|

|

Big acorns from little

apples? Big acorns from little

apples?

That Martins Bank had Branches

at TEN university sites throughout England by 1969, did not come about

overnight. Students are the

professional classes of tomorrow, likely to have a large income, AND the need to have that income

looked after by a bank. The concept of banks offering a dedicated, often

campus-based Branch, was the brainchild of Mr William T Green (pictured,

right) a member of the Bank’s Staff in Liverpool, who became the Assistant

Manager of the first University Branch, which opened in Liverpool in

1958. He had the original idea in

1956, but operational constraints meant that the Bank could not progress

with opening a branch for a further two years. That however, is still not the beginning

of the story. Since the “Silver

Linings Savings Week” of 1948, Martins Bank had provided what we might

nowadays term “pop-up” branches at a wide range of venues and events, in

particular through the use of its fleet of six mobile branch caravans

during the annual country show season. That Martins Bank had Branches

at TEN university sites throughout England by 1969, did not come about

overnight. Students are the

professional classes of tomorrow, likely to have a large income, AND the need to have that income

looked after by a bank. The concept of banks offering a dedicated, often

campus-based Branch, was the brainchild of Mr William T Green (pictured,

right) a member of the Bank’s Staff in Liverpool, who became the Assistant

Manager of the first University Branch, which opened in Liverpool in

1958. He had the original idea in

1956, but operational constraints meant that the Bank could not progress

with opening a branch for a further two years. That however, is still not the beginning

of the story. Since the “Silver

Linings Savings Week” of 1948, Martins Bank had provided what we might

nowadays term “pop-up” branches at a wide range of venues and events, in

particular through the use of its fleet of six mobile branch caravans

during the annual country show season.

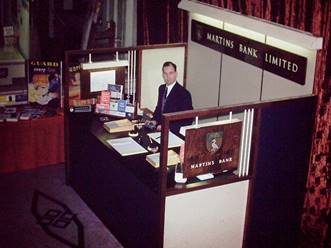

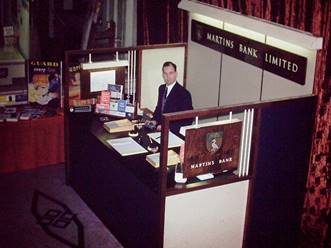

The bank also appeared at

trade shows and events, sometimes using temporary pre-fabricated buildings

and, more often, purpose-built stands – some of which (like this one) could

be taken apart and then re-used at other locations. The FIRST year for which we can find reference to the

appearance of a Branch of any type at a University, is 1953, when Martins

Bank opened a temporary branch in the reception room of the Students’ Union

at Liverpool University from 2nd to 9th September. The occasion was a

meeting of the British Association for the Advancement of Science, which

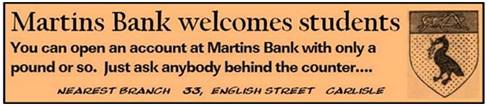

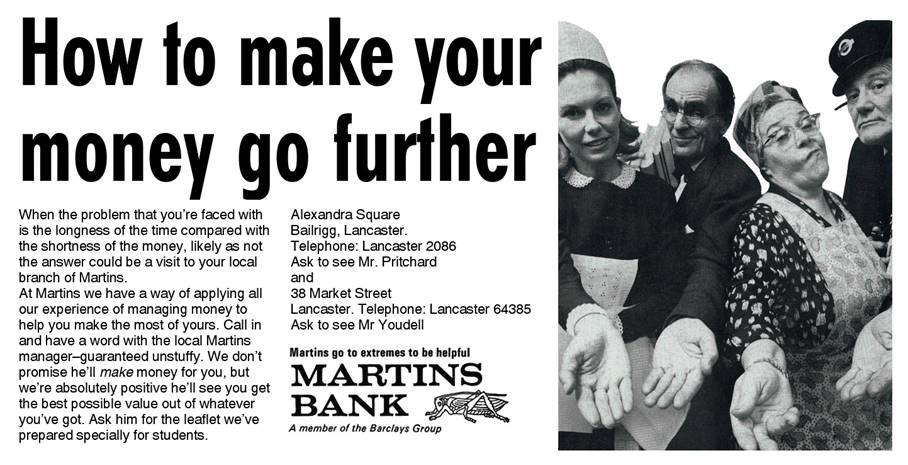

had chosen as its venue, the University at Liverpool. The advertisement shown here is generic

copy from the Bank’s “Stately Homes of England” campaign, and you might be

forgiven for almost missing, hidden

in the middle of the advertisement, the announcement of the establishment

of the temporary branch which will be open at the University for just the

eight days of the meeting of the Science Association. The bank also appeared at

trade shows and events, sometimes using temporary pre-fabricated buildings

and, more often, purpose-built stands – some of which (like this one) could

be taken apart and then re-used at other locations. The FIRST year for which we can find reference to the

appearance of a Branch of any type at a University, is 1953, when Martins

Bank opened a temporary branch in the reception room of the Students’ Union

at Liverpool University from 2nd to 9th September. The occasion was a

meeting of the British Association for the Advancement of Science, which

had chosen as its venue, the University at Liverpool. The advertisement shown here is generic

copy from the Bank’s “Stately Homes of England” campaign, and you might be

forgiven for almost missing, hidden

in the middle of the advertisement, the announcement of the establishment

of the temporary branch which will be open at the University for just the

eight days of the meeting of the Science Association.

Gloves on, gloves off…

The fight

for representation on University campuses is fierce, and often made more

difficult by the Universities’ own

bankers who, invariably, are given first choice over prime customer

sites. In this feature we will look

at what Martins Bank has to offer to students, against the background of

the story of how the Bank – against a number of odds – works for nearly FIVE YEARS to secure one of only two prime

retail sites at LANCASTER

UNIVERSITY in the 1960s, a Branch that along with a

Liverpool University Branch (moved to the campus itself in 1967), stays

open until January 2021.

As we

shall see further down this page, competition between the major banks for

the banking business of students becomes ever more cut-throat, resulting in

a bewildering array of free gifts, and perhaps a little dangerously the

provision of larger limits on ever cheaper overdrafts, credit cards and

loans. Tie this in with the almost

obscene promotion of hard-sell techniques over that of traditional customer

service, and hindsight allows us a sobering glimpse of why, perhaps, so

much went so wrong with Banking in the 1990s.

|

Images © Martins Bank Archive Collections

|

|

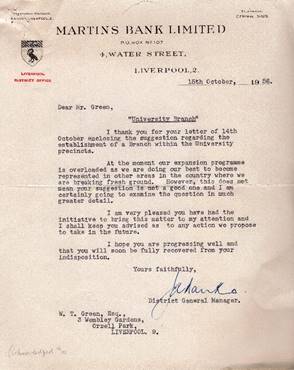

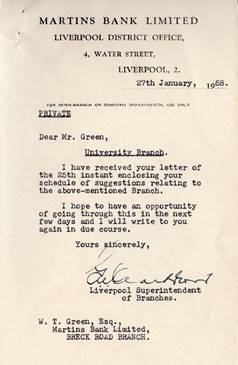

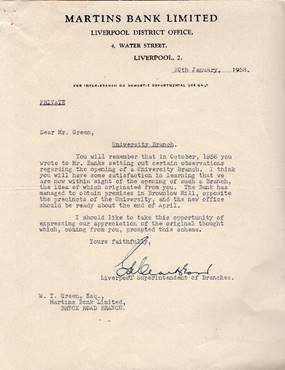

A

bright idea…

Student Banking,

through the provision of on-or-near-campus facilities is suggested to the

Bank as early as 1956 by William T Green.

Mr Green, who joined the bank in 1947, has made good progress,

working his way through the Institute of Bankers Examinations, and building

a reputation as someone who keeps both the operational needs of the bank,

and the needs of its customers firmly and fairly balanced. Thanks to his

Daughter Fiona, we are able to reproduce here a number of letters which

chart the setting up of Liverpool University as the first student service

branch, and which show that good ideas from members of the staff are taken

seriously. Mr Green is given the job

of Branch Second, and works his way up to a full “Pro Manager” signing

position which allows him to fully deputise for the role of bank manager…

|

|

|

|

|

|

Images © Martins Bank

Archive Collections – F Winter

|

|

|

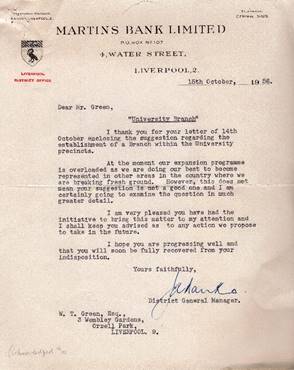

From Mr Green’s

initial suggestion, which was sent into the Bank in October 1956, it takes about

nineteen months for the Bank to be able carry the idea to fruition, with

the opening on 1 May 1958 of Liverpool University sub-branch.

It is interesting

to note from the Bank’s initial response in 1956, that Martins Bank’s

expansion programme is quote “overloaded”, as the business is pushing hard

into areas of England and Wales to create a more national distribution of

outlets.

In the letter, Mr

J A Banks talks optimistically of “breaking fresh ground”, yet despite this

large financial commitment, he thanks Mr Green for his initiative, and

promises to keep him advised of the development of a University Branch.

|

|

|

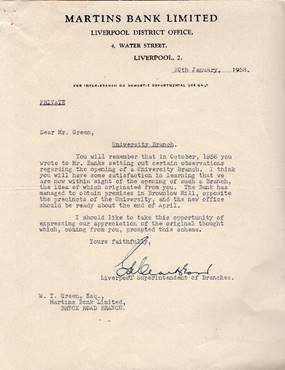

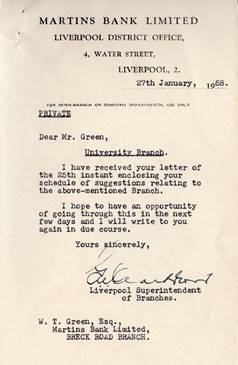

Sure enough, in

January 1958 the Bank writes once more to let Mr Green know that such a

branch is very much on the cards within a few months, and Mr Green,

keen to be in at the start of this exciting new venture, wastes no time in

sending his suggestions for how it all might come together, AND work in practice.

|

|

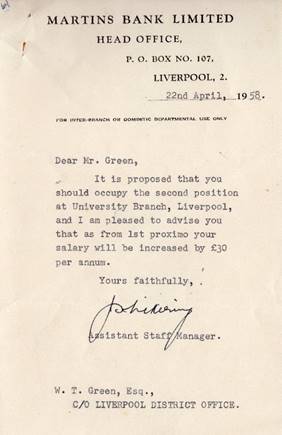

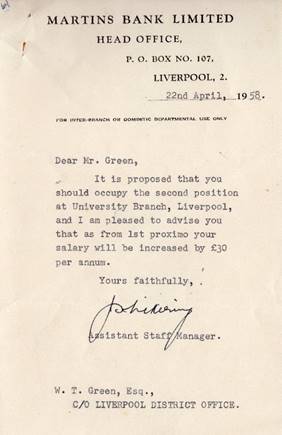

By the end of April 1958, he is

rewarded by the offer of occupying the “second position” at the new Branch,

a job which at that point in time was broadly equivalent to that of an

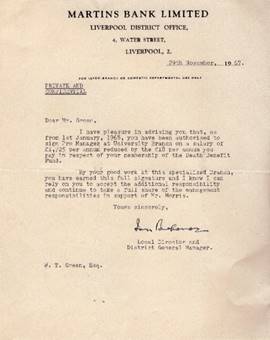

Assistant Manager. Finally, after more than nine years at Liverpool University

he is promoted again and thanked for his “good work at this specialised

Branch”. Once

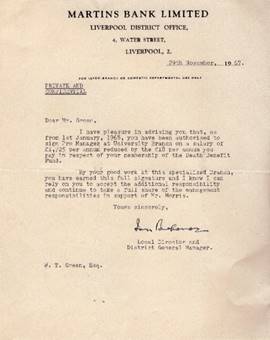

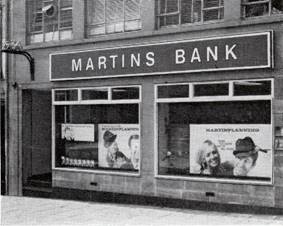

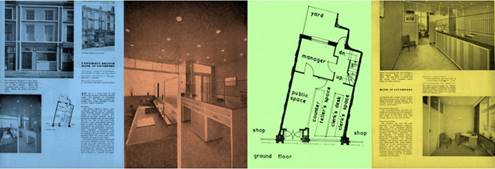

open, Liverpool University Branch attracts the attention of the Architect

and Building News, which publishes this spread once work is complete – the

Branch itself is a renovated former shop, and as Martins sees university

banking as something of an experiment, the whole thing is put together with

the cheapest fixtures and fittings available that will serve as a bank, yet

still attract the “tomorrow people” that Martins wants as its customers. By the end of April 1958, he is

rewarded by the offer of occupying the “second position” at the new Branch,

a job which at that point in time was broadly equivalent to that of an

Assistant Manager. Finally, after more than nine years at Liverpool University

he is promoted again and thanked for his “good work at this specialised

Branch”. Once

open, Liverpool University Branch attracts the attention of the Architect

and Building News, which publishes this spread once work is complete – the

Branch itself is a renovated former shop, and as Martins sees university

banking as something of an experiment, the whole thing is put together with

the cheapest fixtures and fittings available that will serve as a bank, yet

still attract the “tomorrow people” that Martins wants as its customers.

|

|

|

|

|

|

Staking a claim ...

Martins Bank learns much from its early involvement with Britain’s

newest Universities in the late 1950s. Careful monitoring of student banking

habits at Liverpool University provides valuable information, both on the

ways in which students conduct their accounts, and, more importantly, on the

costs that will be involved to Martins in providing free banking and

maintaining local Branches at further and future Universities. As the 1960s progress, and more new red

brick and concrete establishments of learning are brought into being, a

policy begins to emerge, where universities restrict the sole or main use of

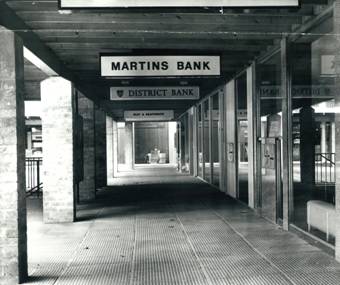

banking outlets on their grounds to those that act as their bankers. This is certainly the situation at Lancaster,

where Martins spends almost five years staking a claim to being able to offer

its services to students. Martins Bank learns much from its early involvement with Britain’s

newest Universities in the late 1950s. Careful monitoring of student banking

habits at Liverpool University provides valuable information, both on the

ways in which students conduct their accounts, and, more importantly, on the

costs that will be involved to Martins in providing free banking and

maintaining local Branches at further and future Universities. As the 1960s progress, and more new red

brick and concrete establishments of learning are brought into being, a

policy begins to emerge, where universities restrict the sole or main use of

banking outlets on their grounds to those that act as their bankers. This is certainly the situation at Lancaster,

where Martins spends almost five years staking a claim to being able to offer

its services to students.

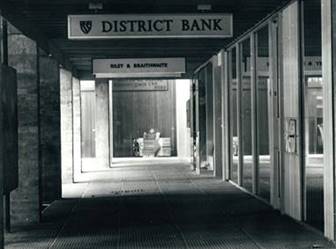

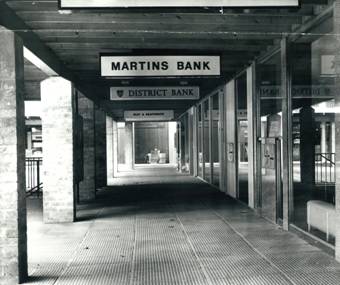

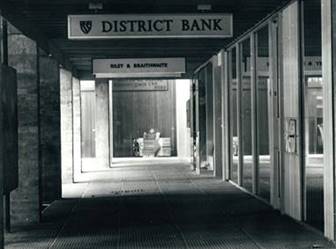

The District Bank, has a very strong

local presence and its role as to the

University of Lancaster means it already has its feet firmly under the table.

On top of this, the University is itself keen to choose a bank that knows and

reflects the locality. Thankfully, Martins Bank also fits the bill by having

a blanket coverage of local branches and undisputed Northern roots – and it

will not take the situation lying down!

The process of wooing the University authorities

at Lancaster begins in 1963, even before the University receives its charter,

and it culminates in the successful establishment of a branch alongside the District Bank in

the main shopping area of the University – Alexandra Square. Along the way Martins encounters the usual

suspects – low key introductions to high profile personnel on both sides,

followed by offers of dining out, and then more formal meetings. The

Bank’s original overtures to the University seem to have paid off, and they

are informally offered a place.

However the whole process is then turned on its head by a tendering

process, which the University feels will make it all look fair, and Martins

must bid along with the other banks for what is in reality just one place –

the other destined almost certainly go to the District Bank. That Martins Bank is successful – at what

is understood to have been an incredibly heavy initial price – goes without

saying and the branch that served students at Lancaster continuously until

closure in 2021, was opened first in temporary premises in 1966, and then in

its permanent shop front outlet in Alexandra Square in 1968.

Researching

the Student Market…

|

Mr W O Davies

|

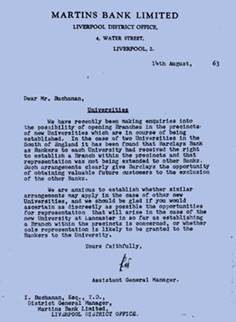

We are

indebted to our friends at BARCLAYS

GROUP ARCHIVES for their research on our

behalf into the Martins’ Branch at Lancaster University, and for making a

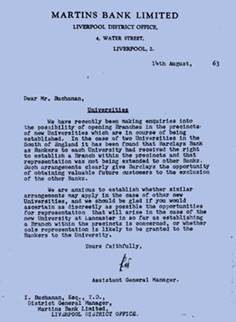

number of key records available to us for this feature. We begin in August 1963 when Mr W O

Davies, Liverpool Assistant District General Manager, writes to Mr I

Buchanan, Liverpool District General Manager, to make the case for actively

pursuing University outlets for the Bank. Research has shown that almost as

soon as new Universities are announced, the fight begins amongst the Banks

and others, including insurance companies, to access the student

market. Mr Davies wants his boss to

understand how crucial it will be for Martins to build on the success of

its Liverpool University branch, and try for a place at Lancaster… We are

indebted to our friends at BARCLAYS

GROUP ARCHIVES for their research on our

behalf into the Martins’ Branch at Lancaster University, and for making a

number of key records available to us for this feature. We begin in August 1963 when Mr W O

Davies, Liverpool Assistant District General Manager, writes to Mr I

Buchanan, Liverpool District General Manager, to make the case for actively

pursuing University outlets for the Bank. Research has shown that almost as

soon as new Universities are announced, the fight begins amongst the Banks

and others, including insurance companies, to access the student

market. Mr Davies wants his boss to

understand how crucial it will be for Martins to build on the success of

its Liverpool University branch, and try for a place at Lancaster…

|

Mr I Buchanan

|

|

Image © Barclays Ref 0025-0613a

|

|

“We

have recently been making enquiries into the possibility of opening

Branches in the precincts of new universities which are in course of being

established. In the case of two

Universities in the South of England it has been found that Barclays Bank

as Bankers to each University had received the right to establish a Branch

within the precincts and that representation was not being extended to

other Banks. Such arrangements clearly give Barclays the opportunity of

obtaining valuable future customers to the exclusion of the other Banks.

We are

anxious to establish whether similar arrangements may apply in the case of

other new Universities, and we should be glad if you would ascertain as

discreetly as possible the opportunities for representation that will arise

in the case of the new University at Lancaster in so far as establishing a

Branch within the precincts is concerned? or whether sole

representation is likely to be granted to the Bankers to the University”

|

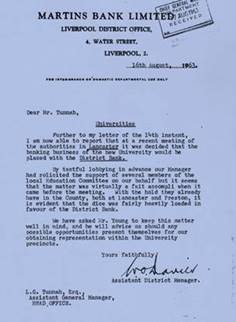

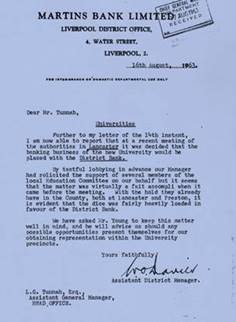

Two days later, Mr Davies writes again, this time to Mr L G Tunnah,

Assistant General Manager at Head Office, with an update on what is a fast

moving situation:

|

“Further

to my letter of the 14th instant, I am now able to report that at a recent

meeting of the authorities in Lancaster it was decided that the

banking business of the new University would be placed with the District

Bank.

By

tactful lobbying in advance our Manager had solicited the support of

several members of the local Education Committee on our behalf but it seems

that the matter was virtually a fait accompli when it came before the

meeting.

With

the hold they already have in the County, both at Lancaster and Preston, it

is evident that the dice was fairly heavily loaded in favour of the

District Bank.

We have

asked Mr. Young

to keep this matter well in mind, and he will advise us should any possible

opportunities present themselves for our obtaining representation within

the University precincts”.

|

|

Image © Barclays Ref

0025-0613a

|

A Fait

accompli…

As feared, the

competition - in the form of the District Bank - has won the right to be

Bankers to the University. This will

guarantee them a retail outlet on the new campus when it opens. Between 1963 and 1966, Martins Bank’s

Lancaster Manager, Mr Youdell (pictured, right) has the job of keeping on the

friendliest terms with the University, and remaining vigilant to any news

that another retail outlet may be up for grabs. His “tactful lobbying” is much appreciated

by Liverpool District Office, and it will eventually bear fruit – rather

expensive fruit: After much deliberation, two banking units are proposed in

the main shopping area of the University, and these are put out to

tender. Wisely, the University wants to

be seen as fair, and to attract the highest bidder for the two leases. The price paid must be the same for both

winning banks, which means that although the District Bank will be one of

those winners, it too, will be expected to dig extremely deep for the

privilege. As feared, the

competition - in the form of the District Bank - has won the right to be

Bankers to the University. This will

guarantee them a retail outlet on the new campus when it opens. Between 1963 and 1966, Martins Bank’s

Lancaster Manager, Mr Youdell (pictured, right) has the job of keeping on the

friendliest terms with the University, and remaining vigilant to any news

that another retail outlet may be up for grabs. His “tactful lobbying” is much appreciated

by Liverpool District Office, and it will eventually bear fruit – rather

expensive fruit: After much deliberation, two banking units are proposed in

the main shopping area of the University, and these are put out to

tender. Wisely, the University wants to

be seen as fair, and to attract the highest bidder for the two leases. The price paid must be the same for both

winning banks, which means that although the District Bank will be one of

those winners, it too, will be expected to dig extremely deep for the

privilege.

Doing the

maths…

Having secured its place at University, Martins Bank must now make the

venture it pay for itself in the long term.

Even as long ago as 1963, the cost per student to Martins of offering

free banking seems very high at £15.

That’s - £245 per student based on the increase in retail

prices over the fifty years between 1963 and 2013, or £540 per student

if based on average earnings over the same period! There is no doubt that the long-term

advantages are good – a graduate who becomes a high earning professional is

likely to need to call upon the Bank’s financial expertise. The facts and

figures are mulled over by top brass of the Bank, who are presented with this

feasibility paper in January 1964…

1. So

far we can measure the success and the cost of our university branch

programme, only by our

Liverpool experience.

2. We cannot

expect to be as successful in attracting undergraduate accounts in other

places as we have been in Liverpool.

3. We

have obtained in Liverpool about 400 undergraduate accounts per annum and, of

these, we can expect to retain, say, 250 after graduation either at the

branch or at other branches.

4.

Our loss will probably persist in the £3,000 per annum range plus, say, share of

special advertising £1,000 per annum. So it is costing £4,000 to get 250

graduate accounts - say, £15 upwards per account.

5. I

would be prepared to regard this as a worthwhile expenditure to obtain the

accounts of this type of person.

6. We

should continue our policy of opening branches to serve universities and

where- existing branches place us at disadvantage to other banks by reason of

location we should consider special university sub or full branches.

7. It

is open for investigation in particular cases whether the best result would

be obtained by being in the university precincts or in a situation convenient

for students but also available to the public.

8. We

should enquire of all branches in university towns

(a)

The average number per annum of undergraduates obtained as customer (show

male/female separately).

(b)

Proportion who remain with:-

(i) the branch

(ii) other branches of the bank

after graduation (male/female

separately)

(c)

Whether they recommend any special facilities, e.g. new sub branch.

We should co-ordinate our publicity efforts with the

activities of relative branch managers

who should be more fully aware of what is being done.

Moving

in…

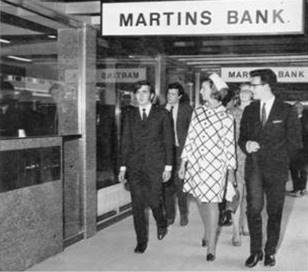

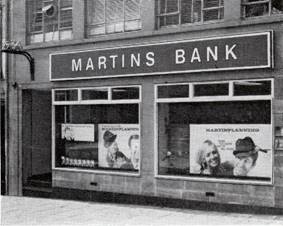

To begin with, Lancaster

University itself is based at St Leonard’s Gate in the centre of the City.

Thanks to the gentle persuasion of Lancaster Manager Mr Youdell, a room is

made available from 18 October 1966 for Martins Bank to offer banking

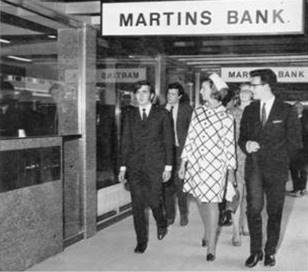

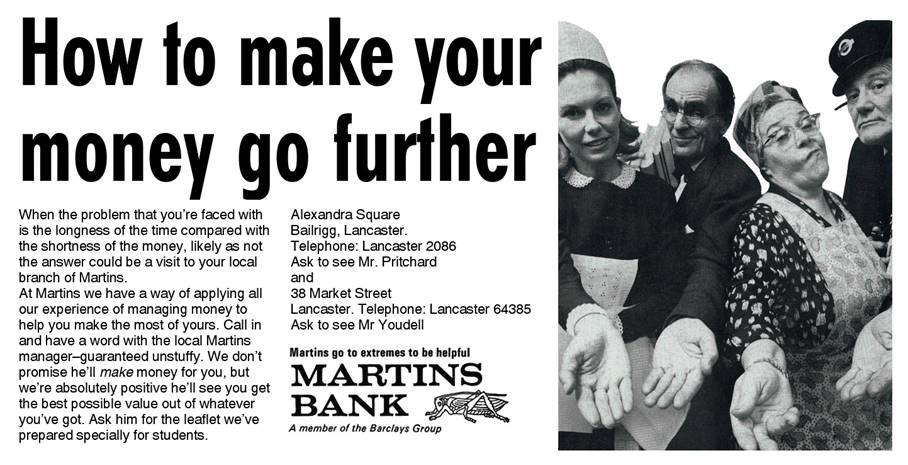

services to students, Monday to Friday, between 12 noon and 3pm. Princess Alexandra is appointed Chancellor

of Lancaster University in 1964, and remains in this position for the next

forty years. The permanent buildings are

finished and occupied in 1968, and the main thoroughfare and shopping area is

named “Alexandra Square” in honour of the Princess. On a tour of the new University, she is

photographed looking through the windows of the new branch. Martins Bank has arrived, and five years of

effort have paid off. Lancaster

University sub-Branch is upgraded quite quickly to Self Accounting status,

with its own sorting code and a clerk in charge available to make on

the spot decisions on student lending.

The following year, Lancaster University Branch is given its own

newspaper publicity (see “1969– How to make your money go further…” below) .

. . To begin with, Lancaster

University itself is based at St Leonard’s Gate in the centre of the City.

Thanks to the gentle persuasion of Lancaster Manager Mr Youdell, a room is

made available from 18 October 1966 for Martins Bank to offer banking

services to students, Monday to Friday, between 12 noon and 3pm. Princess Alexandra is appointed Chancellor

of Lancaster University in 1964, and remains in this position for the next

forty years. The permanent buildings are

finished and occupied in 1968, and the main thoroughfare and shopping area is

named “Alexandra Square” in honour of the Princess. On a tour of the new University, she is

photographed looking through the windows of the new branch. Martins Bank has arrived, and five years of

effort have paid off. Lancaster

University sub-Branch is upgraded quite quickly to Self Accounting status,

with its own sorting code and a clerk in charge available to make on

the spot decisions on student lending.

The following year, Lancaster University Branch is given its own

newspaper publicity (see “1969– How to make your money go further…” below) .

. .

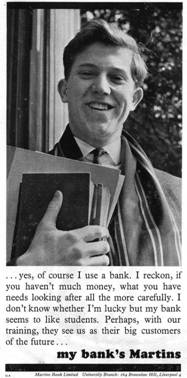

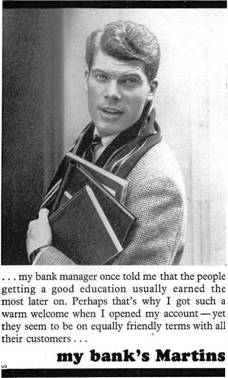

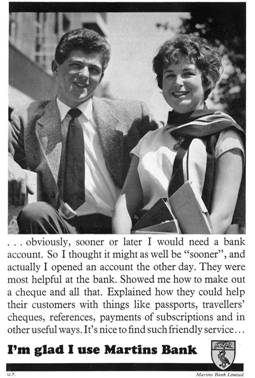

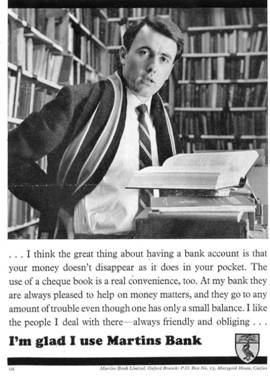

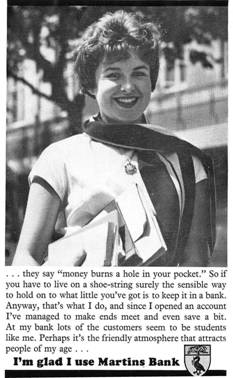

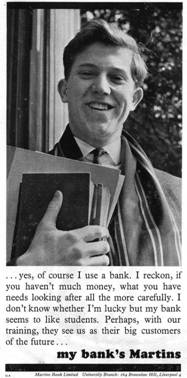

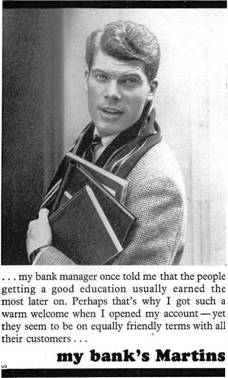

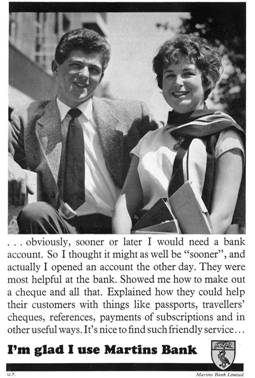

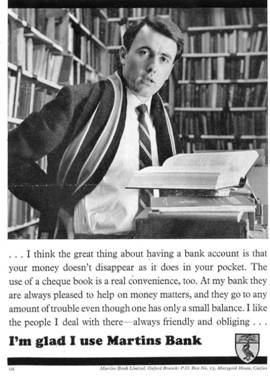

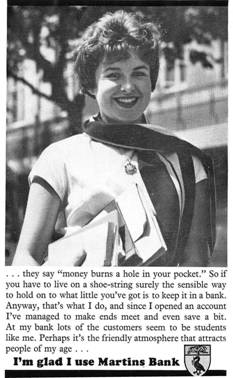

1961-4 My

Bank’s Martins…

Martins goes to extremes to help

students and young workers make the most of their limited budgets. These are

the days of the student grant, a precious commodity that has to be eked out

in baked beans, beer and rolled up tobacco over the year… The names of

Managers and their contact details are prominently displayed, and staff at

Martins Bank’s University Branches are trained to help students stretch out

their grant, or tide them over with a student overdraft. From 1961 to 1964 Martins Bank’s advertising

strategy employs the services of some “decent sorts” for a campaign that

should convince their fellow students that using a bank is the right

thing to do. Perhaps keeping your

money in a sock has finally been recognised as a bad move. Martins goes to extremes to help

students and young workers make the most of their limited budgets. These are

the days of the student grant, a precious commodity that has to be eked out

in baked beans, beer and rolled up tobacco over the year… The names of

Managers and their contact details are prominently displayed, and staff at

Martins Bank’s University Branches are trained to help students stretch out

their grant, or tide them over with a student overdraft. From 1961 to 1964 Martins Bank’s advertising

strategy employs the services of some “decent sorts” for a campaign that

should convince their fellow students that using a bank is the right

thing to do. Perhaps keeping your

money in a sock has finally been recognised as a bad move.

|

|

|

|

|

|

|

|

|

TOP ROW left to right

1961 Liverpool University Student Magazine ‘PantEcho’

1961 Leicester

University Student Handbook

1961 Freshmen’s Guide to

Teacher Training College and The Technical College Freshmen’s Guide

BOTTOM ROW left to right

1961 Student Publications at Leeds and Oxford

1962/3 The Cambridge

University Students’ Union Varsity Handbook, 1963 “Sphincter” the Liverpool

University Medical School Magazine. 1962/3 The Birmingham University Guild

of Undergraduates’ Handbook.

|

|

Images © Barclays

|

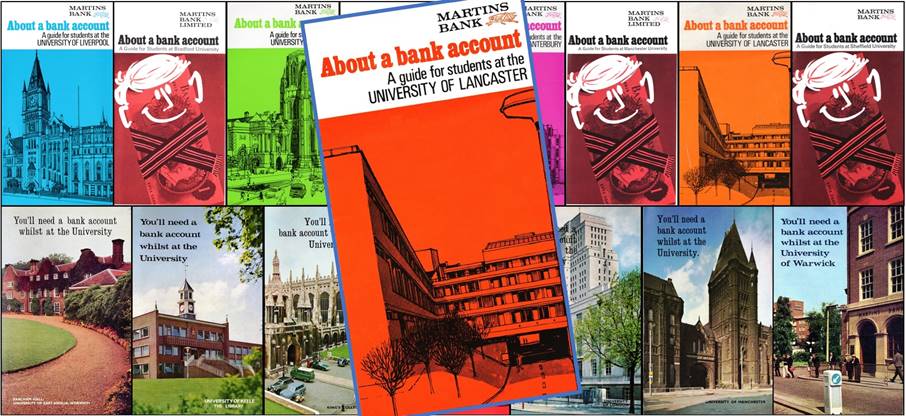

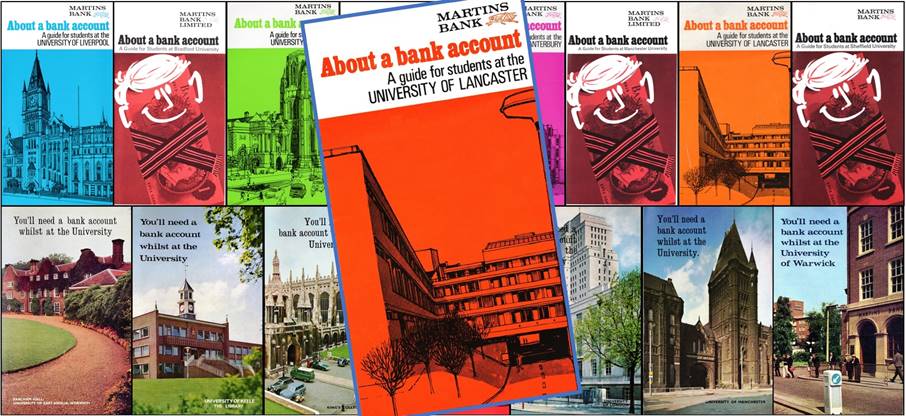

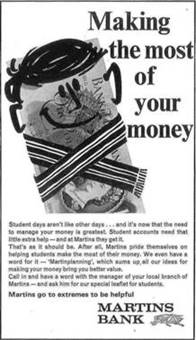

1968 - Making the

most of your money

Even on the eve of the merger, Martins is still going all out to grab a

slice of the student market. Making

the Most of Your Money, and About a Bank Account are among the last to be

seen before the ubiquitous “a member of the Barclays Group” starts to

infiltrate publications.

|

|

|

|

|

|

Images © Martins Bank Archive Collections

|

Image © Barclays

|

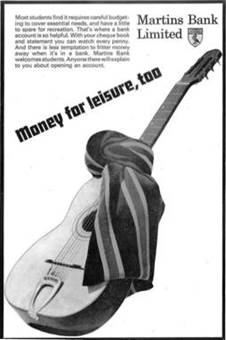

The

swinging sixties gives Martins the opportunity of a lifetime – to cash in at

last on the valuable youth banking market.

Advertisements aimed at students and young wage earners send out the

simple message that help is at hand, and that what little money these people

have is also SAFE. By March 1969, adverts such as the mid-sixties campaigns

‘Counting Up’ and ‘Money for leisure, too’ have given way to the slightly

bolder ‘How to make your money go further’, (see earlier in this feature)

which is carefully calculated to play upon students’ fears that everyone is

out to take their money, and that only a bank can make sense of it all. The

key selling point for these services is to show how they give control back to

the customer. Such control is however about to change hands forever, as at

the height of this campaign, the takeover of Martins Bank by Barclays is

almost complete…

|

Image © Barclays

|

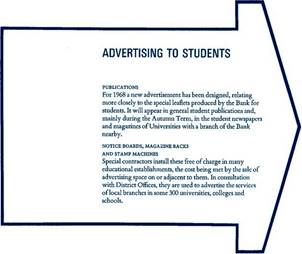

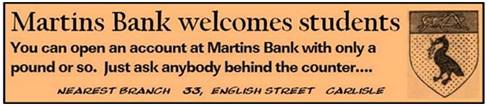

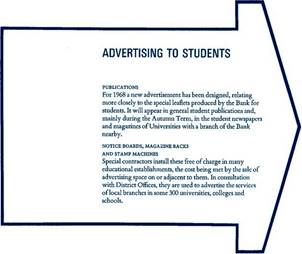

ADVERTISING

TO STUDENTS

PUBLICATIONS

For

1968 a new advertisement has been designed, relating more closely to the

special leaflets produced by the Bank for students. It will appear in

general student publications and, mainly during the Autumn Term, in the

student newspapers and magazines of Universities with a Branch of the Bank

nearby.

NOTICE BOARDS MAGAZINE RACKS AND STAMP

MACHINES

Special

contractors install these free of charge in many educational

establishments, the cost being met by the sale of advertising space on or

adjacent to them. In consultation

with District Offices, they are used to advertise the services of local

Branches in some 300 universities, colleges and schools.

|

|

|

By the mid to late 1960s the Bank

has a co-ordinated plan for attracting the custom of students. Fundamental

to the campaign are these special leaflets produced each year by the Bank

in time for university freshers’ week. Whether there is a Martins Bank

Branch on campus or not, there is a leaflet for just about every university

in England. Packaged either as

“About a bank account” or “You’ll need a bank account whilst at the

university” each leaflet provides information about student banking, local

maps of campuses or town/city centres, and occasionally photographs of

branches. Students are reminded that

Martins Bank is especially friendly to students, and that is why so many

student Bank with them.

|

1969 – How to make your money go further…

Image: ©

Martins Bank Archive Collections

Carry on Campus - Martins Bank’s University

Branches…

|

Bradford

|

Bristol

|

Durham

|

|

|

|

|

|

Lancaster

|

Leeds

|

Liverpool Liverpool

|

|

|

|

|

|

Newcastle-upon-Tyne

|

Sheffield

|

York

|

M M

x

|

![]()