|

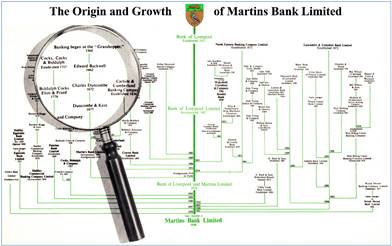

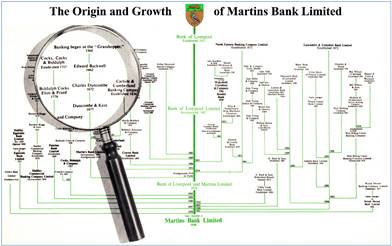

That Martins is itself

eventually absorbed into Barclays, although in many respects a sad moment for

both customers and staff, seems actually to be only a natural progression, as

“Martins Bank Limited” has only come about through the merging of a large number

of banks across England and Wales over four centuries. The Northern constituent banks are what

gives Martins its ubiquitous presence throughout the north of England. Small banks with a number of local branches

joined others nearby, the effect eventually creating a branch or sub branch

of Martins in just about every part of the North. That Martins is itself

eventually absorbed into Barclays, although in many respects a sad moment for

both customers and staff, seems actually to be only a natural progression, as

“Martins Bank Limited” has only come about through the merging of a large number

of banks across England and Wales over four centuries. The Northern constituent banks are what

gives Martins its ubiquitous presence throughout the north of England. Small banks with a number of local branches

joined others nearby, the effect eventually creating a branch or sub branch

of Martins in just about every part of the North.  Further acquisitions of banks

elsewhere in England and Wales, a massive branch opening programme in the

South, and even the purchase of Lewis’s Bank with a branch in Scotland, makes

Martins a truly national bank. In the 1960s, the prudence of lending

practice and gentle but firm instilling of the savings habit gives the Bank

the cash to build newer and yet more lavish premises. In this section of “The Banks that Built

Martins” we look briefly at the publication of “Four Centuries of Banking”

Volume I (1963) and Volume II (1967), which superbly represents the story of

our bank. It is published to coincide

with the 400th anniversary of the establishment of a bank at the

sign of the Grasshopper in London’s Lombard Street, where our London Office

stands. The version of our Coat of

Arms seen here (above) is designed as part of the anniversary celebrations,

and signifies the establishment of banking in Lombard Street in 1563, and

that of the Bank of Liverpool in 1831.

Below, we have two features - The first is taken from Martins Bank

Magazine on the occasion of the publication of Volume I of “Four Centuries of

Banking”. The second, “The Golden

Grasshopper”, is from an information sheet produced by Barclays. In-between the huge family tree of Martins

is represented by a chart that is proudly displayed in EVERY branch and

office of Martins… Further acquisitions of banks

elsewhere in England and Wales, a massive branch opening programme in the

South, and even the purchase of Lewis’s Bank with a branch in Scotland, makes

Martins a truly national bank. In the 1960s, the prudence of lending

practice and gentle but firm instilling of the savings habit gives the Bank

the cash to build newer and yet more lavish premises. In this section of “The Banks that Built

Martins” we look briefly at the publication of “Four Centuries of Banking”

Volume I (1963) and Volume II (1967), which superbly represents the story of

our bank. It is published to coincide

with the 400th anniversary of the establishment of a bank at the

sign of the Grasshopper in London’s Lombard Street, where our London Office

stands. The version of our Coat of

Arms seen here (above) is designed as part of the anniversary celebrations,

and signifies the establishment of banking in Lombard Street in 1563, and

that of the Bank of Liverpool in 1831.

Below, we have two features - The first is taken from Martins Bank

Magazine on the occasion of the publication of Volume I of “Four Centuries of

Banking”. The second, “The Golden

Grasshopper”, is from an information sheet produced by Barclays. In-between the huge family tree of Martins

is represented by a chart that is proudly displayed in EVERY branch and

office of Martins…

the culmination of the celebrations

held to mark our Bank's quater-centenary is the publication of its history.

Volume I of Four Centuries of Banking

by George Chandler, published

by Batsford, contains 572 pages,

including ninety-six plates in colour or black-and-white, and traces the

Bank's development in London and Liverpool.

Volume II, which it is hoped will be published in 1965, will be

concerned with the histories of the other constituent banks.Primarily, Volume

I is the story in human terms of the development of banking at the sign of

the Grasshopper on the site of the principal London Office of Martins Bank,

and also in Liverpool the culmination of the celebrations

held to mark our Bank's quater-centenary is the publication of its history.

Volume I of Four Centuries of Banking

by George Chandler, published

by Batsford, contains 572 pages,

including ninety-six plates in colour or black-and-white, and traces the

Bank's development in London and Liverpool.

Volume II, which it is hoped will be published in 1965, will be

concerned with the histories of the other constituent banks.Primarily, Volume

I is the story in human terms of the development of banking at the sign of

the Grasshopper on the site of the principal London Office of Martins Bank,

and also in Liverpool

It is not intended as an economic history. The 'money men',

goldsmith bankers and bankers who contributed to the development of Martins

Bank in London include Sir Thomas Gresham, 'Court banker' to Queen Elizabeth;

Edward Backwell, who rebuilt the Grasshopper after the Great Fire of London

and was special agent for Charles II; Charles Duncombe, 'the richest

commoner' in England, who welcomed William II and yet refused later to

advance money to him; and the Martins, from whom eight generations of bankers

have descended. The pioneers of

banking in Liverpool, who contributed to the development of Martins Bank as

the largest English bank with its headquarters still in the provinces,

include merchant adventurers like the Heywoods; and Sir William Brown, first

chairman of the Bank of Liverpool, and founder of Brown, Shipley and Company.

The private diaries of bankers and clerks have been quoted in some detail,

for these make the reader feel again what life was like in the past. It is

interesting to learn that Sir Thomas Gresham and his apprentices were

addicted to gambling, that Christmas money was an important source of income

for bank clerks for many years, that friction was often caused amongst clerks

by the rota for 'sleeping in', and that even in the staid Victorian era the

bottle proved to be the downfall of a number of bank clerks.

It is only in comparatively recent years that banking has become

a safe occupation. This volume produces much evidence of the great anxiety

caused to bankers by successive financial crises. A number of runs on banks

are described by contemporary diaries dating from the 17th century to the

20th. The alarms caused to bankers by the outbreaks of war, by rumour and by

very frequent fluctuations in the Bank rate, are vividly described. The

financial problems of to-day seem by comparison, to be less severe, although

the attacks on the pound, with which Sir Thomas Gresham had to contend four

hundred years ago, are still with us.

x

The Golden Grasshopper

The

sign of the grasshopper is one of the ancient shop signs of Lombard Street. It

is associated with Sir Thomas Gresham (d. 1579), Elizabeth I’s financial agent, who played

an important part in the development of English banking. Gresham persuaded

the Crown to cease borrowing from continental lenders and look to the London money- lenders

instead. Realising the potential contribution of the Lombard Street merchants to the

national wealth he established the first Royal Exchange (opened by the Queen

in 1571), as a meeting place for their business.

x

CARVED WOODEN

SHOP SIGN, BELIEVED TO BE FROM THE PREMISES AT 68 LOMBARD STREET

REBUILT FOLLOWING THE GREAT FIRE OF 1666.

THE GRASSHOPPER WAS PROBABLY ORIGINALLY GILDED.

x

Gresham

was a wool merchant who also began a goldsmith business around 1563. He adapted his family crest, a grasshopper

in gold, as his shop sign in Lombard

Street.

The grasshopper was used after Gresham’s

death by successive goldsmiths on the same site - 68, Lombard Street. These early

partnerships evolved into Martins Bank, which became one of the modern

clearing banks and was brought into the Barclays Group in 1969.

Like

Barclays, Martins developed from a London goldsmith’s

business - the first Martin partner was Thomas in 1703. Its customers were commercial rather than

personal. Despite a serious ‘run’ on

its reserves in 1890 during the Baring crisis Martins survived and became a

limited company in 1891. It began to expand as a clearing bank with a few

branches, but its main development came after 1918 when it amalgamated with

the Bank of Liverpool - founded in 1831 as

one of the first English joint-stock banks. Thereafter expansion was rapid.

By 1926 there were 378 branches, but only 28 were in London and the south. Head Office (rebuilt 1932), remained at Water Street in Liverpool (Martins was unique in this respect), and 68 Lombard Street

(rebuilt 1930), became the principal London

office. Foreign exchange was an

important part of the Bank's business at this time, especially in the

industrial north where goods were imported and exported on a large scale.

Martins

strengthened its position further in the north of England by acquiring the

Lancashire & Yorkshire Bank in 1928. Steady expansion across the country

followed, despite falling profits during the Depression, so that by 1939

there were 570 branches. World War II brought Martins the honour of storing Britain's

gold reserves in the Liverpool strong rooms.

During the 50s and 60s Martins gained a reputation as a modern innovative

bank, moving into hire purchase in 1958 by acquiring Mercantile Credit,

matching the ‘swinging’ mood of the 60s in its advertising, and being only just behind Barclays in its experiments

with computerisation and cash machines*. The other interesting

acquisition in 1958 was the business of Lewis's department store bank,

another Liverpool enterprise started in 1928

and with branches in all the Lewis's shops and at London Selfridges.

Like

Barclays, Martins had a decentralised structure based on District Boards and

Offices. By 1968 Martins was the sixth largest clearing bank, with more than

700 branches. Nonetheless it remained too small to survive independently, and

was still largely a northern bank in terms of its high street presence. At first a MERGER with Barclays and Lloyds was

proposed but the government opposed this idea of a ‘super bank’ and in 1968 Martins

agreed to be taken over by Barclays, being fully absorbed by the end of

1969. The official COAT

OF ARMS of Martins Bank combined the

golden grasshopper, representing the original Martins partners in Lombard

Street, with the liver bird representing the Bank of Liverpool.

*This

is not quite true, as Martins is the first UK bank to declare publicly that a

COMPUTER is

used for the purposes of regular daily bookkeeping across a network of its

branches and Martins is also the first bank to install a CASH MACHINE

which uses the principle of CARD and PIN as we know it today.

M M

|

![]()

![]()