 2/-, twenty-four costing 4/-, or in larger sizes to suit

requirements. The use of a cheque avoids the necessity of carrying large

sums of cash about with you and provides a convenient record of the

payments you make from your balance in the Bank. You can give cheques to nearly

everyone to whom you owe money. You also, of course, use a cheque to get

money from your account for

yourself and, as we have mentioned earlier in this booklet, one of the

great advantages of

having a banking account is that we can arrange for you to draw cash

yourself at any branch of any bank in the British Isles. This is an additional convenience if you

are staying in a place where we have no branch of our own. You have to sign each cheque, as this is

your authority to us to pay it, and it must also be dated and the name of

the person or firm who is to receive the money written upon it;

and, of course, the amount

which must be both in words and figures. This latter proviso is a safeguard

against the accidental insertion of a wrong amount. When filling in your cheques there are a few

simple rules to be observed for both your protection -

and ours.

1.

Please

always write your cheques in ink…

2. Start writing as far over to the left-hand side

as possible and do not leave spaces between words. The same remarks apply

to figures. Remember that 'seven' could be altered to 'seventy' and '£7' to '£70' if

space is left. Draw a line through any blank space on your cheque…

3. If you make a mistake, alter it in a legible way

preferably by crossing it out and re-writing the altered word or figure,

and sign your name against each alteration…

4. Always sign in the same manner as you did when

you gave the specimen of your signature on opening your account, otherwise

its correctness may be queried…

5. Remember to fill in the counterfoil. Not only is this

a record of the cheques you issue to keep you up to date with your

financial position, but you can check the counterfoils against your bank statement and should a

cheque be lost or for any reason you wish to stop payment of it, you will

have the exact details to give to the Bank…

|

![]()

![]()

![]()

![]()