|

In February 1968, the work of the London Automation programmers at

Clements House, bears fruit in the form of BRANCH ACCOUNTING – a set of computer programs that will run on the equipment at the

London Computer Centre to process a range of bookkeeping tasks that are

hitherto performed manually at Martins Branches. Thirty six Branches in London are converted

one by one to computer input capability, and staff are given training to

enable them to produce the all important punched paper tape that will be read

and processed by the computer equipment at London Computer Centre. This is the culmination of nearly two

years’ work, during which time the daily bookkeeping work of Martins Branches

has been analysed down to the smallest of routines, individual programs and

sub-routines have been written, tested and re-written, and a robust system

developed, some aspects of which will

last way beyond Martins own existence, and into the twenty-first century. In February 1968, the work of the London Automation programmers at

Clements House, bears fruit in the form of BRANCH ACCOUNTING – a set of computer programs that will run on the equipment at the

London Computer Centre to process a range of bookkeeping tasks that are

hitherto performed manually at Martins Branches. Thirty six Branches in London are converted

one by one to computer input capability, and staff are given training to

enable them to produce the all important punched paper tape that will be read

and processed by the computer equipment at London Computer Centre. This is the culmination of nearly two

years’ work, during which time the daily bookkeeping work of Martins Branches

has been analysed down to the smallest of routines, individual programs and

sub-routines have been written, tested and re-written, and a robust system

developed, some aspects of which will

last way beyond Martins own existence, and into the twenty-first century.

Life,

like truth, is often stranger than fiction: We are indebted to one of

Martins’ original programming staff – friend of the Archive Clive Frost – for

turning up a reel of punched paper tape amongst his belongings and sending it

to us. It was part of the 1967 final test run for Martins Bank’s Branch

Accounting Computer Program. Having

found ourselves in possession of such a significant piece of computer

history, we thought what should we do with it – send send it down to

Bletchley Park, home of the National Museum of Computing, and those nice

codebreakers? Well, yes that’s exactly

what we did. Bletchley Park ran the tape through a reader, extracted the

data, and with the help of a coding chart that Clive had donated to us some

years ago, the data was listed for us in several forms by the National Museum

of Computing’s Tony Frazer. A series of test entries to fictitious bank

accounts was thus revealed. When

Martins began to roll out computerisation across London, customer data was

collected in Branch using Addo X machines coupled to tape punching

equipment. Life,

like truth, is often stranger than fiction: We are indebted to one of

Martins’ original programming staff – friend of the Archive Clive Frost – for

turning up a reel of punched paper tape amongst his belongings and sending it

to us. It was part of the 1967 final test run for Martins Bank’s Branch

Accounting Computer Program. Having

found ourselves in possession of such a significant piece of computer

history, we thought what should we do with it – send send it down to

Bletchley Park, home of the National Museum of Computing, and those nice

codebreakers? Well, yes that’s exactly

what we did. Bletchley Park ran the tape through a reader, extracted the

data, and with the help of a coding chart that Clive had donated to us some

years ago, the data was listed for us in several forms by the National Museum

of Computing’s Tony Frazer. A series of test entries to fictitious bank

accounts was thus revealed. When

Martins began to roll out computerisation across London, customer data was

collected in Branch using Addo X machines coupled to tape punching

equipment.

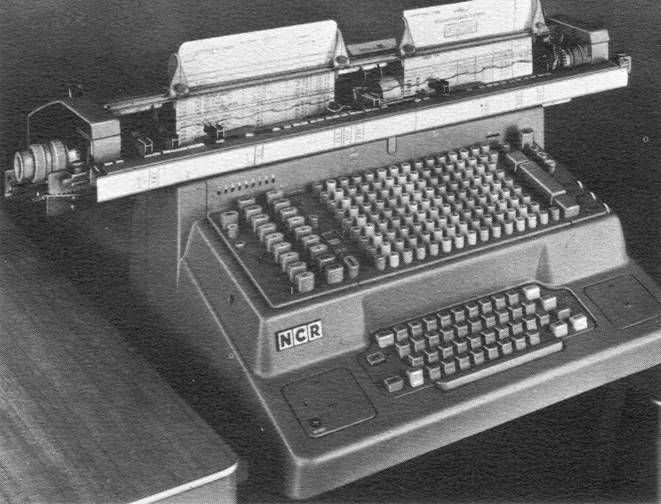

The

tapes were sent at the end of each working day to the Bank’s Computer Centre

at Bucklersbury House in Walbrook where they were read and processed into

what were then powerful computers, the NCR model 315. The data extracted gave a digital record of

transactions and other customer records, as the basis for the production of

bank statements, and the recording of statistics which would lead to the

computerised decision making we take for granted in today’s banking

world. The

tapes were sent at the end of each working day to the Bank’s Computer Centre

at Bucklersbury House in Walbrook where they were read and processed into

what were then powerful computers, the NCR model 315. The data extracted gave a digital record of

transactions and other customer records, as the basis for the production of

bank statements, and the recording of statistics which would lead to the

computerised decision making we take for granted in today’s banking

world.

Martins’ method of collecting input from its London Branches in this

way is the “missing link” between the early efforts of Banks to process

everything direct to a single remote computer, and the delineation of data by

computer terminals within branches themselves. The next stage for Martins was

to have been the transmission of data by telephone line direct from Branch

equipment to a central computer, and as we shall see later on this page, the

building that in 1971 would become Barclays’ Wythenshawe Computer Centre, was

originally planned by Martins as the home of its Branch Networked Computer

Systems. Experiments were carried out in 1968 to transmit work between London

and Liverpool. Martins Bank’s Branch

Accounting was a sophisticated program even for its own time, as it enabled

the collection of a large variety of accounting statistics alongside the

daily recording of actual transactions.

Significant chunks of this original program remained within Barclays’

own program – also known as Branch Accounting – well into the early years of

the twenty-first Century.

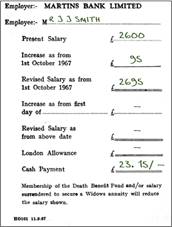

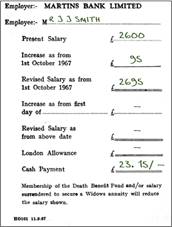

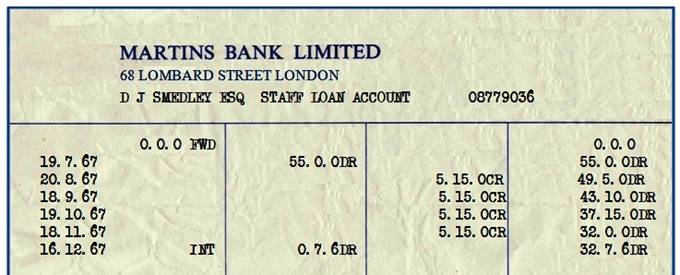

Most

of Martins Bank’s staff are provided with an annual handwritten payslip right up to the time of the merger with

Barclays in 1969. This example from 1967 show just how little information is

given to staff about the most important of their employment terms and

conditions! Three years earlier the

Bank had begun to treat the

computerisation of its customers’ accounts as a priority, and working

with N C R, Martins puts its finest brains to the task of producing what

becomes known as BRANCH

ACCOUNTING. Alongside

this activity, the Bank begins to migrate the recording of Staff loans and

the production of monthly payslips to automated systems at Martins’ London

Computer Centre. Most

of Martins Bank’s staff are provided with an annual handwritten payslip right up to the time of the merger with

Barclays in 1969. This example from 1967 show just how little information is

given to staff about the most important of their employment terms and

conditions! Three years earlier the

Bank had begun to treat the

computerisation of its customers’ accounts as a priority, and working

with N C R, Martins puts its finest brains to the task of producing what

becomes known as BRANCH

ACCOUNTING. Alongside

this activity, the Bank begins to migrate the recording of Staff loans and

the production of monthly payslips to automated systems at Martins’ London

Computer Centre.

The computerised payslip will eventually provide a whole host of facts

and figures, most importantly a permanent record for each member of staff of

where their money actually goes in the course of deductions between gross and

net pay. The example here is actually

a payslip produced on an accounting machine, NOT a computer, but it provides

the basis from which computerised forms will be produced to ease the manual

work of Branches. It is interesting to note that at this stage “National

Health Insurance” and “Government Pension” are listed as separate deductions,

whereas today  a

single amount is taken as “National Insurance”. Members of staff can also see their

contributions to the Bank’s own pensions scheme – Superannuation Fund – and

to the Widows and Orphans Scheme. In

modern times these two separate items have been absorbed into one deduction

for Occupational Pension for those who have to pay into a pension scheme. a

single amount is taken as “National Insurance”. Members of staff can also see their

contributions to the Bank’s own pensions scheme – Superannuation Fund – and

to the Widows and Orphans Scheme. In

modern times these two separate items have been absorbed into one deduction

for Occupational Pension for those who have to pay into a pension scheme.

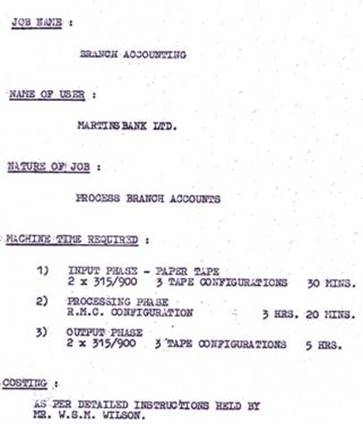

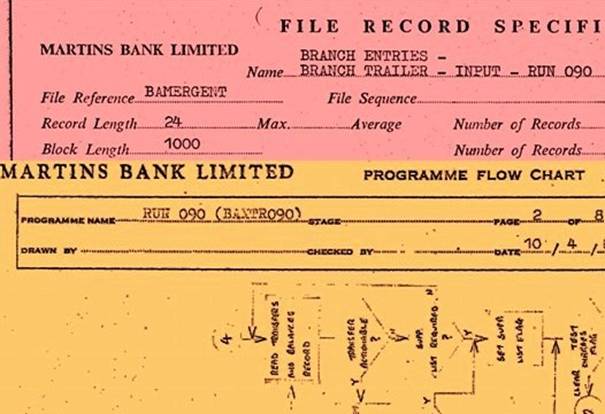

Now

we turn our attention to various aspects of the BRANCH ACCOUNTING program,

and the way in which it is initially set up to handle the work of Martins

Bank’s London Branches. A little later, we shall see some of the test data

from the punched paper tape decoded for us by Bletchley Park, but first we

need to understand that although computers are “fast” in 1968, they work on

infinitely less memory power and processing capability than we take for

granted today. This can be seen by the

amount of machine time taken to process each separate tape of work from the

Branches… Now

we turn our attention to various aspects of the BRANCH ACCOUNTING program,

and the way in which it is initially set up to handle the work of Martins

Bank’s London Branches. A little later, we shall see some of the test data

from the punched paper tape decoded for us by Bletchley Park, but first we

need to understand that although computers are “fast” in 1968, they work on

infinitely less memory power and processing capability than we take for

granted today. This can be seen by the

amount of machine time taken to process each separate tape of work from the

Branches…

|

|

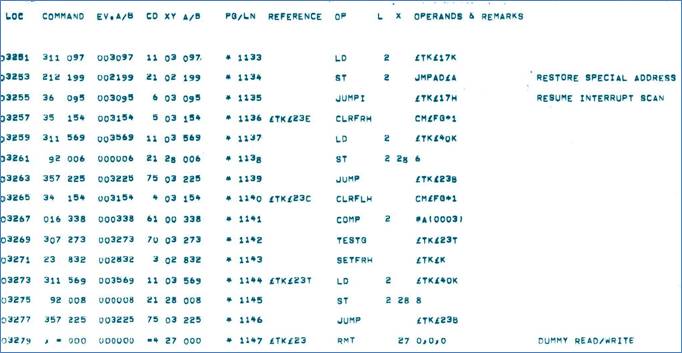

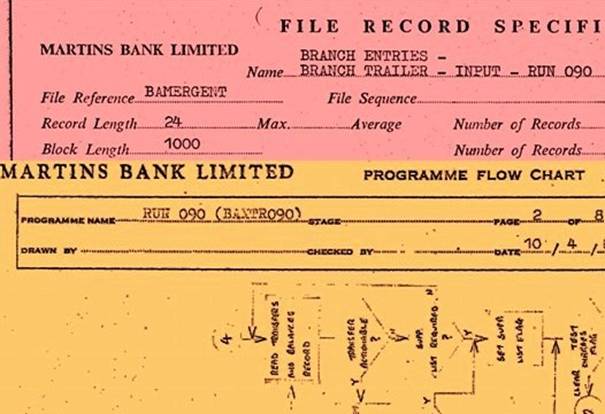

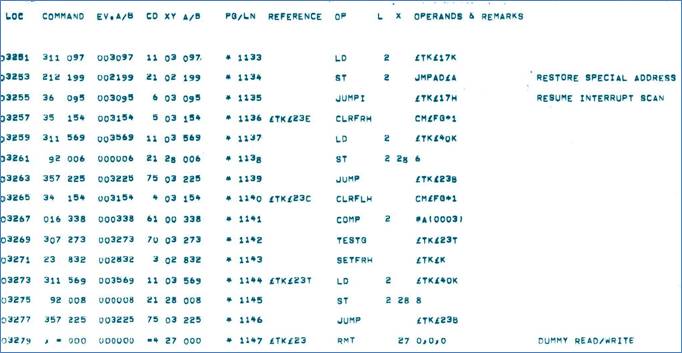

One of the most complex of the Branch Accounting

Programs is the input program – called BAINP050. Hard copies of the various Branch Accounting

programs are printed by line printer onto A3 sized fan folded paper. The list of instructions for each is vast,

with a major program like BAINP050 stretching over hundreds of pages of code,

as in this example from another of the Branch Accounting programs,

responsible for generating automatic transfers between customers’ accounts.

BAINP050 reads the paper tapes from branches and performs a number of

validity checks to ensure the security of the information held on the tapes,

as Martins must go to extremes to protect its Customers’ Data. One of the most complex of the Branch Accounting

Programs is the input program – called BAINP050. Hard copies of the various Branch Accounting

programs are printed by line printer onto A3 sized fan folded paper. The list of instructions for each is vast,

with a major program like BAINP050 stretching over hundreds of pages of code,

as in this example from another of the Branch Accounting programs,

responsible for generating automatic transfers between customers’ accounts.

BAINP050 reads the paper tapes from branches and performs a number of

validity checks to ensure the security of the information held on the tapes,

as Martins must go to extremes to protect its Customers’ Data.

Image © Martins Bank Archive Collections

Procedures are in place for rejected

information, and for its re-input once the necessary corrections have been

made. Branches are informed when errors

are detected and also if this has necessitated the computer centre having to

re-process the work. This is because

the fault could well lie in the machinery Branches have used to punch data

onto the tapes in the first place. The

system constantly checks data, and will report errors as it goes, providing

error messages to help staff identify the problem. A further complicated program, BAMFU120

(BRANCH ACCOUNTING MAIN FILE UPDATE) is responsible for updating all the

records, and by virtue of its having to constantly access magnetic tape for

various pieces of information, it takes a very long time to run.

Image © Martins Bank Archive Collections

The seriousness with which the Bank is

taking computerisation shows itself in many ways – some quite subtle such as

these futuristic items of stationery, designed specifically to help with the

production of computer programs.

At this time in the development of computers, it is

necessary to input ALL the leading zeros that might come before an amount, so

that every amount of money debited or credited to a customer’s account will

have the same quantity of characters.

This will be tedious for machine operators, who will have to take

extra care inputting amounts. Branch

Accounting Input will recognise an entry to a customer’s account in the

following format: At this time in the development of computers, it is

necessary to input ALL the leading zeros that might come before an amount, so

that every amount of money debited or credited to a customer’s account will

have the same quantity of characters.

This will be tedious for machine operators, who will have to take

extra care inputting amounts. Branch

Accounting Input will recognise an entry to a customer’s account in the

following format:

|

|

The machinists in the newly automated

branches will be very familiar (and doubtless fed up) with having to input

all those leading zeros in order to achieve the correct amount to be debited

or credited to an account! All this,

and having to meet the end of day deadlines too - one member of staff who

remembers this, is Alicia Blaney, who worked at London 88 Wigmore Street

Branch during the conversion to computer accounting:

“I

worked in the machine room and I was involved in computerisation. I remember

very well if we hadn't finished our input by the time it was due to be picked

up by security at the end of the day we had to take the tape on the tube

ourselves to somewhere near Bank station”.

How appropriate it

seems, to have used BANK

underground station!

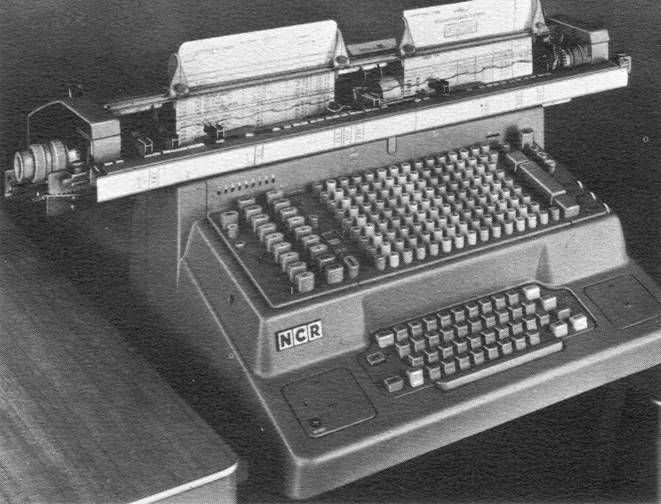

N C R

32 Range Accounting Machine

Image © 1966 N C R Limited

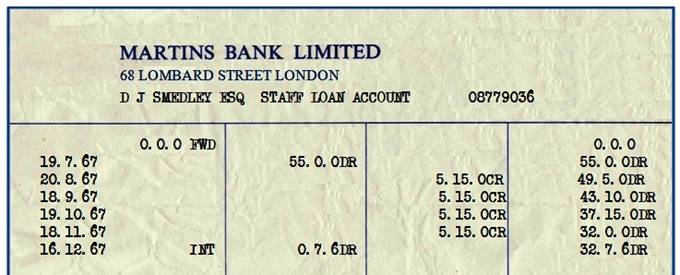

As far as customers are concerned, one of

the major benefits of automation will be the production of statements by the

computer. Until now staff have

repeatedly fed the same sheet of paper into a manual statement printing

machine like the one shown above, to add sometimes just one transaction to a

customer’s records, and the results have never been ideal. Staff loans are one of the first types of

account to be computerised:

Still

not perfect, but getting there.

Image (content simulated) © Martins Bank

Archive Collections

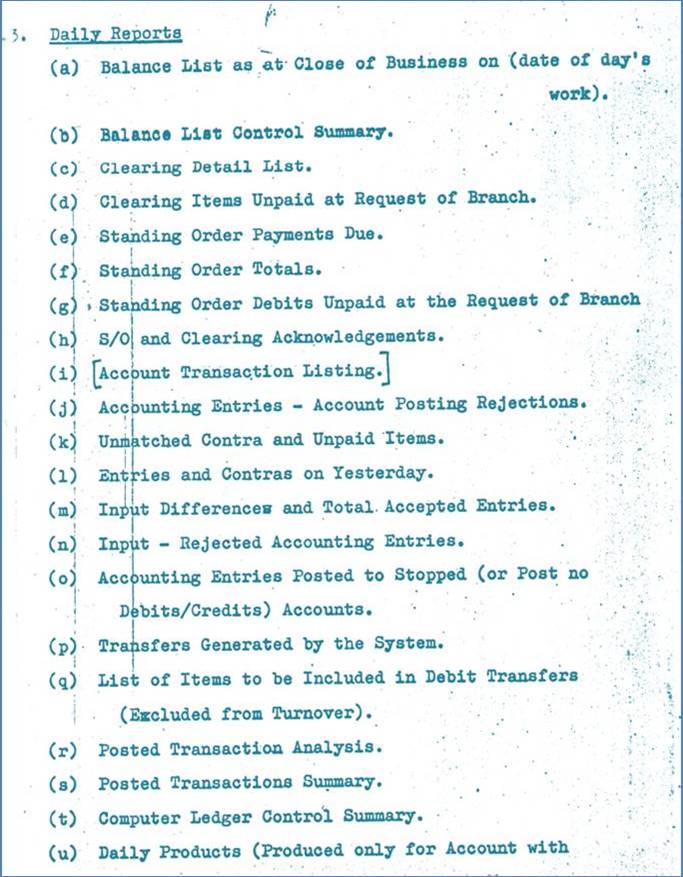

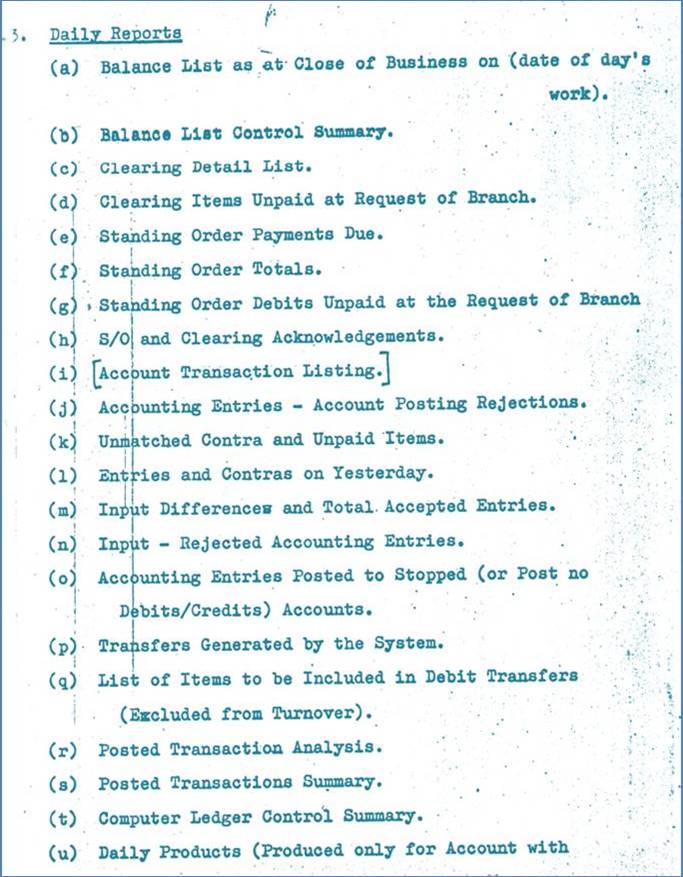

The Branch Accounting system is capable of

producing a wealth of statistics which even for 1968 seems to be quite

sophisticated and comprehensive.

Reports are produced daily, weekly, monthly, quarterly, half-yearly and

annually, and cover everything from those required to ensure correctness of

book-keeping, to management reports that show trends, or that comply with

legal requirements such as snapshots of savings or lending across all

accounts at a specific point in time.

The following list shows those reports that must be produced DAILY for

use by branches and the London Computer Centre: The Branch Accounting system is capable of

producing a wealth of statistics which even for 1968 seems to be quite

sophisticated and comprehensive.

Reports are produced daily, weekly, monthly, quarterly, half-yearly and

annually, and cover everything from those required to ensure correctness of

book-keeping, to management reports that show trends, or that comply with

legal requirements such as snapshots of savings or lending across all

accounts at a specific point in time.

The following list shows those reports that must be produced DAILY for

use by branches and the London Computer Centre:

Image © Martins Bank Archive Collections

February 1968

sees Martins pushing the bounds of available technology once again, with the

fruition of its experimental plans to transmit data from the Liverpool

Computer Centre to London, so that the bookkeeping being recorded at both

ends of the Country can be combined into one centralised record system. Although the capability to transmit data

down telephone lines has existed since the Second World War, this is the February 1968

sees Martins pushing the bounds of available technology once again, with the

fruition of its experimental plans to transmit data from the Liverpool

Computer Centre to London, so that the bookkeeping being recorded at both

ends of the Country can be combined into one centralised record system. Although the capability to transmit data

down telephone lines has existed since the Second World War, this is the  first time that this method will

be used so widely, as the implication is that all Branches in England Wales,

the Channel islands and the Isle of Man will be connected to the system. The whole thing relies on a clever method

of data transmission known as “packet switching”, which is commonplace in

today’s wireless world. In the home it

allows your broadband router to process the data that is sent and received by

any number of devices, laptops, tablets etc.. The beauty of the system is that instead

of having to keep each stream of data separate, everything combines into one

stream which is separated out at the destination and fed to individual

devices. Even our televisions use this

system now that the UK has gone digital.

Instead of the image being scanned line by line and sent to your tv on

a single channel, the picture is encoded into conveniently sized “blocks”,

and in the space previously needed for just one analogue channel, up to

twenty or so channels are now fed simultaneously to your TV’s digital

receiver which then extracts only the information needed to show the

programme you want to watch. first time that this method will

be used so widely, as the implication is that all Branches in England Wales,

the Channel islands and the Isle of Man will be connected to the system. The whole thing relies on a clever method

of data transmission known as “packet switching”, which is commonplace in

today’s wireless world. In the home it

allows your broadband router to process the data that is sent and received by

any number of devices, laptops, tablets etc.. The beauty of the system is that instead

of having to keep each stream of data separate, everything combines into one

stream which is separated out at the destination and fed to individual

devices. Even our televisions use this

system now that the UK has gone digital.

Instead of the image being scanned line by line and sent to your tv on

a single channel, the picture is encoded into conveniently sized “blocks”,

and in the space previously needed for just one analogue channel, up to

twenty or so channels are now fed simultaneously to your TV’s digital

receiver which then extracts only the information needed to show the

programme you want to watch.

Well before the merger with Barclays, the British

Government makes it clear that the clearing banks should be computerised in

time for decimalisation on “D-Day” 15 February 1971. Martins is already researching long distance

data transmission in the mid 1960s, and experiments successfully with the

processing of the work of several Liverpool Branches at the LONDON Computer

Centre, using the transmission of data down GPO telephone lines. With a large concentration of branches in

the North of England, Martins chooses to develop a site at Wythenshawe,

Manchester to provide a computer centre that can handle the traffic of data

being transmitted to and from these branches.

Martins chooses Wythenshawe as it meets the requirements of the

availability of GPO telephone lines, adequate labour resources and good road

communications. The plans have to be put on hold pending the merger, but

Barclays, faced with having to revise its own computerisation methods once it

takes over so many Northern branches, revisits Martins’ original plans and

revises them to develop a much larger centre on the same site. The centre

will be the receiving point for all input to the Branch Accounting Program by

branches all over England, Wales the Channel islands and Isle of man. Thus Wythenshawe opens in November 1971,

and goes on to serve the needs of Barclays’ computer operations for several

decades; Barclays’ Gloucester Computer Centre handles a proportion of the

work, and both centres are capable of taking over from each other in the case

of major faults. Sadly as computer

centre technology becomes less labour intensive, Wythenshawe is eventually

closed in the 1990s. Well before the merger with Barclays, the British

Government makes it clear that the clearing banks should be computerised in

time for decimalisation on “D-Day” 15 February 1971. Martins is already researching long distance

data transmission in the mid 1960s, and experiments successfully with the

processing of the work of several Liverpool Branches at the LONDON Computer

Centre, using the transmission of data down GPO telephone lines. With a large concentration of branches in

the North of England, Martins chooses to develop a site at Wythenshawe,

Manchester to provide a computer centre that can handle the traffic of data

being transmitted to and from these branches.

Martins chooses Wythenshawe as it meets the requirements of the

availability of GPO telephone lines, adequate labour resources and good road

communications. The plans have to be put on hold pending the merger, but

Barclays, faced with having to revise its own computerisation methods once it

takes over so many Northern branches, revisits Martins’ original plans and

revises them to develop a much larger centre on the same site. The centre

will be the receiving point for all input to the Branch Accounting Program by

branches all over England, Wales the Channel islands and Isle of man. Thus Wythenshawe opens in November 1971,

and goes on to serve the needs of Barclays’ computer operations for several

decades; Barclays’ Gloucester Computer Centre handles a proportion of the

work, and both centres are capable of taking over from each other in the case

of major faults. Sadly as computer

centre technology becomes less labour intensive, Wythenshawe is eventually

closed in the 1990s.

Wythenshawe Computer Centre opens

for business in November 1971 - Image

© Barclays

The familiar strains of “Hello, Wythenshawe”

will be fondly remembered by many Barclays staff, especially those of us

still trying to process the day’s work at 8pm because the computer centre had

ground to a halt. Even as late as

1985, some Barclays branch staff were faced with turning computer engineer, having to manually

switch the branch telephone lines from “four wire” to “two wire “

working. Surprisingly the two wire

option usually did the trick and work disappeared quickly up the line to

Wythenshawe. In the days before the

call centre threatened to execute staff who did not answer the phone within

two rings, is was quite normal to phone Wythenshawe and sit with a plate of

sandwiches, waiting for an answer. The

call itself could take anything up to an hour, as the always friendly

staff helped you with your problem. Such happy days, now gone forever along

with branch machine rooms and the staff who worked there…

Image and some detail kindly provided by Barclays Group

Archives.

In July 1968, the programmers at Clements House decide

for fun to write a program that will test the capabilities of line

printing. They need to write more than

fifty pages of code simply to reproduce Martins’ Coat of Arms, using a

collection of dots, dashes, strokes and letters. By the standards of today’s sophisticated

graphics, the result might well seem primitive, but we think the Coat of Arms

is a tribute to the ingenuity of the pioneers at London Automation. What we

have seen in this feature is only a glimpse into the capabilities of Branch

Accounting, but it shows that those at work in Clements house and London

Computer Centre strived to produce a highly sophisticated set of programs,

given the equipment they had to work with.

The fact that Branch Accounting is written “in-house” – i.e. not

bought in from an outside agency, shows the sheer quality of Martins’

Computer Staff, all of whom are hand-picked for their analytical skills from

branches all over the country. That

parts of this program remain at work within Barclays for the next forty years and beyond, is an amazing

legacy and a great tribute to their dedication… In July 1968, the programmers at Clements House decide

for fun to write a program that will test the capabilities of line

printing. They need to write more than

fifty pages of code simply to reproduce Martins’ Coat of Arms, using a

collection of dots, dashes, strokes and letters. By the standards of today’s sophisticated

graphics, the result might well seem primitive, but we think the Coat of Arms

is a tribute to the ingenuity of the pioneers at London Automation. What we

have seen in this feature is only a glimpse into the capabilities of Branch

Accounting, but it shows that those at work in Clements house and London

Computer Centre strived to produce a highly sophisticated set of programs,

given the equipment they had to work with.

The fact that Branch Accounting is written “in-house” – i.e. not

bought in from an outside agency, shows the sheer quality of Martins’

Computer Staff, all of whom are hand-picked for their analytical skills from

branches all over the country. That

parts of this program remain at work within Barclays for the next forty years and beyond, is an amazing

legacy and a great tribute to their dedication…

M M

|

![]()

![]()