|

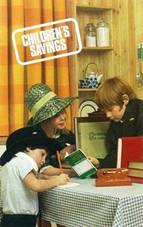

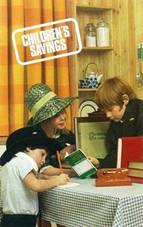

Looking at this picture (right), It doesn’t seem like there are only a

few months left until the “Summer of Love”, with its long hair, flower power

clothes, drugs and freedom to explore almost anything, but in 1966, this is

how most of our shiny scrubbed children still look. Seen here, feigning interest in savings

whilst a lady looking more like a 1940s film star than a Bank Offical smiles

sweetly, they pose for the cover of the Spring 1966 Edition of Martins Bank Magazine,

reassuringly “un-rock ‘n’ roll” in the same year that an Elephant, a Camel

and a Hippo will fundamentally change the way Martins Bank advertises

itself. Perhaps we are witnessing the

strong family appeal that the Bank has always engendered amongst its staff,

and would like to keep forever? The

fact is, that time is sadly running out for the idyllic childhood of the

1950s. New freedoms will bring not

only great opportunity, but also many many dangers for the next generation of

children, as the world becomes at once more competitive, and less safe. In ten years time these smiling children might be heading for university, or they

might be adorned with safety pins and torn clothing, screaming out the

message of punk on “Top of the Pops”…

Let’s return now to the relative safety of the 1960s, to see just how

our kids are being wooed by Martins Bank and others, to put their pennies in

the vault. The majority

of Martins’ Giveaways are aimed at children, and in this re-written feature,

we look at what has been on offer at Martins (and some other banks) down the

years, in order to tempt young savers… Looking at this picture (right), It doesn’t seem like there are only a

few months left until the “Summer of Love”, with its long hair, flower power

clothes, drugs and freedom to explore almost anything, but in 1966, this is

how most of our shiny scrubbed children still look. Seen here, feigning interest in savings

whilst a lady looking more like a 1940s film star than a Bank Offical smiles

sweetly, they pose for the cover of the Spring 1966 Edition of Martins Bank Magazine,

reassuringly “un-rock ‘n’ roll” in the same year that an Elephant, a Camel

and a Hippo will fundamentally change the way Martins Bank advertises

itself. Perhaps we are witnessing the

strong family appeal that the Bank has always engendered amongst its staff,

and would like to keep forever? The

fact is, that time is sadly running out for the idyllic childhood of the

1950s. New freedoms will bring not

only great opportunity, but also many many dangers for the next generation of

children, as the world becomes at once more competitive, and less safe. In ten years time these smiling children might be heading for university, or they

might be adorned with safety pins and torn clothing, screaming out the

message of punk on “Top of the Pops”…

Let’s return now to the relative safety of the 1960s, to see just how

our kids are being wooed by Martins Bank and others, to put their pennies in

the vault. The majority

of Martins’ Giveaways are aimed at children, and in this re-written feature,

we look at what has been on offer at Martins (and some other banks) down the

years, in order to tempt young savers…

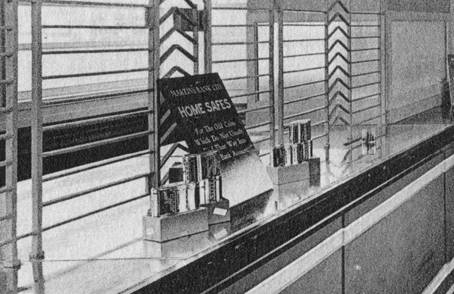

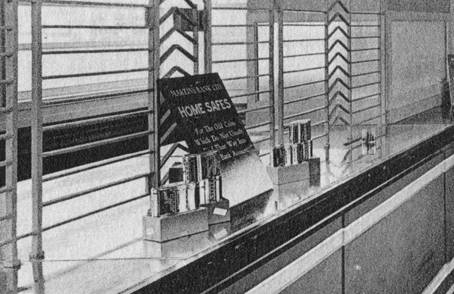

The moneybox comes of age…

Marketing savings to children is nothing new, and

certainly not born from the new competitiveness that Banking undergoes from

the late 1960s onwards. In 1921, a

classic design is born – the oval metal

HomeSafe that is used

by generations of adults and children to save for that rainy day. This image

shows a stack of Home Safes, ready for customers of the Bank’s portable

Branch at the Royal show in Manchester, 1930. The concept is of course, quite

simple. The Home Safe is like having a secure little piece of your bank at

home with you: Locked at all times, and opened only at the counter of the

bank so that the contents can be paid into an account. These oval money boxes

are by no means rare, and it

is very easy to pick them up cheaply on internet auctions sites. Tens of Thousands were issued by

hundreds of banks and building societies throughout the United Kingdom

between 1921 and the early 1940s, and those bearing the names of Martins

Bank, and the Bank of Liverpool and Martins should not be difficult to find,

and you should not expect to pay more than a few pounds for one of these

charming souvenirs of banking days gone by… Marketing savings to children is nothing new, and

certainly not born from the new competitiveness that Banking undergoes from

the late 1960s onwards. In 1921, a

classic design is born – the oval metal

HomeSafe that is used

by generations of adults and children to save for that rainy day. This image

shows a stack of Home Safes, ready for customers of the Bank’s portable

Branch at the Royal show in Manchester, 1930. The concept is of course, quite

simple. The Home Safe is like having a secure little piece of your bank at

home with you: Locked at all times, and opened only at the counter of the

bank so that the contents can be paid into an account. These oval money boxes

are by no means rare, and it

is very easy to pick them up cheaply on internet auctions sites. Tens of Thousands were issued by

hundreds of banks and building societies throughout the United Kingdom

between 1921 and the early 1940s, and those bearing the names of Martins

Bank, and the Bank of Liverpool and Martins should not be difficult to find,

and you should not expect to pay more than a few pounds for one of these

charming souvenirs of banking days gone by…

Images © Martins Bank Archive Collections

With the exception of Lewis’s

Bank, and a small number of others, there’s not much to choose from really –

the majority of HomeSafes look exactly the same, and the effect

might even be to encourage someone to open accounts with the minimum deposit

at several banks simply to collect

the differently named oval

HomeSafe boxes, and

not bother to use them as intended by the banks. This will hardly encourage

brand loyalty. By the 1950s many banks

have moved away from the generic oval tin, to Home Safes of their own

creation, but the basic idea of the key being held by the bank remains. You might think that the banks had learned

the pitfalls of a ubiquitous design, but even when many, Martins included, go

for something new and attractive, it ends up looking much of a muchness…

Images © Martins Bank Archive Collections

Catching the Savings

Bug…

|

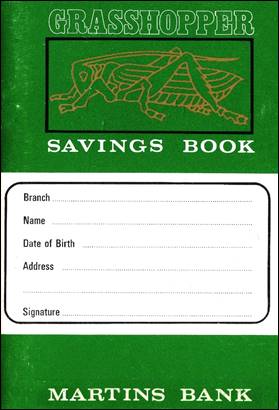

With the merger already on the cards, Martins’ swansong

offering becomes an instant classic – the see-through yellow plastic

grasshopper money box, given away to young savers, in combination with a

golden coloured grasshopper lapel badge, allows the

Bank one last chance to exhibit brand independence before the Spread Eagle

takes over. Sadly, at the same

time, a key player in the history and fortunes of Martins drops off the

radar, when suddenly the Liver Bird, symbolic both of the Bank of

Liverpool, Martins Bank itself, AND its glorious Head Office Building, is

nowhere to be seen. With the merger already on the cards, Martins’ swansong

offering becomes an instant classic – the see-through yellow plastic

grasshopper money box, given away to young savers, in combination with a

golden coloured grasshopper lapel badge, allows the

Bank one last chance to exhibit brand independence before the Spread Eagle

takes over. Sadly, at the same

time, a key player in the history and fortunes of Martins drops off the

radar, when suddenly the Liver Bird, symbolic both of the Bank of

Liverpool, Martins Bank itself, AND its glorious Head Office Building, is

nowhere to be seen.

|

|

Image ©

Martins Bank Archive Collections

Special

thanks to John Robertshaw

|

|

|

|

The thinking behind this might

be to make the Bank more attractive to London-centric investors. The

sturdy little plastic grasshopper which is (apparently) indestructible,

might be a strong statement about the bank, but this seems sadly ironic

considering how these beautiful little boxes have outlasted the bank

itself. Indestructible they might

be, but they certainly don’t need a super-criminal to break into them and

steal the contents. In a departure

from lockable money boxes that can only be emptied out in front of the

cashier, the grasshopper money box has only a small plastic sliding door

between you and your pennies.

|

|

Martins Bank makes

the most of the arrival of its latest giveaway, and the grasshopper

moneybox is celebrated by the following tongue in cheek article in Martins

Bank Magazine…

|

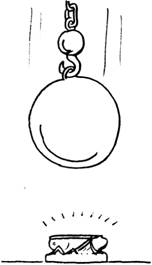

Grasshoppers Under Stress…

The Childproof Grasshopper

Moneybox has taken the nation's children by storm, replacing the traditional

piggy-bank, now lying forgotten in dingy attics. In this article we describe

the work of the Grasshopper Testing Establishment and pay tribute to the

staff whose skill and devotion to duty have brought about this revolution in

nurseries throughout the country… fatigue failures in the initial

manufacturing stages of the Mark I Grasshopper brought to the fore the danger

to the young saver of lethal knife-edged plastic splinters from disintegrated

money-boxes. 'Safety for Savers' became the order of the day and the

Grasshopper Testing Establishment was set up at Nether Hopping. The project

was naturally highly secret and only after careful The Childproof Grasshopper

Moneybox has taken the nation's children by storm, replacing the traditional

piggy-bank, now lying forgotten in dingy attics. In this article we describe

the work of the Grasshopper Testing Establishment and pay tribute to the

staff whose skill and devotion to duty have brought about this revolution in

nurseries throughout the country… fatigue failures in the initial

manufacturing stages of the Mark I Grasshopper brought to the fore the danger

to the young saver of lethal knife-edged plastic splinters from disintegrated

money-boxes. 'Safety for Savers' became the order of the day and the

Grasshopper Testing Establishment was set up at Nether Hopping. The project

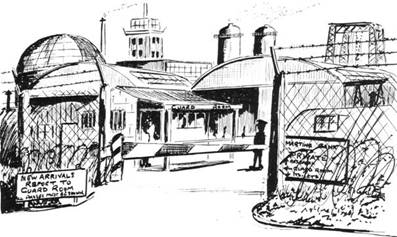

was naturally highly secret and only after careful  screening, were we permitted to make our

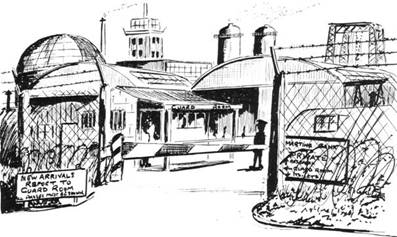

visit, travelling down with the weekly supply convoy. Arriving at the heavily guarded main gate

we found the duty dog-handler Herbert Rumford-Street and his watchful tripe

hound who were on special detachment from No. 2 Mobile Sub-branch (Fred's

Caff, Great North Road). Our passes carefully scrutinised, we were ushered

through the outer perimeter to the Admin. Office which had been skilfully

disguised as a derelict Nissen hut. On the door was a weatherworn notice which

we deciphered as TO LET. FOR GENTLEMEN ONLY — a cunning subterfuge. screening, were we permitted to make our

visit, travelling down with the weekly supply convoy. Arriving at the heavily guarded main gate

we found the duty dog-handler Herbert Rumford-Street and his watchful tripe

hound who were on special detachment from No. 2 Mobile Sub-branch (Fred's

Caff, Great North Road). Our passes carefully scrutinised, we were ushered

through the outer perimeter to the Admin. Office which had been skilfully

disguised as a derelict Nissen hut. On the door was a weatherworn notice which

we deciphered as TO LET. FOR GENTLEMEN ONLY — a cunning subterfuge. Stepping inside we were impressed with the subtle decor, reminiscent of the later

Great Western period, of chocolate and cream relieved with quaint motifs — in particular a simple but effective epitaph

for the ubiquitous Kilroy. Here we met the Director of

Operations, Isaac O'Kelly (Mac to his friends), who showed us an example of

the Grasshoppers at that time being tested. 'These beggars nearly got the

better of us' he remarked with a wry smile. Briefly he described testing

methods, the ultimate aim, he assured us, being the creation of the

Indestructible Grasshopper Moneybox. Donning our

protective suits of imitation plastic and matching gumboots, we began our

tour of the Establishment. At Econ. Inf. Pub. and Ad. we met charming Joan

Farnsbarns, a prominent figure. While reluctant to reveal vital statistics of

which she is in sole charge, she entertained us with several amusing

anecdotes.

Stepping inside we were impressed with the subtle decor, reminiscent of the later

Great Western period, of chocolate and cream relieved with quaint motifs — in particular a simple but effective epitaph

for the ubiquitous Kilroy. Here we met the Director of

Operations, Isaac O'Kelly (Mac to his friends), who showed us an example of

the Grasshoppers at that time being tested. 'These beggars nearly got the

better of us' he remarked with a wry smile. Briefly he described testing

methods, the ultimate aim, he assured us, being the creation of the

Indestructible Grasshopper Moneybox. Donning our

protective suits of imitation plastic and matching gumboots, we began our

tour of the Establishment. At Econ. Inf. Pub. and Ad. we met charming Joan

Farnsbarns, a prominent figure. While reluctant to reveal vital statistics of

which she is in sole charge, she entertained us with several amusing

anecdotes.

|

The Grasshopper Testing Establishment at Nether Hopping

|

She told us that her hobbies are numismatics, embroidery and

that she is a black belt. We moved on… At the reception shed we watched a

consignment of Grasshoppers being carefully unpacked. Each received a sharp

blow with a six-pound hammer before being forwarded to No. 2 bay where Jim

Blogworthy and his happy staff select specimens at random into which are

dropped foreign coins of equivalent weight to 73/6d and which are then

hurled at a thick brick wall. Jim informed us that 17% of the Grasshoppers

handled by his section are found defective, as was a similar percentage of

his staff. Mr Blogworthy, who served his apprenticeship at Brooks's Bar, is

the father of nine children. He has no hobbies. From a distance we viewed

the more sophisticated techniques to test resilience.

|

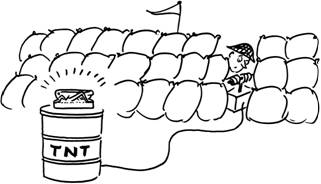

Even the ordinary domestic explosion

(gas cookers, geysers, oil heaters, etc.) is simulated, thus guaranteeing

that our moneyboxes (or 'bug-banks' as they are laughingly termed) are

completely child-proof. Our final call was to the

packaging department where the Grasshoppers are boxed together with a simple

picture-leaflet explaining to the kiddies exactly what they can do with them.

We were told of the grand opportunities opening up in this field for young

men of muscular physique who feel perhaps that their duties in general

banking do not give them sufficient outlet. A management training scheme is

now in operation for men of the right calibre. It was time to take our leave of Mr O'Kelly and on our way back we

recalled the words inscribed above his desk which summed up the raison d'etre of the Establishment

—

'We're Bugging Britain'.

Rainy Day Records…

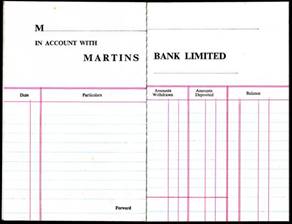

In common

with the building societies, many 1960s banks still offer Passbook Savings –

the bank statement is replaced in importance by the passbook, a record of

savings activity kept by the customer, and updated by the bank.

|

The credit transfer system, introduced in 1962 is

updated in 1968 and re-named Bank Giro Credits. This is in anticipation of the full computerisation of all banks expected by the Government by the

time of the introduction of decimal currency on 15 February 1971, and this

is also the time when the National Girobank is created at Bootle, near

Liverpool. The Savings Account

paying in slip shown here is virtually the only re-designed piece of

Martins Bank customer stationery before the merger with Barclays. The money mark begins to appear, a

symbol used by all banks to denote the new faster ways to transfer

money. The credit transfer system, introduced in 1962 is

updated in 1968 and re-named Bank Giro Credits. This is in anticipation of the full computerisation of all banks expected by the Government by the

time of the introduction of decimal currency on 15 February 1971, and this

is also the time when the National Girobank is created at Bootle, near

Liverpool. The Savings Account

paying in slip shown here is virtually the only re-designed piece of

Martins Bank customer stationery before the merger with Barclays. The money mark begins to appear, a

symbol used by all banks to denote the new faster ways to transfer

money.

|

|

|

This system is still largely

in place in the twenty-first century, although the use of paper transactions

is now seen as a hindrance to the fast flow of funds, and in 2018 all banks

began working to establish a new system of photographing cheques in order to

abolish the traditional clearings. This has mixed results, as the Cheques Act

is broken where “house” cheques are concerned. The spirit of the act is that

you should be able to take a cheque to the bank branch on which it is drawn,

and obtain payment for it immediately.

This is simply unworkable today, and

now that the banks have actively discouraged customers from visiting

branches, it probably won’t be an issue. Still, waiting a week for a “house”

cheque to clear is exactly good progress.

Let’s Play!

The 1960s child is not only interested in playing

“Cowboys and Indians” and “Hide and Seek”.

Some like to count their pennies into shillings and their shillings

into pounds. Being given a ten

shilling note by a favourite aunt is a magical experience that

fewer and fewer of us remember, but playing with money, be it the real thing

or cardboard coins used in maths lessons at school helps us learn all

about the stuff. From the late 1950s

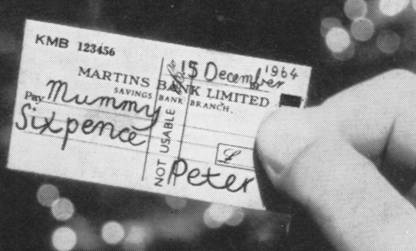

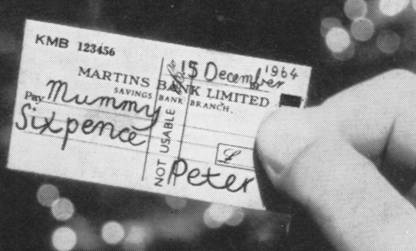

all the way up to the merger, Martins in conjunction with the Kiddicraft® toy company, offers sets of play money that

include miniature Martins cheque and paying in books. The toys make the front cover of Martins

Bank Magazine in Winter 1964, when young Peter is shown giving a miniature cheque for sixpence (£0.025) to his mother in exchange for

a bag of chocolate coins. – What fun Christmas must have been in that

household. How much for a roast dinner? Or and hour in front of the TV? Who knows - this may well have been the

starting block for many an entrepreneur! The 1960s child is not only interested in playing

“Cowboys and Indians” and “Hide and Seek”.

Some like to count their pennies into shillings and their shillings

into pounds. Being given a ten

shilling note by a favourite aunt is a magical experience that

fewer and fewer of us remember, but playing with money, be it the real thing

or cardboard coins used in maths lessons at school helps us learn all

about the stuff. From the late 1950s

all the way up to the merger, Martins in conjunction with the Kiddicraft® toy company, offers sets of play money that

include miniature Martins cheque and paying in books. The toys make the front cover of Martins

Bank Magazine in Winter 1964, when young Peter is shown giving a miniature cheque for sixpence (£0.025) to his mother in exchange for

a bag of chocolate coins. – What fun Christmas must have been in that

household. How much for a roast dinner? Or and hour in front of the TV? Who knows - this may well have been the

starting block for many an entrepreneur!

Buy your own Martins Bank!

|

Image

© Martins Bank Archive Collections

|

This

is not really a giveaway, more of a

1960s collaboration with model railway makers to provide a little scale

model Martins Bank to add authenticity to any collector’s train set. Sometimes sold alone, sometimes joined to

a model shop, this special branch of Martins comes as a flat piece of

cardboard that you then make into a three dimensional model. We already have one example of each of

the 1960s designs in our archive, but imagine our surprise, on learning

that these models have just started to undergo a Twenty-First Century

renaissance, thanks to our friends at Metcalfe Models of Skipton, North

Yorkshire. We recently contacted the company, and Nick Metcalfe told us how

one of Martins Bank’s branches became the inspiration for the new

generation of models:

“I

chose the SKIPTON BRANCH as it is a local

bank to us, and also it is not over intricate in its design which made it

easy to model in card. I remember

going into that branch of Martins Bank when I was a small boy with my

Grandmother, and the Manager gave me a bag full of Farthings, which had

just gone out of circulation. I

still have some of them today”.

|

Martins

Colleague Dave Baldwin, who is Secretary of the Grasshopper Pensioners’ Club,

reminds us that the model is based on how the branch looks TODAY: Martins

Colleague Dave Baldwin, who is Secretary of the Grasshopper Pensioners’ Club,

reminds us that the model is based on how the branch looks TODAY:

“During Martins’ time, the frontage was completely different

and the model depicts the branch as it is today. Original windows have become

doors, the property owned by the bank and leased to Skipton solicitors

Charlesworth, Wood and Brown has been incorporated into the frontage whilst

'The Hole in the Wall' public house has become a newsagent’s”.

Here (right) is the new version, just one of a whole host of intricately

designed models available from the Metcalfe

site. Our Archive is dedicated to

preserving the memory of Martins Bank, whether by preserving items from the

past, or supporting those from the present day - so naturally we are thrilled

when others want to do the same. You

can find out more about the current range of Metcalfe Models here: www.metcalfemodels.com. Please remember that by clicking on the link to Metcalfe

Models, you will be taken directly to their site, which is not part of

Martins Bank Archive.

And

finally, the small print…

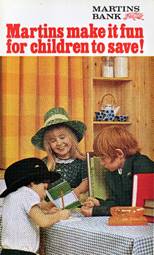

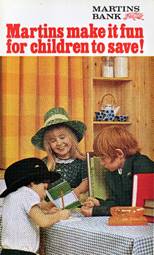

Martins

make it fun for children to save! These are the days when children can earn a

decent return on their savings of around 4.5%, unlike today when children

have no real concept of being paid to save. In fact pre-paid debit card with

fees of £2.99 per MONTH, whilst marketed as the way to teach your child to manage their pocket

money, provides no incentive whatsoever to save. Noiwadays your “credit

score” is the only thing that matters – how much you can BORROW, and sadly

all too often not be able to repay.

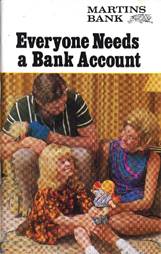

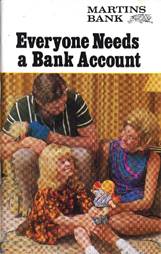

The optimism of Martins Bank’s leaflet for children is charming, but

definitely, and sadly now confined to history. EVERYONE NEEDS A BANK ACCOUNT is Martins’ final branded customer leaflet to set

out the wares of the bank as at November 1968. Various types of account, and other

products are explained in detail, including the new Grasshopper Savings

Accounts for Children. Cue an

advertising pose, struck by some “typical” children of the period grouped

around the iconic new Grasshopper Moneybox and other account paraphernalia,

but please do beware those sunshine bright curtains… Martins

make it fun for children to save! These are the days when children can earn a

decent return on their savings of around 4.5%, unlike today when children

have no real concept of being paid to save. In fact pre-paid debit card with

fees of £2.99 per MONTH, whilst marketed as the way to teach your child to manage their pocket

money, provides no incentive whatsoever to save. Noiwadays your “credit

score” is the only thing that matters – how much you can BORROW, and sadly

all too often not be able to repay.

The optimism of Martins Bank’s leaflet for children is charming, but

definitely, and sadly now confined to history. EVERYONE NEEDS A BANK ACCOUNT is Martins’ final branded customer leaflet to set

out the wares of the bank as at November 1968. Various types of account, and other

products are explained in detail, including the new Grasshopper Savings

Accounts for Children. Cue an

advertising pose, struck by some “typical” children of the period grouped

around the iconic new Grasshopper Moneybox and other account paraphernalia,

but please do beware those sunshine bright curtains…

|

|

Grasshopper Savings Accounts for Children

These are designed to encourage children to

save. When a Grasshopper Savings Account

is opened — the initial deposit can be as little as 1 shilling.

The child is given an attractive money box in

the shape of a grasshopper, a

colourful savings book, and a special paying-in and withdrawal

book. The child also receives a gilt

grasshopper lapel badge.

This scheme is run on proper banking lines.

Children aged seven and over can open their own account: for those under

seven the account is opened by a parent or guardian. The rates of interest and withdrawal

arrangements are the same as for ordinary Savings Accounts, but if the

child is under seven the parent or guardian signs the withdrawal slips.

|

… and there we will leave our 1960s children playing with toy money,

Post Office Playsets and model railways.

The competition for the youth market has not yet reached full steam,

but will see some unusual attempts by all the banks to grab a slice of the

young savers’ market. One fine example

is the collaberation between Barclays, the Bank of Scotland and the Royal

Bank of Scotland (known previously in England as Williams & Glyns Bank)

and Kellogg’s® cereals. Children have

only just got out of bed, when already three banks are offering them £2 and a

moneybox, and the lure of Saturday morning banking. Where will it all end?

M M

R R

|

![]()

![]()