|

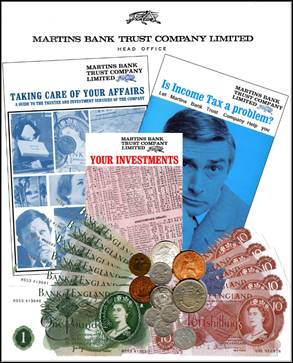

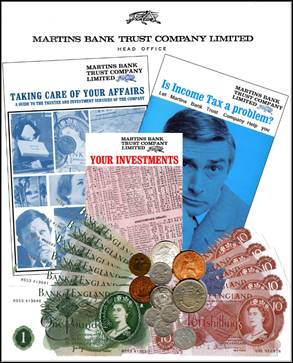

Image © Martins

Bank Archive Collections

|

In Service 1908 to 21 November 1969

Martins Bank is justifiably proud of its regional

structure, local branches, local head office departments, and the quick

decisions that can be made to help customers, based on local

knowledge. It comes as no surprise

then, to find that the Bank’s Trustee and Investment and Income Tax

Departments can also be found, arranged in a similar way, covering England

and Wales, The Isle of Man and the Channel islands. The first of the Trustee

Departments is established in 1908 by the Bank of Liverpool. Sixty years later

Martins Bank combines that business with regional Income Tax and Investment

Offices to create MARTINS

BANK TRUST COMPANY LIMITED. We

were delighted to be provided with an insight into what what life was like

for the staff of the Liverpool Trustee department in the late 1940s / early

1950s, from Friend of the Archive Derek Lucas who wrote to us about his own

time there. Martins Bank is justifiably proud of its regional

structure, local branches, local head office departments, and the quick

decisions that can be made to help customers, based on local

knowledge. It comes as no surprise

then, to find that the Bank’s Trustee and Investment and Income Tax

Departments can also be found, arranged in a similar way, covering England

and Wales, The Isle of Man and the Channel islands. The first of the Trustee

Departments is established in 1908 by the Bank of Liverpool. Sixty years later

Martins Bank combines that business with regional Income Tax and Investment

Offices to create MARTINS

BANK TRUST COMPANY LIMITED. We

were delighted to be provided with an insight into what what life was like

for the staff of the Liverpool Trustee department in the late 1940s / early

1950s, from Friend of the Archive Derek Lucas who wrote to us about his own

time there.

|

|

It

would appear to have been not so much a behind the scenes environment, as a

quiet backwater from which you really had to try hard to escape, if you

wanted to get on elsewhere in the Bank…

“I was nine years at Water Street in the bank's Head Office Trustee

Department, along with, soon after rejoining the Bank after war service,

several clerks of my age. I was assigned to the Securities Desk and it soon

became apparent that the Bank dealt with numerous and very rich settlements

founded by very well-known Liverpool families. In addition, more and more

will appointments meant that the Bank had to have a comprehensive service

throughout the country and branches had been established to this end. All

went well, it was quite exciting to be working in Head Office, even if you were

on the fourth floor, but you were where things happened and not in some

remote Branch. “I was nine years at Water Street in the bank's Head Office Trustee

Department, along with, soon after rejoining the Bank after war service,

several clerks of my age. I was assigned to the Securities Desk and it soon

became apparent that the Bank dealt with numerous and very rich settlements

founded by very well-known Liverpool families. In addition, more and more

will appointments meant that the Bank had to have a comprehensive service

throughout the country and branches had been established to this end. All

went well, it was quite exciting to be working in Head Office, even if you were

on the fourth floor, but you were where things happened and not in some

remote Branch.

However, time passed and by the fifth year one came to realise this career path was in reality a “cul-de-sac”. The Department had three signing officers,

an Assistant Manager, a Sub-Manager

and the Manager, six in

all. I must say the

staff were very happy up to a point, but we hadn't joined the Bank to be

Executors and Trustees. All our contemporaries were gaining valuable

experience in Branch banking which would lead in many cases to promotion and

to the higher echelons of Management. However, time passed and by the fifth year one came to realise this career path was in reality a “cul-de-sac”. The Department had three signing officers,

an Assistant Manager, a Sub-Manager

and the Manager, six in

all. I must say the

staff were very happy up to a point, but we hadn't joined the Bank to be

Executors and Trustees. All our contemporaries were gaining valuable

experience in Branch banking which would lead in many cases to promotion and

to the higher echelons of Management.

Along with some others with similar views it took several years to be extricated

from this 'backwater' and on rejoining the mainstream of branch banking

several years of intensive activity to get and keep abreast of those luckier

enough to have had a head start, as it were. I don't intend to sound just an old sour grape, but a huge

number of staff must have had the same experience and indeed the Staff

Turnover must have gathered pace in the fifties and early sixties. These departments should have attracted

recruits from the professions, such as the law and accountancy, a worthwhile

experience for any young trainee solicitor or trainee accountant. The lack of

appointments, compared to the expansion of the Branch Network, meant that you

were placed in a backwater, in some cases for life, no pun intended. If that all sounds very pessimistic

I apologise, but being the biggest separate department, outside of the Branch

Network, there must surely be a case for it and its records to join Martins Bank Archive”…

|