|

|

<

![]()

|

NEW TECHNOLOGY – AUTO SORT EXERCISE |

![]()

|

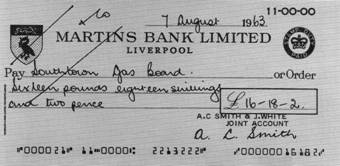

Following a great deal of research, much of it by

Martins’ own Ron

Hindle, the Committee of London Clearing Bankers

publishes “Requirements for Automatic

Cheque Processing” in 1962, but Martins is first to seize the initiative

and convert words into actions.

“The Pegasus Computer System installed in Liverpool in 1961

was in use for branch book-keeping before any other bank announced similar

developments. The I B M Reader/Sorter

was installed in London in the same year and work is in progress to marry the

current account and the clearing operations in order to provide an integrated

accounting system” Sir John Nicholson,

Bart CLE JP - Chairman of Martins Bank

- Summer 1963 To keep the staff of the Bank informed of these important

developments, Martins Bank Magazine publishes the following article in its

Autumn 1963 issue. It gives a glimpse

into the future of the ordinary bank branch – and crucially, the machinery

and processes that everyone will have to adopt to cope with the exponential

growth of payments by

cheque that will

characterise banking in the 1970s.

AUTO SORT EXERCISE

MAGNETIC ENCODING

The listing and encoding completed, the

total amount of the cheques was compared with the remitting bank's figure and,

as it happened, found to be 10d short. Once the error was located—a cheque for £12.15.10d had been listed as

£12.15.0d—the correcting method was explained and demonstrated. An encoded amount can be read by the automatic sorter

only if preceded and followed by the 'amount symbol1 (see page

30): remove one of these symbols and the sorter will ignore the amount. For

the purpose of the exercise, the sorter's ignoring the amount of a wrongly

encoded cheque is preferable to encoding it again and this end is achieved by

deleting the last amount symbol. The magnetisable property in the encoding

ink is ferrous oxide and a special magnetic lead pencil which can deposit a

further coating of oxide is used to obliterate the last amount symbol. The

cheque incorrectly listed as £12.15.0d was treated in this way.

THE SORTER'S CAPABILITIES

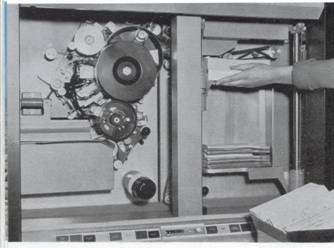

From the reading head the cheques pass between metal strips,

one of which runs to each of the sorting pockets. The sorter selects the appropriate

metal strip according to the characters read and the reading or sorting task

it has been set. There are thirteen sorting pockets, ten of which are

numbered 0 to 9, two for special sorting marked A and B, and the last, marked

R, for rejects. With mind still boggling

at the ingenuity of man in creating such a machine, we watched the first run

or 'pass' as it is called. On this, the reading pass, the sorter added the amounts of the cheques as

encoded and produced a total for balancing against the earlier listing. All

the cheques passed to one pocket except one 'reject' which was deposited in

pocket R: this was the cheque for £12.15.0d which had been wrongly encoded. It was necessary to

add this amount to the sorter's total to balance the batch.

Before removing the partially sorted

cheques from their pockets for the second

sorting pass the machine was fed with sets of yellow and red cards,

each the size of an eight inch cheque. There was a card of each colour for

every branch and the purpose of the yellow card was explained to us first.

Each carries a branch name and en- coded sorting code number; in addition it

is encoded with an amount of nothing—a row of O's. The need for an 'amount' lies in the machine's

built-in logic which would cause the rejection of any item not bearing an

amount on the final reading pass. Fed through the sorter, the yellow card

drops behind the cheques and

from then on it follows the cheques drawn on its branch so that when the

sorting is complete each branch's batch of cheques is separated from the next

by a yellow card—so much more convenient than having to search for the last

cheque!

VITAL ROLE The red or 'auto-total' cards, which are

fed in behind the yellow cards, play a vital role in the exercise. Once the

cheques are sorted into branches, amount totals are required for entering on

the Auto-Sort exercise response slips forwarded to branches along with the

cheques. Each red card, lying behind the yellow card at the back of each

branch batch, is encoded with the amount of Id and on the final pass—a reading pass—the machine is instructed to

throw out a total of the cheques it is electronically listing each time it

meets a single amount of Id, and at the same time to discard the red cards.

It is further instructed to ignore the amount of Id in its additions. We watched these final stages—the feeding of the yellow cards, the red cards,

the last two sorting passes on digits 4 and 2, the reading pass

giving branch totals and the rejection of the red cards. All that remained was

the manual attaching of the exercise response slips to the appropriate

bundle of cheques and the removal of the yellow cards. The exercise has been a success and the eventual link-up

with a computer can now be envisaged. This will drastically cut the

operating time as a number of the passes, at present necessary to the

exercise, will be omitted. The first reading pass will be superfluous—the amount will be fed to the computer as the

first sorting pass is made—and by adapting the sorting pockets most cheques

will be both read and sorted into branch batches in only two passes and the

remainder in one further pass. In a few

years' time we shall have ceased to marvel: electronics will be a part of the

daily life of every one of us in the Bank.

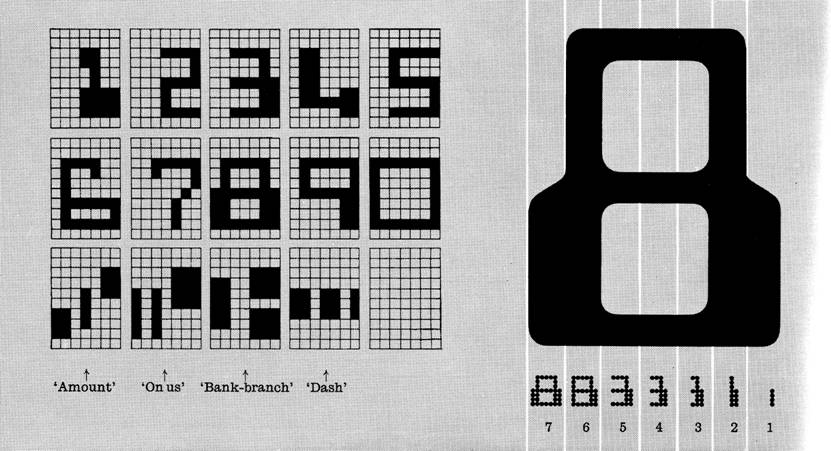

The principle of electronic reading, showing how

characters printed in magnetic ink are sensed and interpreted.

The multi-channel reading head breaks

up the characters into 10 horizontal elements. Seven separate readings are

made as the character passes under the reading head, so that each numeral or

special character is divided into 70 blocks, or sensing areas. The presence

or absence of magnetic ink in each of these sensing areas is recorded in an

electronic register, which therefore builds up an image of the printed

character. Powerful logical circuits compare this image with the perfect

character, and with the thousands of permitted variations. Some variation is

inevitable, and the machine's usefulness would be very limited if only

perfect reproductions were accepted. It therefore rejects only those images

in the electronic register which could be related to more than one of the 14

possible characters. The characters which make up the E13B typeface have been

carefully designed after exhaustive analyses of comparative shapes. Each is

as different as possible from all the others, yet retains its legibility for

the human reader. This style has been adopted by all British and American

banks for use in machine reading systems.

|