|

|

![]()

|

MARTINS BANK AT YOUR SERVICE –

CORPORATE BANKING |

![]()

|

|

WHY NOT ALSO

VISIT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Up, up and away!

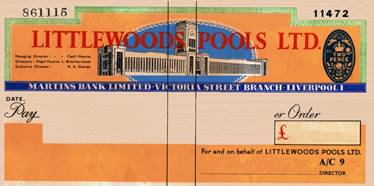

It’s only money…

(Each lucky winner will have received a share of £50, which in 1964 was the equivalent of winning about £950 in 2017)

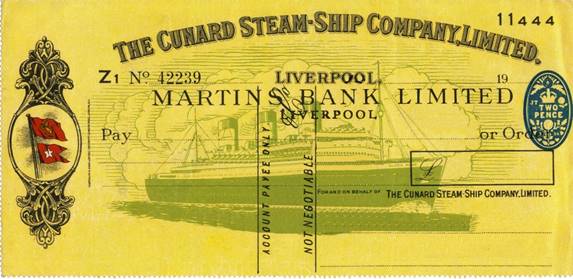

Sailing by…

Cap in hand.

Menage a trois? ,

{Special factors

affecting Martins

92. Some of the

reasons for merging discussed in the foregoing sections apply with especial

force to Martins, particularly the potential increase in the size of

facilities required by large companies and the need for wider overseas

connections. Equally significant from

the point of view of Martins are the problems created by incomplete national

coverage at a time of growth in the geographic range of industrial and

commercial customers and of greater mobility of personal customers, and the

high capital cost of attempting to achieve national coverage by the

establishment of new branches.

Furthermore, in recent years there has been an increasing tendency for

the banks to compete by moving into related fields and by developing

ancillary services – export houses, factoring, leasing, credit cards,

etc.. Martins by reason of its size,

is at a competitive disadvantage in this respect.}

Barclays’ submission to the

Monopolies Commission

Report For Submission To The Monopolies Commission re The Automation Activities Of Barclays Bank Limited and The Savings Which Will Result From the Merger Of Barclays, Lloyds And Martins Banks This report is intended to present a factual survey

of the Automation activities upon which Barclays Bank Limited are engaged.

The second part of the paper seeks to give an indication of the gains which

will follow the proposed merger. Equipment The

Bank's total complement of computers, installed or on order, is as follows:- IBM 1 x

360/65 (purchased) 4

x 360/50 (3 purchased, 1 temporarily rented) 10 x 360/30 (all purchased) 3

x 1401 (2 purchased, 1 rented) Burroughs 1

x B8500 (purchased) ICT 2 x

Emidec 1100 (purchased) Punched Card equipment is being built up; so, too,

are the number of Branch Terminals, Input Machines and Amount Encoding

Machines. In all fields the objective

has been to order sufficient hardware to permit completion of the Bank's

current plans Computer

Centres There are seven

of these either in being or in course of preparation as follows: -

Staff

Projects in hand or already completed Barclays Bank Limited first became interested in the

possibilities of automating certain of its activities as long as 10 years ago

and opened its first branch book-keeping Computer Centre in 1961. The Bank decided, as a matter of policy,

not to commit itself to a large scale programme of automation until suitable

third generation equipment became available. It was only approximately three

years ago that the decision was taken to move into automation across a very broad

front. Some of the projects referred to in this report are already completed

and the remainder will be completed by early 1971. The equipment which is

shown has been bought or ordered with a view to enabling this to be done and

where the choice has been between additional equipment and a manual process

(e. g. teleprocessing as opposed to Van Collection of Input) the decision has

invariably been to go for the additional equipment and thereby avoid

increasing our manpower requirements. The projects to which we have referred above are as

follows: - § Branch

Book-keeping § Standing Orders

and Direct Debiting § Clearing

Operations § Registrar's

Department § Chief Foreign

Branch § Executor and

Trustee Business § Staff Salaries

and Statistics § Barclaycard § Customer

Services, e. g Payroll, Stock Analysis,

etc. § Magnetic Tape

Exchange between Banks and their Customers. § Branch

Securities § Management

Information § Management

Science Techniques. It will be appreciated that many of these projects

are of immense magnitude and have involved extensive preparatory work and

planning. Distribution

of Activities and Computers Inevitably there are from time to time transfers of

work and/or machines between Centres, but the following describes the present

position adjusted to incorporate changes now imminent:-

The Willesden Centre, which is to receive the

Burroughs computer, should be commissioned later this year. Initially it will undertake only branch

book-keeping, retaining spare capacity for later developments. Current plans

are to move the book-keeping now performed at the No.1 and Lombard Street

Centres and concentrate this at Tottenham Court Road and Willesden by 1971.

Lombard Street Centre will be closed. No. 1 Centre will be used for computer

processing of the Foreign work for the three banks. Constraints In its planning the Bank has had to act within two

main constraints, namely: -

Because of these the Bank has had to continue with

its plans and the execution thereof during the period since its proposal for

a merger with Lloyds Bank Limited and Martins Bank Limited was referred to

the Monopolies Commission. Expected Gains from the Proposed Merger

between Barclays, Lloyds and Martins Banks This part of the paper gives an indication of the

total gains, both short-term and long-term, which may be expected in: -

Both Barclays and Lloyds have particularly heavy commitments

in respect of branch automation programmes, which they need to meet in full

before decimalisation. This date,

February 1971, therefore becomes a convenient demarcation line between

“short-term” and “long-term”. The short-term gains can be more readily

assessed than the long-term ones, though there is no doubt that both will be

considerable. SHORT-TERM SAVINGS Systems and Development Staff Barclays and Lloyds each have a Systems/Programming

strength of 150 skilled staff, whilst Martins have 34. These numbers are

growing and, of necessity, there must be some duplication of effort, so that

a saving of 125 in the short-term maybe regarded as a conservative estimate.

It is emphasised that these are highly qualified people whose skills are

becoming yet more pronounced as computer development progresses Their short

supply is a national problem which is likely to grow rather than lessen in

the years ahead. Management Science Management Science in banking is an exciting new

prospect to which Barclays are increasingly devoting resources. Their team will grow to some 30 highly

skilled analysts, comparable in strength to that of Bankers Trust Company of

New York who are leaders in this field. The Barclays’ team will handle the

work for the three banks following the merger and there will be no need for

their duties to be duplicated by Lloyds and Martins. A team of at least

equivalent numbers to that of Barclays can thus be saved in entirety. These

are the elite of the operational research area; M.Sc’s and B.Sc’s of high

calibre who are nationally in great demand. Organisation and Methods Barclays, Lloyds and Martins all have resources allocated

to this field of operations and Barclays, in particular, are in the process

of building up their O. & M. section from 50 to some 120 staff so that a

clerical work improvement programme (Work Study) may be introduced throughout

the entire bank. Lloyds and Martins will benefit from the manual of

predetermined time data which is being established, and in addition it is

considered that one O. & M. Team

instead of three will produce short-term savings of at least 25 staff. Martins Branch Automation Martins are about to plan the automation of their

branch network, which would involve them in central computer equipment

costing £1,500,000.

Their 1 million accounts can be accommodated either on Barclays’ Burroughs

computer, or on Lloyds Birmingham Computer Centre, at an estimated cost of

not more than £500,000, principally for disk storage. There would be related

savings of space and of some 60 skilled operating staff. Clearing Departments The total staffs of the three banks’ Clearing

Departments number more than 2,000. The major savings will follow the

long-term amalgamation, but short-term it is considered that at least 50

staff, principally concerned with distribution tasks in the City of London,

can be saved. Share Registration. Lloyds’ Registrar’s Department is already fully

automated, using an IBM 360/40 at Worthing.

Barclays’ Registrar’s work is in the process of being automated and

could be comfortably accommodated on the Lloyds’ computer. Apart from

releasing the Barclays’ computer for other tasks, it is estimated that some

100 Barclays’ staff would be saved, over and above those that would have been

surplus following their own automation programme. Credit Cards Lloyds intention to enter the credit card field

would entail the employment of a minimum staff of 385. Barclaycard have now developed an extremely

able staff and have, too, acquired considerable expertise. Their Management

consider that the Lloyds work could be absorbed into their existing

organisation at the cost of 100 staff, thus saving 285 people. Computer and

ancillary equipment savings can be conservatively assessed at £200, 000, whilst Lloyds would also benefit from not

having to undertake the considerable development work inherent in such an

operation. Foreign Work Barclays are well advanced with the automation of

their Chief Foreign Branch. This is an involved and complex task, and Lloyds

and Martins can take advantage of all the preparatory work which has been

completed. In addition, by re-arranging their computers Barclays will

undertake the whole of the Foreign automation work for the three banks, thus

freeing Lloyds’ and Martins’ computers of an equivalent task. The No. 1 Computer Centre (Drummond Street) will be

vacated pre-decimalisation and into there will go the IBM 360/50 earmarked

for Barclays’ Chief Foreign work, together with the “Barclaycard” 360/50 from

Northampton. Back-to-back these two

computers will handle the total foreign work and provide stand-by. Into

Northampton for the Barclays branch clearing will go the IBM 360/30 which is

at present spare in the Greater London Centre and to this will be linked the

duplex 1419’s. The Barclaycard updating run, at present processed on the

Northampton 360/50, will be run overnight on one of the “Foreign” 360/50’s. Trustee Work Lloyds Bank have already made much progress in the

systems/programming studies which precede the automation of their Trustee Department.

Barclays can benefit from the acquisition of this work. Customer Services This is an area into which all the banks will

increasingly make inroads, undertaking a wide variety of services such as

payroll, stock control, discounted cash flow and cheque reconciliation.

Barclays have already developed computer programs and can make these

available to Lloyds and Martins. Branch Terminals The intention of the three banks is to link all

their branches to main computer centres by means of terminal equipment and G.

P. O. telephone lines. The terminal equipment costs from £3,000 to £4,000, depending on type, whilst the running

expenses vary inversely to the capital expended. For every branch closed, or not

opened, following the merger, there

would therefore be an immediate capital saving of up to £4,000, together with

lower running costs, whilst the demand for Post Office telephone lines would

be reduced at a time when the G. P. O.

is faced with a major programme of line networks for the banks, to be

completed by decimalisation. (See also BRANCH ACCOUNTING) The short-term savings may be summarised

in the following chart:

Annual

Savings

Capital

Savings

Long-Term Savings Capital savings on branch terminal equipment, with

the corresponding lessening of demand on the G. P. O. for telephone lines, will continue for as

long as does the branch rationalisation programme. Every branch closed, or not opened, in the future will mean a reduction of up

to £4, 000 on capital outgoings, plus

related savings in running expenses. There will,

too, be continued saving of Specialist staff and in the long-term it

is considered that another 50 systems/programmers will be spared as a result

of combining the research and development work. At that stage, therefore,

the requirements for highly qualified data processing staff will have

been reduced by some 290, quite apart

from the savings to be achieved in the short-term from Registrar’s

Department, Credit Cards or Clearing Department, and quite separate from any long-term

savings which will follow the amalgamation of the Clearing department or the

Computer Centres. An amalgamation of the Clearing Departments of the

respective banks can profitably be undertaken. Two courses will be open; to

merge the entire clearing operations into one London Centre (as against the

present arrangement of three centres in London and one in Northampton), or to

process the total branch clearing in Barclays’ branch clearing centre in

Northampton and amalgamate the general clearing into one London centre. At

the worst, this will mean two clearing

centres instead of four and will produce capital equipment savings in the

region of £1

million, since an amalgamation would require 4 fewer reader/sorter systems.

Not only will this in itself lead to fewer skilled operating staff, but

further substantial staff savings will follow the removal of the need for

inter-bank settlement in respect of the considerable quantity of items which

will automatically change from the category of general clearing to branch

clearing To quantify more exactly the total benefits which will accrue in

this area will call for a detailed study by a combined inter-bank team. Further principal gains from the merger will be

realised when the various branch systems have been rationalised and are fully

compatible. A joint study team can commence immediately to plan this

work, but completion of the task is

unlikely to be effected before decimalisation. Subsequently, however, with

full compatibility of branch systems,

it will be possible to merge the computer centres of the three banks

and to complete such an undertaking by about 1974. The merit in having purpose-built centres is

becoming clear, for in themselves they bring economy of operation. Barclays

and Lloyds, individually, would certainly have to face this in the seventies.

Together, and with Martins, they could

reap the advantages of a combined operation. Whether the three banks, when

merged, will wish to go for just two super-centres, one near London and one

in the North, or for three or four centres sited at various strategic

geographical points, has yet to be decided. There is something to be said for

each course. Either way, to a greater or lesser degree, there will stem from

such an amalgamation the following benefits:-

At present it is not possible to quantify these

long-term savings This will require a detailed investigation of some

magnitude. What is very evident is that if we job-back to a point in time

five, or seven years ago, we can

visualise the time, effort and capital

which could have been saved in the field of automation had we acted in unison

as one bank rather than as three separate entities. There is every reason to

believe now that comparable gains will be achieved in the future as the

result of concerted policy and action. Management

Services Department, 16th

April, 1968 Special Thanks to

Barclays Group Archives What

might have been?

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||