|

Like

science fiction – only BETTER…

“The

banks have declared already that no redundancy of staff is expected from

the introduction of computers”.

1959 – The future has arrived, and the clock innocently

begins the countdown to a world without the need for Branch Banking…

Image © Martins Bank Archive Collections

Testing Times…

|

The British computer firm

Ferranti is chosen by Martins after successful demonstration of their

Pegasus I computer. Programs are

written and re-written, Pegasus II is born, and ordered for use by

Martins. There follows the birth

of the automation of branch accounting, travellers’ cheques, customer

stationery, the notion of a computer terminal in every branch, AND the

birth of the cash machine – In fact Martins unveils the World’s first

cash dispenser to use a plastic

card with a Personal Identification Number in the Autumn of 1967. The British computer firm

Ferranti is chosen by Martins after successful demonstration of their

Pegasus I computer. Programs are

written and re-written, Pegasus II is born, and ordered for use by

Martins. There follows the birth

of the automation of branch accounting, travellers’ cheques, customer

stationery, the notion of a computer terminal in every branch, AND the

birth of the cash machine – In fact Martins unveils the World’s first

cash dispenser to use a plastic

card with a Personal Identification Number in the Autumn of 1967.

Following the success of the London pilot, a

Pegasus II computer is installed at Liverpool Head Office in 1962, not

before strike action at companies connected with Ferranti causes some

delay to the project.

|

WHY NOT ALSO VISIT THESE PAGES

|

|

|

|

Martins Bank’s programme of automation is quite

ambitious for a bank of its size, with plans to connect every branch to the

computer centre by phone line to enable the daily submission of work

recorded by each branch onto punched paper tape and fed through

transmission equipment. That these

plans never reach fruition is due in part to the merger, but mainly to

Martins’ choice of computer equipment and its limitations as we shall see

below.

How it all begins…

The following feature entitled “ENTER PEGASUS” appears in Martins Bank

Magazine in the Spring of 1960, and gives the official version of the

Bank’s decision to move into computers.

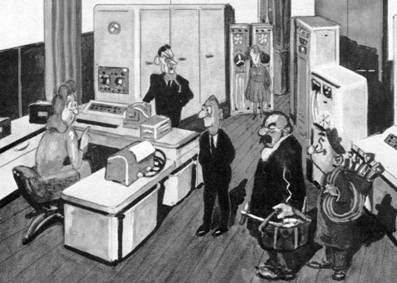

Our bank is the first

bank in this country to use an electronic computer for the complete current

account book-keeping operation including the production of statements for

customers. Here is the Pegasus computer manufactured by Ferranti Ltd. which

was used for our experiment. Pegasus II can deal with 30,000 accounts in five hours

with no more than five people in attendance. Our bank is the first

bank in this country to use an electronic computer for the complete current

account book-keeping operation including the production of statements for

customers. Here is the Pegasus computer manufactured by Ferranti Ltd. which

was used for our experiment. Pegasus II can deal with 30,000 accounts in five hours

with no more than five people in attendance.

A room approximately 30

x 20 feet would

offer ample accommodation for the units shown here. The actual computer is in the foreground

on the left and there are four magnetic tape units, two of which face the

camera immediately adjoining the actual computer. At the rear can be seen

the power cubicle in front of which are the two other magnetic tape units.

On their immediate right is the high speed punch, and adjoining it on the

far right is the magnetic tape control unit. The introduction of electronic

techniques into banking routine has been talked about for some time but to

the majority of members of the staff no doubt this has been a prospect of

the distant future likely to affect the next generation of bank staff

rather than the present. A room approximately 30

x 20 feet would

offer ample accommodation for the units shown here. The actual computer is in the foreground

on the left and there are four magnetic tape units, two of which face the

camera immediately adjoining the actual computer. At the rear can be seen

the power cubicle in front of which are the two other magnetic tape units.

On their immediate right is the high speed punch, and adjoining it on the

far right is the magnetic tape control unit. The introduction of electronic

techniques into banking routine has been talked about for some time but to

the majority of members of the staff no doubt this has been a prospect of

the distant future likely to affect the next generation of bank staff

rather than the present.

The announcement that

the Bank has ordered a computer and that delivery is expected no more than

twelve months hence may have come as a rude shock to some who have prayed

that it would not come in their time.

Computers were heralded by the popular press a decade ago as the

electronic brains that would revolutionise life in the future. This is the

kind of sensationalism on which newspapers thrive but the devices of that

time were not quite so clever as such accounts would have had readers

believe. They were certainly of little use to commercial enterprises and

the Bank's interest was merely academic. By 1955 it became clear that

electronic developments applicable to commercial projects and particularly

to banking were on the way and during that year the London Clearing Banks

set up an Electronics Sub-Committee. Our earlier interest permitted Martins

Bank to play its part in this inter-bank Committee from the beginning,

providing a member of the Working Party of three. The Committee and Working Party are still

hard at work and our independent work is not in any way in conflict with

the joint research; indeed one is complementary to the other. The announcement that

the Bank has ordered a computer and that delivery is expected no more than

twelve months hence may have come as a rude shock to some who have prayed

that it would not come in their time.

Computers were heralded by the popular press a decade ago as the

electronic brains that would revolutionise life in the future. This is the

kind of sensationalism on which newspapers thrive but the devices of that

time were not quite so clever as such accounts would have had readers

believe. They were certainly of little use to commercial enterprises and

the Bank's interest was merely academic. By 1955 it became clear that

electronic developments applicable to commercial projects and particularly

to banking were on the way and during that year the London Clearing Banks

set up an Electronics Sub-Committee. Our earlier interest permitted Martins

Bank to play its part in this inter-bank Committee from the beginning,

providing a member of the Working Party of three. The Committee and Working Party are still

hard at work and our independent work is not in any way in conflict with

the joint research; indeed one is complementary to the other.

For the next year

or two our efforts were almost completely identified with the inter-bank

effort but subsequently more and more attention was paid to the Bank's own

needs. Only in very broad principle is the inter-bank Committee interested

in accounting procedures and it was quite clear that it would be left to

individual banks to develop the details of their own systems. Consequently

the Bank opened discussions with all major computer manufacturers and this

culminated in the development of what was called the First Assessment of

Computer Specification for Martins Bank Limited which was distributed to

interested manufacturers in March, 1958, along with specimen data relating

to a group of branches. On this basis " Feasibility Studies "

were carried out, our own research staff co-operating extensively with the

staffs of manufacturers. Visits to the U.S.A. and European countries

provided extensive and valuable experiences to support this effort. By

September 1958 the first Feasibility Study was complete and many more

followed in the ensuing six months. Amongst these was the study produced by

Ferranti jointly with our own staff based on the Pegasus computer and this

appeared to stand out as the one most likely to satisfy the Bank's needs. For the next year

or two our efforts were almost completely identified with the inter-bank

effort but subsequently more and more attention was paid to the Bank's own

needs. Only in very broad principle is the inter-bank Committee interested

in accounting procedures and it was quite clear that it would be left to

individual banks to develop the details of their own systems. Consequently

the Bank opened discussions with all major computer manufacturers and this

culminated in the development of what was called the First Assessment of

Computer Specification for Martins Bank Limited which was distributed to

interested manufacturers in March, 1958, along with specimen data relating

to a group of branches. On this basis " Feasibility Studies "

were carried out, our own research staff co-operating extensively with the

staffs of manufacturers. Visits to the U.S.A. and European countries

provided extensive and valuable experiences to support this effort. By

September 1958 the first Feasibility Study was complete and many more

followed in the ensuing six months. Amongst these was the study produced by

Ferranti jointly with our own staff based on the Pegasus computer and this

appeared to stand out as the one most likely to satisfy the Bank's needs.

A feasibility study

is no more than its name implies. It is a study of the specification of a computer

in relation to the task to be set, involving an estimate of the speed of

operation that can be expected on such a task, the capacity of the

equipment in terms of the amount of work that it can cope with and the

probable economies of operation. A computer is not a fixed unit as is the

case with an accounting machine; it is an assembly of component parts with

almost unlimited permutations and combinations. The feasibility study aims amongst other

things at assessing which particular units should be adopted for a given

purpose. This stage of theoretical study is essential because one cannot

buy a computer just to try out as one might an accounting machine. Many potential users will buy a computer

on the basis of a feasibility study but this can be a risky procedure as

many have found to their cost. Instead of taking such a step the Bank

decided that the ideas and systems evolved during the study phase should be

tested out by practical experiment and in April 1959 authority was given

for an exercise involving one of our branches aimed at carrying out the

whole of the current account operation by electronics in parallel with

normal operating of the branch accounts by conventional methods. A computer requires a programme of

detailed instructions on which it is to act. A feasibility study

is no more than its name implies. It is a study of the specification of a computer

in relation to the task to be set, involving an estimate of the speed of

operation that can be expected on such a task, the capacity of the

equipment in terms of the amount of work that it can cope with and the

probable economies of operation. A computer is not a fixed unit as is the

case with an accounting machine; it is an assembly of component parts with

almost unlimited permutations and combinations. The feasibility study aims amongst other

things at assessing which particular units should be adopted for a given

purpose. This stage of theoretical study is essential because one cannot

buy a computer just to try out as one might an accounting machine. Many potential users will buy a computer

on the basis of a feasibility study but this can be a risky procedure as

many have found to their cost. Instead of taking such a step the Bank

decided that the ideas and systems evolved during the study phase should be

tested out by practical experiment and in April 1959 authority was given

for an exercise involving one of our branches aimed at carrying out the

whole of the current account operation by electronics in parallel with

normal operating of the branch accounts by conventional methods. A computer requires a programme of

detailed instructions on which it is to act.

There is no single

correct programme to be produced with mathematical accuracy. On the

contrary, there is a variety of logical approaches to the programme and

different programmers may produce quite different end products which

nevertheless lead to the same ultimate result. There is scope for

individuality. A good programmer is at least equal in importance to a good

computer. Quite commonly up to two man-years is spent in studying an

operation and programming it for a computer. The Bank, fortunately, could call

on a good programming team provided jointly from our own staff and Ferranti

and the work was completed by the end of the year after only eight months'

work. This was in fact the target that had been set when the exercise was

begun. The resultant programme proved to be very successful. Computer time

was booked at intervals to test parts of the programme as they were

completed and the process commonly known as "de-bugging"—the elimination of flaws in the elaborate logical structure

of the programme— went through smoothly and quickly. This is the hallmark

of good programmers. Finally the whole process was strung together into one

complete programme and was then ready for practical testing. There is no single

correct programme to be produced with mathematical accuracy. On the

contrary, there is a variety of logical approaches to the programme and

different programmers may produce quite different end products which

nevertheless lead to the same ultimate result. There is scope for

individuality. A good programmer is at least equal in importance to a good

computer. Quite commonly up to two man-years is spent in studying an

operation and programming it for a computer. The Bank, fortunately, could call

on a good programming team provided jointly from our own staff and Ferranti

and the work was completed by the end of the year after only eight months'

work. This was in fact the target that had been set when the exercise was

begun. The resultant programme proved to be very successful. Computer time

was booked at intervals to test parts of the programme as they were

completed and the process commonly known as "de-bugging"—the elimination of flaws in the elaborate logical structure

of the programme— went through smoothly and quickly. This is the hallmark

of good programmers. Finally the whole process was strung together into one

complete programme and was then ready for practical testing.

Meanwhile the branch end of the

operation had to be prepared. South Audley Street branch was chosen because

it is near to Portland Place where the computer used for the experiment is

situated and because the research staff were housed in that branch. The

branch is not so large as to be unwieldy but nevertheless provided a

reasonable sample of current account business.

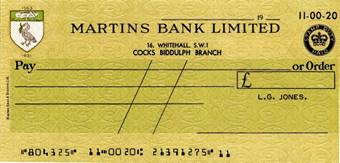

The first step was

to give numbers to accounts. This is no simple process. Each number has to

be computed so that it is self-checking and for this purpose the computer

itself was used. Numbers have to be allocated so that accounts are

substantially in alphabetical and also in numerical order, leaving gaps for

new accounts. Then the co-operation of customers was sought because these

numbers had to be printed on all cheques before issue to the customer. A

machine was provided to imprint each cheque, with the name and number of

the account-holder. This operation of personalisation was carried out each

time a cheque book was requested and customers helped by bringing in their

partly used cheque books for personalisation. The medium used to feed data

into the computer is punched paper tape. An adding machine had to be

provided at the branch to produce this tape simultaneously with a normal

adding operation. The first step was

to give numbers to accounts. This is no simple process. Each number has to

be computed so that it is self-checking and for this purpose the computer

itself was used. Numbers have to be allocated so that accounts are

substantially in alphabetical and also in numerical order, leaving gaps for

new accounts. Then the co-operation of customers was sought because these

numbers had to be printed on all cheques before issue to the customer. A

machine was provided to imprint each cheque, with the name and number of

the account-holder. This operation of personalisation was carried out each

time a cheque book was requested and customers helped by bringing in their

partly used cheque books for personalisation. The medium used to feed data

into the computer is punched paper tape. An adding machine had to be

provided at the branch to produce this tape simultaneously with a normal

adding operation.

The first machine tried was not very satisfactory for our

purposes but we were able to persuade Addo, a Swedish firm, to hasten through their workshops a

prototype of a new model not yet in production and this was used for the

exercise. Each day the work of the branch, after passing through the normal

waste process, was handled a second time by an operator on the Addo machine to produce the

necessary tape and also a print on an ordinary waste sheet. In January we were all ready and for the

first time in this country the current account work of a branch was

operated day by day on an electronic computer. It was on the basis of this

exercise that an order has now been placed for our own computer. The

exercise will not end with the operation of current accounts on the new

equipment. Already other aspects of the Bank's routine are under

consideration for application to the computer. This is the beginning of a

new and exciting era in the development of bank methods. The Bank has

clearly indicated that, far from lagging behind, it intends to point the

way. The exercise has served its purpose and has been closed down. Now we

are faced with a year of intense activity in preparation for our own

computer. The first machine tried was not very satisfactory for our

purposes but we were able to persuade Addo, a Swedish firm, to hasten through their workshops a

prototype of a new model not yet in production and this was used for the

exercise. Each day the work of the branch, after passing through the normal

waste process, was handled a second time by an operator on the Addo machine to produce the

necessary tape and also a print on an ordinary waste sheet. In January we were all ready and for the

first time in this country the current account work of a branch was

operated day by day on an electronic computer. It was on the basis of this

exercise that an order has now been placed for our own computer. The

exercise will not end with the operation of current accounts on the new

equipment. Already other aspects of the Bank's routine are under

consideration for application to the computer. This is the beginning of a

new and exciting era in the development of bank methods. The Bank has

clearly indicated that, far from lagging behind, it intends to point the

way. The exercise has served its purpose and has been closed down. Now we

are faced with a year of intense activity in preparation for our own

computer.

The Bank’s “Brave New World” introduction to Pegasus certainly gives

the idea that exhaustive testing makes a computer operation foolproof, and

the various stages of recording the data should be smooth running and

simple to achieve. Here comes the “BUT” - As we have already mentioned in

our MARTINS’ FIRSTS section, the race to be first with computers begins when

another bank opens a drive through branch right under Martins’ nose in

Liverpool. Ferranti sell Pegasus as a general purpose computer, and it is

already in use at I C I in Manchester a year or two before Martins order

one of their own. We are immensely

grateful to our colleague Peter Hayes, who actually worked with the data

collection for Pegasus at our Liverpool Heywoods Branch in the early 1960s,

for the following recollections. As

you will see, it certainly was not “plain sailing” and Peter’s story

also gives us what might be another, albeit undesireable first for Martins – “Rubbish in, rubbish out”….

The mysterious case of HMS Ark Royal, the sweet shop, and

“Pegasus finger”…

“I

had a lot to do with the Pegasus Mark 2 which I had to make work whilst at

Heywoods branch but it never did work properly. My recollection of the

computer is of two accounts. A Shipbuilders (who at the time were laying

down the keel of the Ark Royal) and a sweet and tobacco shop owner. The account numbers had to be preceded by

a large number of zeros, as at this time there was no zero suppression and

ALL leading zeros had to be entered for the computer to be able to

accurately record the transaction against the correct account. So the young

girls who each day produced the punched paper tape for inputting into

Pegasus had to type all these noughts followed by a seven digit account

number for each cheque or credit. “I

had a lot to do with the Pegasus Mark 2 which I had to make work whilst at

Heywoods branch but it never did work properly. My recollection of the

computer is of two accounts. A Shipbuilders (who at the time were laying

down the keel of the Ark Royal) and a sweet and tobacco shop owner. The account numbers had to be preceded by

a large number of zeros, as at this time there was no zero suppression and

ALL leading zeros had to be entered for the computer to be able to

accurately record the transaction against the correct account. So the young

girls who each day produced the punched paper tape for inputting into

Pegasus had to type all these noughts followed by a seven digit account

number for each cheque or credit.

The shipbuilding company would

have say fifty cheques a day going out of their account and the sweet shop

owner perhaps one or two per week.

By the time the girls had punched in the shipbuilders’ account

number fifty or so times, they had developed what Ferranti called a

"finger pattern" so when the next cheque for the sweet shop

turned up with just one digit difference they would invariably punched in

the shipbuilders’ account number and the shirt purchased at M&S by the

sweet shop owner for £2.10.0 was debited to the shipbuilder. There was also

another customer whose account suffered this finger problem as a result of

which about £1m for the steel for the Ark Royal's keel was debited to his

account and he came in sweating profusely as his overdraft limit was

exceeded. The best bit was the

terminology we used. The date when someone wanted a statement was known as

the "statement periodicity date".

An 18 year old cashier at Heywoods was approached by a woman of a

certain age and asked for a statement of her account. He responded with

"When is your periodicity date?" and was clouted round the ear by

an umbrella! The account was also closed forthwith”…

In Spring

1961, R Hindle Manager (Organisation Research and Development) writes a

detailed report for Martins Bank Magazine to show staff what Pegasus could

do, and why the whole project is necessary. It is fascinating to note from

the first few lines of Mr Hindle’s article, that he seems to be advocating

the installation of computers as a more reliable replacement for WOMEN, as

computers are not likely to want to work for only a few years before

leaving to get married!

You and Pegasus

Many members of the staff,

their daily work flowing easily and smoothly, must query the reason for

radical change in the Bank's methods, whilst those who are labouring under

an apparent overload of work resulting in long hours generally see as the

logical solution to their problem an increase in staff rather than a change

in system. The fact is that, in

banking, profits are made from the holding of monetary balances and not

from movements of money from place to place, but it is the movement of money

that gives rise to the continually increasing load of routine work which

engages the greater part of the Bank staff's man hours. To recruit staff in

proportion to the increase in routine work would be to reduce the chances

of a satisfactory career to those incoming members of the staff and this is

not likely to encourage satisfactory recruiting. More purely routine staff

who would have no expectation of a successful career could be employed—and

of course generally these are girls the majority of whom simply want

employment for a few years until they leave to be married—but there is

considerable competition for the services of available people in this

category in many areas and organisations depending on large numbers of them

can find themselves in a very precarious position. Many members of the staff,

their daily work flowing easily and smoothly, must query the reason for

radical change in the Bank's methods, whilst those who are labouring under

an apparent overload of work resulting in long hours generally see as the

logical solution to their problem an increase in staff rather than a change

in system. The fact is that, in

banking, profits are made from the holding of monetary balances and not

from movements of money from place to place, but it is the movement of money

that gives rise to the continually increasing load of routine work which

engages the greater part of the Bank staff's man hours. To recruit staff in

proportion to the increase in routine work would be to reduce the chances

of a satisfactory career to those incoming members of the staff and this is

not likely to encourage satisfactory recruiting. More purely routine staff

who would have no expectation of a successful career could be employed—and

of course generally these are girls the majority of whom simply want

employment for a few years until they leave to be married—but there is

considerable competition for the services of available people in this

category in many areas and organisations depending on large numbers of them

can find themselves in a very precarious position.

|

|

x

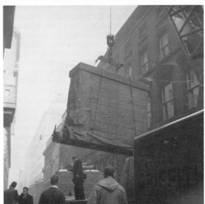

The start of something big often

means a grand entrance, and equipment that is designed to control in

excess of 30,000 current accounts requires a special room of its own,

Liverpool Computer Centre at Derby House, close to Martins’ Water Street

Head Office.

x

|

Just like moving a piano: Every care is taken to ensure

that each piece of the delicate and futuristic technology is handled with

care and great skill by those who operate the crane and other lifting

equipment.

|

Mechanisation

x

In 1932 conventional mechanisation was

just beginning to spread and consequently forms an interesting basic year

for comparison purposes. Since then postings to customers' accounts have

increased by 160%. The increase up to 1947,

just after the war, was only 50%. Note that these figures represent

the increase in numbers of postings, not of the sterling value of the

entries. So it appears that since the end of the war the Bank has added to

its routine load more than its total commitments in 1932.

There is no reason to think that this expansion

of normal banking services is at an end. Indeed, new factors are appearing

which are likely to increase the expansion rate. For instance, the credit

transfer development has just been extended to include "third

party" credits and one estimate puts the figure for credit transfers

likely to be handled by the clearings in a few years' time at 400 million

per year. This compares with the present cheque load of around 900 million

per year. The possibility of extension of the principle of paying wages by

credit into a banking account will bring more people into the banking

circle.

Mechanisation has helped the Bank to

cope with increases and conventional mechanisation continues to be

extended. The effect of mechanisation has been twofold. Firstly, it has

introduced to the Bank a section of staff with a high natural wastage rate,

members who are not likely to compete for the more responsible jobs.

Secondly, it has increased the capacity per member of staff to deal with

routine work so that numbers of staff do not have to increase in proportion

to work increase.

Fitted and working, Pegasus II takes on the work that until

that point had cost hundreds of man hours in manual procedure.

Use Of Computer

x

A computer has quite a different

effect. It is not merely an aid to production, a tool in the hands of a human

being: it can take over from human beings complete routine tasks and

requires only a very modest degree of human supervision. Before it can

start on such a task, however, it must be provided with human guidance in

intricate detail. Such guidance is called a programme and as a result of

the need to produce such programmes important and responsible new posts are

created. First, "Systems Analysts" study the purpose of the

operations to be carried out in great detail and decide how best the computer

can tackle the job. They build into their system techniques which were

quite impracticable by conventional methods but which will be of great

assistance in managing the affairs of the Bank. The shorthand of the

Systems Analysts' trade is the flow chart which represents their thoughts

in pictorial form. The flow charts then pass to the Programmer or coder,

who reduces the charts to apparently meaningless lists of numerals which

represent, in fact, the way in which instructions can be given to the

computer. The people who are performing these new duties are all drawn from

the ranks of our own staff. A new department has been set up to deal with

"Organisation, Research and Development," including the task of

programming the computer, but the purpose of this Department is not solely

related to electronics. Its personnel must approach each problem with an

open mind, and must weigh up the virtues of different methods, electronic

and otherwise, before deciding how a job should be tackled.

Progress Report

x

And now a progress report on the

exercise to introduce Pegasus. Premises

adjacent to our Head Office building in Liverpool have been obtained and

have been modified for this purpose. The computer is expected to be

installed and commissioned by the time this Magazine appears. A complete

current account programme was written by our staff in co-operation with

Ferranti, the manufacturers, during 1959. The task took nine months and in

January, 1960 was given an exhaustive test. Our South Audley Street branch

proved to be a very willing guinea pig; their accounts were applied to the

computer and each day the branch produced a punched paper tape bearing

details of entries passing through their books. The exercise was then

closed down and the programme has since been completely re-written in the

light of the experiences during the exercise. A larger team has spent ten

months on the re-writing of the programme though this period includes the

training of new members of the team. There is no one correct programme for

a computer operation; a programme is in fact a growing thing reflecting the

personalities of those working on it and it will continue to develop as

time goes on until optimum results are achieved. In the early stages the

programmers will operate the equipment, for they must ensure the successful

application of their work, but meanwhile a team of operators will be

trained to take over. The need for programmers will continue after

installation for re-programming work and also they will have to turn their

attention continually to new applications as the scope of the computer

extends, perhaps, to travellers' cheques reconciliations, to Trustee,

Registrar's, Overseas and other departmental accounting problems, and to a

whole range of statistical work. In the first place the computer will work

on current accounts, for which operation it has a capacity of 40/50,000

accounts. Clearly this requires the centralisation of the routine of a

number of branches and this involves problems of communication. The Bank

has experimented already with a system of data transmission over G.P.O.

telegraphic circuits and is now studying methods of higher speed

communication over the ordinary telephone line network. The first

objective, however, is to centralise branches in a compact area around the

location of the computer providing about half the total capacity of the

computer. Under these circumstances communication can be handled quite

satisfactorily by means of porters who can physically transport data

through the streets.

The Pegasus Programming Team

(Left to Right): KE Buxton, TA Bacon, PRF Jones, IEK Jones,

Miss M Owens,

Mrs R Leach (of Ferranti Ltd, London), D Bissett (of

Ferranti Ltd, London) K Whalley

(Chief Programmer in charge of the project) and Mr R Hindle.

What Pegasus Can Do

x

The computer will be programmed to deal

with all aspects of current account book-keeping, including:— (1) Posting of normal debit and credit entries, e.g.,

details from cheques, credit notes, etc. (2) Incorporation of corrections

to normal entries. (3) Alteration of account information. (4) Addition of

new accounts. (5) Removal of closed accounts. (6) Accumulation of

statistics for management information, interest charges, etc. (7) A check

of each debit entry against a list of stops. Any stop so found is rejected

by the computer. (8) Comparison of the closing balance of each individual

account or group of set-off accounts against overdraft limits. Any excess

of these limits causes control information to be printed out, drawing

attention to the excess. (9) Printing of customers' Statements. Most of

these are produced on a period basis agreed with the customer but provision

is made for Statements to be obtained outside this standard requirement by

special request. (10) The accumulation through the day of the following

branch statistics which will be printed out and returned to the branch—(a)

A daily list of balances, debit and credit, of all accounts, (b) A daily

audit sheet providing details of any items rejected by the computer,

balancing figures and any other item requiring further attention by the

branch.

Method

x

Two main files, called the Balance and

History Files, form the basis of the system. Both files are stored on

magnetic tape in account number order and contain the following information

in respect of each account:—

x

(1) Balance

File

(a) Account

number;

(b) name;

(c) balance;

(d) report

limit;

(e) overdraft

limit;

(f) details

of stopped cheques;

(g) accumulated

statistics for management Information and the computation of charges.

(2) History

File

(a) Account

number;

(b) name;

(c)

periodicity of statement issue;

(d) amount of

balance and date from last statement;

(e) date,

description and amount of each posting awaiting print out on the next

statement.

Both these files need to be updated

each day in respect of the vouchers passing through the branch and it is

therefore necessary to transcribe the relevant details from the vouchers on

to a suitable medium for the computer. Paper tape is used for this input

medium.

Preparing for Pegasus

x

Preparations have already been made at

one Liverpool branch, and others are following. This involves the numbering

of accounts for purposes of internal identity. Cheques are already being

"personalised," i.e., printed with account name and number,

before books are issued to customers.

The traditional ledger posting machine

has a threefold purpose, i.e., (1) Arithmetic processes have to be carried

out to produce new balances and adjust statistics. (2) Historic purposes

require the assembly of entries in chronological order. (3) A visible

record of (1) and (2) has to be produced.

A fourth process, the production of

statements, exists in conventional systems generally as a separate

operation but the three purposes above are combined in a single process.

For electronic operation, however, the above three purposes are dealt with

in separate processes.

The complete daily sequence of events

is as follows: - All vouchers

entering the branch must pass through one of two listing operations - the In-clearing or the Waste. By adding a

paper tape punch to a conventional adding machine the paper tape input for

the computer is being prepared as a direct by-product of the normal listing

function with little additional effort. Details (account number, simple

description and amount) from each voucher relating to an account in the

branch, are keyed into the machine and, on depression of the motor bar, are

printed on the machine list and simultaneously punched on to paper tape.

At intervals check totals are punched into the tape. These check totals are

used by the operator to check her entries on the machine and also by the

computer for checking the data on input.

|

![]()

![]()