|

sp |

|

|

|

|

|

|

|

|

|

![]()

![]()

|

MARTINS BANK

TIMELINE – 1918 ONWARDS… |

![]()

|

|

||||||||||||

|

1918 |

North and South combine, and an apostrophe is

dropped… |

|||||||||||

|

|

|

A banking service of one kind or another has been

offered on the site of 68 Lombard Street since 1563, when Sir Thomas Gresham

is said to have traded “at the sign of the grasshopper”. By 1918 on this site, Martin’s Private Bank

has its London Head Office and there are fourteen branches dotted mainly

around the Kentish/London border. Under the Chairmanship of Edward Norman,

Martin’s Private Bank is acquired by the

Bank of Liverpool and renamed the Bank of Liverpool and Martins.

|

||||||||||

|

1928 |

The modern day Martins Bank |

|||||||||||

|

|

The incorporation of the Lancashire and Yorkshire

Bank leads to the shortening of the title to Martins Bank Limited. The new Bank has several hundred branches

and is easily big enough to take on the London Banks, and resist further

amalgamations. Martins Bank goes

against the grain by successfully keeping its Head Office in Liverpool.

Martins Bank’s Coat of Arms shows the Grasshopper of Martin’s Private Bank

over the Liver Bird of the Bank of Liverpool…

|

|||||||||||

|

1929 |

Shows and Exhibitions |

|||||||||||

|

|

|

The North East coast Exhibition of 1929 is one of

the first opportunities for the new Martins Bank to make its presence

felt. A stand at the show is rented

from May to October in the “Palace of Industries”. Even contactable by

telephone, the stand runs as a mini Branch of the Bank and thereafter Martins

cannot resist taking part in everything from the Annual ideal Homes

Exhibition at Olympia, to the British Industries Fair, and the Shoe Trades

Exhibition. The Bank’s lavish stands

often win prizes.

|

||||||||||

|

1930 |

The Grasshopper is rebuilt |

|||||||||||

|

|

68 Lombard Street – the site of the original

“Grasshopper” – is demolished and rebuilt to accommodate the expanding

business of Martins Bank in London.

Lombard Street is amongst the Capital’s narrower thoroughfares, and

one of the best photographed images of this building is only achieved when

one of the buildings opposite has to be demolished, and the photographer is

able to move far enough away to be able to capture the entire frontage! By

1932 both Liverpool and London have purpose built premises to see Martins

Bank through a new phase in the history of Banking which will include the

arrival of mobile branches, computers, drive-in branches, cash machines, and

decimal currency… |

|||||||||||

|

1932 |

A new Head Office |

|||||||||||

|

|

No 4 Water Street Liverpool, the new Head Office

of Martins Bank Limited is opened. The

building is a lavish affair themed around Liverpool’s maritime

connections. With three floors below

ground, and eight above, customers and staff travel in high speed lifts

situated in beautifully decorated rotundas at the front of the building. The “horseshoe” counter is stunning, and

along with the main building, has listed status in the twenty-first century.

Innovative heating and lighting systems make the building firmly ahead of its

time, and its cathedral like banking hall provides a backdrop for film makers

into the twenty-first century… |

|||||||||||

|

1938 |

Anyone for

money? |

|||||||||||

|

|

|

A sub-Branch is opened at the prestigious All England

Lawn Tennis Club, on Wimbledon’s Centre Court. Who knows how many World famous tennis

stars will be served with cash by the staff seconded from Wimbledon High Street

Branch? Hours of business run from 12 noon until close of play, so staff must

expect a few eight hour shifts during the two weeks of the annual

tournament. The prize of a sub-Branch

on Centre Court will be game, set, and match for Barclays when it takes over

in 1969… |

||||||||||

|

1940 |

A golden opportunity |

|||||||||||

|

|

The new Head Office Building is put to the test

in 1940, when in May, a large part of Britain’s reserves of gold are brought

to Liverpool and stored in the vaults of the Bank. The Bank of England recognises that Martins

Bank has one of the most sophisticated and impregnable safes in the country,

and once the gold has been removed and shipped from Liverpool to Canada, the

governor of the Bank of England extends his thanks and glowing praise to

Martins for their “national service”… |

|||||||||||

|

1941 |

Keep Calm, and Carry On |

|||||||||||

|

|

Exeter Branch is destroyed in the famous

Baedecker Air Raid in April 1941. It is one of a number of casualties

suffered by the Bank around the Country during the Second World War – 32

Lowndes Street London, 19 South John Street Liverpool, and Manchester Corn

Exchange are amongst those destroyed by enemy action. Meanwhile an “army” of female members of

staff is temporarily promoted to run Branches and sub-Branches whilst the

male staff are away fighting in the Second World War. Many of these women take on the

responsibilities of Clerk in Charge, and maintain the vital service of

providing cash for local people and businesses in the days when a bank was

almost the only way to obtain it. Between 1939 and 1946, many more branches

are closed either for the duration of hostilities, or permanently. |

|||||||||||

|

1948 |

Martins Bank goes on the road |

|||||||||||

|

|

Martins Bank launches a mobile banking service in a

specially converted caravan which makes its debut during “Thrift Week”. Despite being iron framed and needing a

large vehicle to tow them, the mobile branches are quite versatile and

remarkably useful: They also stand in for branches that are being built or

rebuilt. In the 1950s they bring

banking to ordinary people on housing estates. By the late 1960s, a fleet of

six caravans attends more than 80 annual agricultural shows and other events

around the country, promoting the services of the Bank. The vans are given a

makeover by Barclays and used briefly in the early 1970s, but we had to wait

nearly forty years before the “bank on wheels” came back into regular use… |

|||||||||||

|

1951 |

Banking from Dover to Calais |

|||||||||||

|

|

Martins Bank’s Business is enhanced by the

acquisition of the British Mutual Bank, which has two branches in London and

operates a special banking service on board the UK’s first Cross-Channel

Ferry. Customers can only be served whilst the ship is moving through the

English Channel. In the early days

just one cashier has sole responsibility for all the cash, and the

balancing of the books in several currencies! The Cross-Channel Bank operates

until the early 1980s, when newer ways of spending money abroad, such as

debit cards and an internationally available network of cash machines lessens

the popularity of, and the need for the changing Sterling for foreign

currencies and travellers’ cheques… |

|||||||||||

|

1955 |

An agricultural legacy |

|||||||||||

|

|

Finance for Farmers and Growers is a unique

collaboration between Martins Bank and the ministry of Agriculture. It is published in 1955 shortly after food

rationing in the UK is abolished. This annual summary of trends in farming,

and the ways in which it can be financed, is an immediate hit, and continues

to be produced by Barclays until the late 1980s. Published for more than thirty years,

Finance for Farmers and Growers now provides us with a detailed historical

record of the changing face of farming in Britain. |

|||||||||||

|

1958 |

Banking on the Student Pound |

|||||||||||

|

|

|

Martins Bank opens a branch at Liverpool University,

to look after the finances of the lawyers, doctors and teachers of tomorrow.

For the next forty years, competition amongst banks for the student market

will reach fever pitch as they try to out-do each other with larger and

better incentives and giveaways in order to secure new accounts. Martins opens branches at ten University

sites, losing many of them at the time of the merger with Barclays in 1969… |

||||||||||

|

1958 |

Are you being served? |

|||||||||||

|

|

Martins Bank acquires Lewis’s Bank Limited, a unique

banking enterprise for its size, with branches inside department stores. This briefly provides Martins Bank with its

first (and only) branch in Scotland.

Lewis’s Bank opens all day Saturday, and runs a dedicated children’s

counter in each of its department store branches to encourage thrift in the

young. Martins Bank owns Lewis’s for

nine years, before selling it on to Lloyds Bank in 1967. For many years Lewis’s Bank has a branch at

the top London department store Selfridges, because Lewis’s Stores actually owns

Selfridges during that time. |

|||||||||||

|

1959 |

Bringing the Bank to the workplace |

|||||||||||

|

|

One of Martins Bank’s first modern “workplace”

Branches opens at the I C I Wilton Works at Middlesbrough. Over the next ten years, branches for the

use of company employees will open at a number of sites around England,

including a hospital in Liverpool, two RAF Stations in the North East, a Paper Mill in Kent, and the scarily

futuristic gas research station at Killingworth, Northumberland. The

sub-Branch at Wilton Works remains open for FORTY years… Several years later, at the British Wool Marketing

Board in Kew, Surrey, banking in the workplace is one of a number of

initiatives used by Martins Bank to dispel the myth that bank accounts are

only for the rich… |

|||||||||||

|

1959 |

The Leicester Drive-In Bank |

|||||||||||

|

|

Charles Street – Martins Bank’s second branch in the City

of Leicester – includes a new drive-in banking service which is opened by the

Minister for Transport, Harold Watkinson. The drive-in becomes one of the

most photographed of the Bank’s innovations, but there is controversy on day

one when young attractive models are used in place of local staff in some of

the publicity shots. Despite drive-in banking never really taking off in

Britain, the Martins Drive-in Branch at Leicester is kept on by Barclays, and

operates for nearly thirty years…

|

|||||||||||

|

1960 |

The digital revolution begins |

|||||||||||

|

|

Martins Bank becomes the first Bank in the UK to

successfully demonstrate the day to day processing of its customers’ current

accounts using an electronic computer. Trials of the british made “Pegasus”

Computer are run in Liverpool and London, and extensive research into

marrying together the processes of the Branch Counters and the Back office is

undertaken by Martins’ Head of Organisation research and Development, Ron

Hindle, who visits the USA and Sweden in search of the expertise and

equipment that will deliver computerised banking. Originally the size of a room, the Pegasus

computer can process the details of 30,000 accounts, yet its memory capacity

is less than you might find today in some children’s toys.

|

|||||||||||

|

1963 |

Four Centuries of Banking |

|||||||||||

|

|

The business originally founded “at the sign of

the Grasshopper” the principal

London office of Martins Bank celebrates its Four Hundredth Anniversary. Martins Bank publishes part one of its

“autobiography” – Four Centuries of Banking – which charts the Bank’s

activities and key personnel back to 1563. Martins Bank does not simply look

back at its history, it is also working hard on the future, and the Clearing

Department at Lombard Street has just been equipped with an IBM Reader-Sorter

Machine, capable of handling nearly 1000 cheques per minute… |

|||||||||||

|

1963 |

Beryl at the helm |

|||||||||||

|

|

Beryl Evans becomes Martins Bank’s first female

appointed member of staff. She takes

on the role of Assistant Manager of the Bank’s Advertising Department. Beryl has been involved in all aspects of

Head Office life, and has also taken part in, or planned most staff social

events since the late 1940s. She leads by example, turning her hand to just

about anything to help maintain the success of the Bank. Under her leadership

the advertising department takes a much needed and radical step away from the

staid and boring, and embraces the surreal and swinging 60s head on. |

|||||||||||

|

1965 |

The only way is up |

|||||||||||

|

|

At 23 St James’s Street, London, the former British Mutual

Bank Branch is demolished and rebuilt for a modern age. The new building

becomes Martins Bank’s first “escalator Branch”, where all services are

accessed by first travelling to the upper floors by escalator. St James’

Street is amongst the most modern of the Bank’s Branches, and Martins’ use of

top designers, architects and craftsmen produces new branches and rebuilds

that are often a radical departure from the stuffiness and claustrophobia of

many of the older style bank branches.

St James’s Street Branch is retained by Barclays and stays in service

until 1995… |

|||||||||||

|

1966 |

Joined up banking |

|||||||||||

|

|

The London Computer Centre is completed at

Bucklersbury House, Walbrook, London, and runs a Martins designed branch

accounting program that will last into the twenty-first century. A partnership with N C R sees the Bank’s

first real steps towards computerising its Branch network. This is partly achieved with a system

linking more than 30 branches in the London area, and experiments with data

transmission between London and Liverpool are well advanced by the time of

the merger with Barclays. When

Bucklersbury House is demolished in 2011, all trace of the London Computer

Centre is lost to history. Martins’ original plans for a new computer centre

at Wythenshawe, Manchester, are however taken on and expanded by Barclays… |

|||||||||||

|

1966 |

Working with Animals and children |

|||||||||||

|

|

|

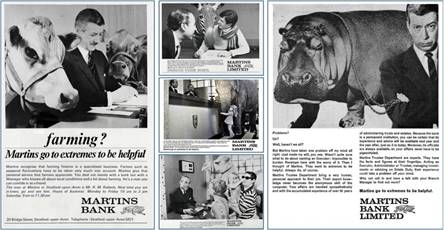

The Bank’s advertising takes on the services of a small girl, and variety

of animals - an elephant, a camel, a zebra a hippo and some cows in order to

appeal to the full range of potential customers! The elephant advertisement in particular,

is so popular that a Yorkshire Zoo re-creates it by taking one of its own

elephants and a small girl into York Branch to open an account. From now

until the merger with Barclays, Martins Advertising will be striking and

innovtive, but always just a little tongue-in-cheek… |

||||||||||

|

1966 |

The Epsom Drive-In Bank |

|||||||||||

|

|

Martins Bank opens a second drive-in Branch at Epsom,

Surrey, serving what the Bank refers to as “the gin and Jaguar belt”. Epsom Branch is opened in a former police

station, and stands in its own grounds with ample space for a drive-in

window. The branch is built at the

insistence of one of Martins Bank’s Directors, whose wife has expressed

embarrassment at not having a local Branch of the bank at which to cash her

cheques! The Epsom drive-in remains

open until 1979, with the branch itself closing a couple of years later. |

|||||||||||

|

1967 |

The Grasshopper and the Unicorn |

|||||||||||

|

|

The Unicorn brand

is originally partly the creation of Sir Edward DuCann MP, whose “Unicorn

Securities” Company is re-branded Martins Unicorn, in 1967. Martins Bank acquires Unicorn Unit Trusts,

which along with the profitable Martins Bank Trust Company branches around

the country, will provide lucrative income opportunities for Barclays for

decades to come. Martins Unicorn is

the subject of the Bank’s one and only television advertisement, which airs

in three regions of the newly reshuffled ITV network in October 1968. |

|||||||||||

|

1967 |

Money round the

clock |

|||||||||||

|

|

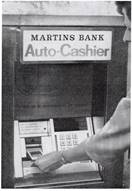

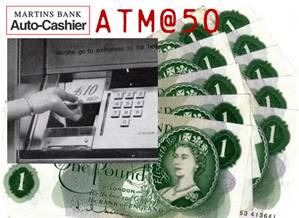

Martins Bank unveils

the first cash dispenser in the North of England at Liverpool, Church Street

Branch, in October 1967. Although

Barclays opens the World’s first cash dispenser in Enfield, Middlesex some

five months earlier, it requires the use of paper vouchers and a six digit

personal code number. Martins

Auto-Cashier is the first dispenser of its type in the World to use the

combination personal identification number (PIN) and a plastic card that we

know today. At first these machines

operate on the principle of pre-payment, something which has come back into

fashion in the twenty-first Century, through prepaid debit cards. Manufactured by the CHUBB Safe and Lock

Company, the second generation of this machine wins a Prince Philip

Design Award in 1969. |

|||||||||||

|

1968 |

The shock of the

new |

|||||||||||

|

|

|

|||||||||||

|

1968 |

The beginning of

the end |

|||||||||||

|

|

By Special Act of

Parliament, Martins Bank Limited and Barclays Bank Limited are merged. Despite reassurances by Martins’ Management

to their staff, it seems the name of Martins will not live on. - The

name of the business will be Barclays Bank Limited, and the words “Martins

Branch” will appear on the cheques of some former Martins customers, and on

other items of stationery. The merger

of the main business is all but complete on 1 November 1968. The date for the

full incorporation of the branches themselves is set by the Act of Parliament

as 15 December 1969. |

|||||||||||

|

1982 |

Getting closer to

the end |

|||||||||||

|

|

Barclays Bank

Limited becomes Barclays Bank plc, and the words “Martins Branch” disappear

forever from customer stationery. The

“plc” stands for Public Limited Company, and at first companies choose either

upper or lower case letters to show the acronym on their stationery… |

|||||||||||

|

2008 |

The end of the end |

|||||||||||

|

|

Some thirty-nine

years after merging with Barclays, Martins Bank Limited is finally wound up

in the records of Companies House. The

name cannot now be reused to trade with, by anyone, unless they are

recognised and licensed AS A BANK by Companies House. This should safeguard the name of Martins,

but given the twenty-first century fashion for resurrecting the names of

defunct banks to create new brand loyalties, who knows if Martins Bank will

make a reappearance on the high street? |

|||||||||||

|

2009 |

Bringing Martins

Bank back to life |

|||||||||||

|

|

Martins Bank

Archive is established; an online and physical archive dedicated to

preserving the memory of the Bank.

Started in 1989 as a collection of memorabilia, the Archive makes

itself available as online exhibits for the interest of anyone who can access

the internet. Run in collaboration

with, and the guidance of Barclays, the Archive is NOT part of the

Barclays Group of Companies. |

|||||||||||

|

2013 |

Looking back with

pride |

|||||||||||

|

|

Celebrating four

hundred and fifty years since a banking service first began on the site of 68

Lombard Street London, more than one hundred and fifty Martins Staff gather

to celebrate at London’s Royal Overseas League. A commemorative tie is

produced to mark this milestone anniversary, and nearly three hundred are

sold, showing the affection with which Martins Bank is still held by its

former employees and customers.

|

|||||||||||

|

2017 |

50 Years of Cash |

|||||||||||

|

|

|

Whilst a number of

banks can claim to be instrumental in the introduction to the World of the

“hole in the wall”, the honour of being first rests with Barclays by exactly

eighteen weeks. Like so many other originally simple ideas, the notion of

using a bank when it was closed was irresistible, and sparked a race, which

fifty years on leaves us with a device that is taken for granted and used all

over the World millions of times each day.

Martins Bank was never one for resting on its laurels, and like

Barclays, it enjoyed being “first” with many banking ideas and technologies.

Following hot on the heels of Barclays’

“Barclaycash” machine (27 Jun 1967), Martins Auto Cashier (31 Oct

1967), the first type of cash machine to use a plastic card, was unveiled as

the first cash dispenser in the North of England. |

||||||||||

|

2018 |

Merged for 50 Years…

|

|

||||||||||

|

|

|

Martins becomes

part of the Barclays Group in November 1968. Much of 1969 is spent

amalgamting services and back office systems before branches themselves can

operate at part of the new Bank. Fifty years on from the merger of Martins

and Barclays Banks, there remain fewer than one hundred of the seven hundred

Martins branches that were absorbed on 15 December 1969. Computerisation,

which Martins was first to embrace in the late 1950s has now taken over so

much that was achieved in branches by human staff or customers themselves,

that the entire banking network is now contracting at a rate nobody could

have imagined just a few decades ago… |

||||||||||

|

|

||||||||||||