|

|

|

|

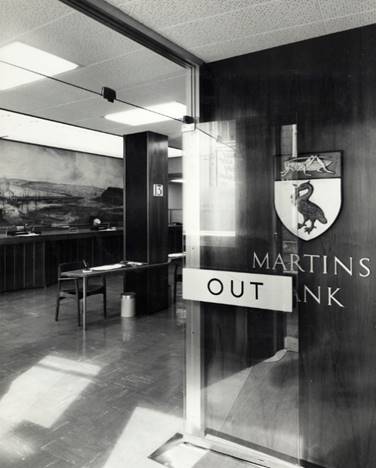

In Service: 1951 until 21 November 1969

Branch

Image © Barclays Ref 0030-1444 |

||||||||||||||||||||||

|

Sadly,

Martins Bank Magazine does not record a specific visit to the Trust Company

in St Helier, so If you can help with images and/or information about this or

any of Martins Bank’s branches, please do get in touch with us at the usual

address: - gutinfo@btinternet.com. In 1968, the Bank produces

one of its final product leaflets before the merger with Barclays – EVERYONE

NEEDS A BANK ACCOUNT – from which the following is

a short extract outlining the services of the Trust Company:

Martins Bank Trust

Company, a subsidiary of the Bank, has a special Income Tax Division to help

customers with their Income Tax and Surtax problems.With the growing

complexity of tax law, more and more people are finding it worthwhile to make

use of the Company's experience in this field, and in many cases the modest

charge made is more than offset by tax recovered for the customer.

Looking after

investments If you do not

have the time you would wish to devote to looking after your investments, or

if, perhaps, you feel the need for skilled advice about their management

Martins can help you through the Trustee and Investment Division of Martins

Bank Trust Company. The investments remain your own property and the Company

manages them in accordance with your particular wishes. Generally,

recommendations regarding investments are submitted for your approval, but

if you wish the Company will manage investments in accordance with wider

terms of reference. In addition the Company will undertake the collection of

dividends, deal with 'rights* issues and attend to all necessary

documentation in relation to your investments.

Unit trusts enable you to invest in a

large number of public companies without the bother of the many separate

transactions needed to acquire the stocks and shares. You can buy units of

the Martins Unicorn Group of Unit Trusts at any branch of Martins and your

Manager will help you to select the Trust best suited to your investment

needs. You do not need a large amount of money to invest in Martins Unicorn

Trusts. There is a savings plan to enable you to buy units month by month,

and Martins Unicorn Bonds, in units of £20, provide a simple and convenient

way of investing in the Martins Unicorn Trust of your choice.

|

|||||||||||||||||||||||

|

|

|||||||||||||||||||||||