|

|

![]()

|

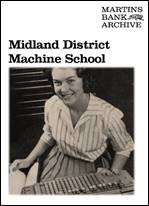

SENIOR TRAINING

COURSE - 1963 |

![]()

|

|

|

|||

|

WHY NOT ALSO VISIT THESE PAGES |

||||

|

|

|

|||

|

Mr A Struthers speaking at a review session The syndicate system

The

syndicate system was based on the pattern of the Administrative Staff College

at Henley. For each study a different member of the seven was appointed

chairman and briefed by his syndicate leader as to the terms of reference. It

was then up to the chairman to explain the objects of the study to his

fellows and set each the task of research into one or more facets of the

topic so that when all seven members came to pool their findings a summary

could be prepared in the form of a speech. The four chairmen made their

speeches in a 'review session' before all members of the Course and, in the

case of some of the studies, in the presence of the Head Office official

within whose sphere the study fell. The latter commented on each syndicate's

findings and then expanded upon the theme. At the time of our visit to the Course

'current affairs' were being shaped into speech form by the syndicates, each

working in separate rooms and quite independently of each other. One

syndicate was discussing the effect on the Bank that the drift to the south

of the country would have, a situation which, it was judged, the Beeching

plan for the railways might easily aggravate. To the views collected from the

press and elsewhere the member from the North East was able to add first-hand

knowledge. The final review session which concerned branch

management was attended by the Chairman of the Bank, Sir John Nicholson,

Bart., C.I.E., and the Chief General Manager, Mr. M. Conacher. Syndicate meetings each lasted one and a

half hours: from 9.30 to 11.0 a.m. and 11.30a.m. to 1.0 p.m., and again from

5.0 to 6.30 p.m. and 8.0 to 9.30 p.m., leaving the afternoons free. On

several days of the fortnight one period was set aside for a lecture by a

senior official of the Bank and usually lasted one hour, leaving the

remaininghalf-hour for questions. The first lecture 'How the Bank works' was

delivered by Mr. D. O. Maxwell (Deputy Chief General Manager). Mr. T. I. Bond

(Assistant General Manager (Administration)) gave a talk on relations with

banks at home. Mr. L. J. Walton (Assistant General Manager) came from London

to speak on the Money Market, and Mr. A. R. W. Wetherell (Chief Overseas

Manager) on relations with overseas banks.

|

||||

|

Back Row (left to right): A Atkin A Potter A W Denton R N Weightman C G S Tiffin C Wilson R E Pickering J E Davies D M J Harding A W Wescombe |

Middle Row: J E Crowe J R K Dean T A Douglas P Barwell J W Kay R D Batey A Hill C A Shuttleworth R J Pearson E M Farrell R T Insull |

Seated: T E Rigby R J Halford A Struthers D W Hall A J A James P M Lister R P Gordon H Taylor M W Thompson J B Hawkins D J Crellin F Tunstall |

||

|

Questioning the specialists

In addition

to the lectures, four 'syndicate visitors' made themselves available at

individual syndicate sessions for questioning on their particular subject.

The visitors were Mr. A. J. Frost (Income Tax Manager of the Bank), Mr. D. G.

Hanson (Assistant Manager, Head Office Trustee Department), Mr. R. Hindle

(Manager, Organisation Research and Development Department), and Mr. J. L.

Shenton (Superintendent of Branches (Staff)). Although the time-table

specified six hours each day for study many more were, in fact, worked, the

evening session, on occasion, stretching well into the night. By its very

nature the syndicate system encouraged this tendency and the trainees

appreciated the value of each extra minute. The afternoons, however, had

beenset aside specifically to give the trainees a necessary break but these,

too, were frequently spent in study, work continuing either in the Hall or

during strolls in the grounds. The absence of recreational facilities in or

around the Hall was possibly responsible for this. Despite the intensity of the Course, humour was not

lacking (a gathering of twenty-eight men is bound to produce at least one

comedian!). Neither were creature comforts overlooked for although the Hall

is not licenced it had been possible to

arrange for modest bar facilities to be available for a period before dinner

each evening. For those who sought atmosphere and draught, however, there was

the local inn once the evening session had ended at 9.30. We gained the impression, talking to the trainees,

that by the end of the Course they expected to be quite exhausted but

considerably wiser, sentiments also expressed by the Course leaders. And

surely to produce wiser bankers was the very object of the Course.

|

||||

|

|

||||