|

Martins Bank is first – or almost first – with a number of banking services and

technologies, which is not bad going, when you consider the competition from

the other major banks in the UK. As

the largest of the “small six” clearing banks of the 1960s, Martins can use

its relatively large network of branches and its other interests, in

securities, executor and trustee, unit trusts etc., to act like some of its

larger rivals, taking risks with innovation and new technology to expand both

the size of the Bank, and the range of services it can offer to its

customers. On this page we look at some of these “firsts”, and if you would

like to know more about any of them in particular, simply click on the

leaflet image at the beginning of each section… Martins Bank is first – or almost first – with a number of banking services and

technologies, which is not bad going, when you consider the competition from

the other major banks in the UK. As

the largest of the “small six” clearing banks of the 1960s, Martins can use

its relatively large network of branches and its other interests, in

securities, executor and trustee, unit trusts etc., to act like some of its

larger rivals, taking risks with innovation and new technology to expand both

the size of the Bank, and the range of services it can offer to its

customers. On this page we look at some of these “firsts”, and if you would

like to know more about any of them in particular, simply click on the

leaflet image at the beginning of each section…

|

1959

The

curse of being first…

First to use a computer to process day to day banking transactions

YOU CAN READ MORE

HERE:

|

Being first to do something does have its

drawbacks. Martins themselves would

surely have acknowledged that having been first to use a computer soon left

them lagging behind, as the other banks also explored possibilities and

faster, more capable computers and equipment became available. This problem

affects many banks well into the 1990s - fitting out an entire branch

network with computer equipment that very quickly goes out of date, is

hugely expensive – consequently the shabby looking computer terminals you

might have seen in YOUR bank look like that because they are being used way

beyond their expected shelf life.

Repair companies make a fortune by trying to keep these systems

running, and despite advances in computer software, programs still need to

be written in a way that the older equipment can still understand.

How Martins actually achieves a first with computers is a fascinating

story, and we are grateful to our colleague Peter Hayes who actually worked

on Pegasus, the computer shown above – for telling us about it. Martins

Bank’s tradition of being first with things is spoiled on home territory,

when another bank dares to open the country’s first drive-in branch in

Liverpool itself. How Martins actually achieves a first with computers is a fascinating

story, and we are grateful to our colleague Peter Hayes who actually worked

on Pegasus, the computer shown above – for telling us about it. Martins

Bank’s tradition of being first with things is spoiled on home territory,

when another bank dares to open the country’s first drive-in branch in

Liverpool itself.

Those in charge at Martins are beside themselves

with rage, and determined not only to open a better one, but to immediately

be first in banking to introduce something else – in fact ANYTHING else, it

doesn’t really matter what. A board

meeting is held and someone suggests computers – the fight back begins, and

results in the arrival of Pegasus.

The winged horse is, however, not it all it is cracked up to be, and

you can read more about this, and Peter Hayes’ involvement with the

computer on our Pegasus II page.

|

|

|

|

|

|

1967

Racing

to be first:

The World’s first cash machine to

Use a plastic card and PIN…

YOU CAN READ MORE

HERE:

|

Barclays and Martins are neck and neck in the

race to bring us the world’s first cash machine. That the race is won by

Barclays, five months ahead of its rival is still seen as no setback at all

by Martins, who proudly promote their

machine as the first cash machine in the North of England. There is,

however an even bigger claim to fame here - the Barclays machine is at

first operated by special cheques dotted with holes which have to be

matched onto pins inside a drawer.

Martins is first to use a plastic card and a personal identification

number together.

Despite the two banks using different manufacturers, the workings of

the two machines are surprisingly similar.

The customer is issued with a stock of special chemical cheques or

plastic cards and a code number. Despite the two banks using different manufacturers, the workings of

the two machines are surprisingly similar.

The customer is issued with a stock of special chemical cheques or

plastic cards and a code number.

Used together, these will unlock a drawer

providing access to a small pack containing ten one-pound notes. Perhaps a clumsy system compared to what

we have today, but nevertheless it was ground-breaking for the time it was

introduced.

We will have to wait at least another twenty

years for anything that will resemble a more electronic system, from any of

the banks… Barclays’ later attempts produce a credible ATM that is a cross

between a one-armed bandit and a cash machine, where customers’

instructions appear behind a window courtesy of a large roller that spins

backwards or forwards to the relevant passage of text. Sometimes the roller gets stuck or only

reveals part of the instructions through the window. Happy days!

|

|

|

|

|

|

1959

First with innovation

The first drive-in bank?

YOU CAN READ MORE

HERE:

|

This is one of Martins’ most successful (and

certainly most well publicised) firsts. It is also one that really hasn’t

been seen much since. It’s amazing

what rivalry can achieve – one of the Bank’s competitors dares to open a

drive-in branch in Liverpool (what cheek!) and Martins retaliates by

becoming the first Bank to use a computer to process daily work. It also

opens a lavish drive-in Bank in Leicester, AND engages the services of the

Minister for Transport himself to open it!

There is no doubt, that by these actions, and as the leader of the

“small six” Banks, Martins wants its customers and its competitors to take

it seriously.

It is a shame that this original drive-in bank did not fully catch

on, despite lasting until the late 1980s. Banks still experimented with the

idea, but with payment methods developing at a more rapid pace, the cash

machine put paid to ideas of any large-scale development of drive-ins. It is a shame that this original drive-in bank did not fully catch

on, despite lasting until the late 1980s. Banks still experimented with the

idea, but with payment methods developing at a more rapid pace, the cash

machine put paid to ideas of any large-scale development of drive-ins.

In the high-tech gadget filled twenty-first

century, despite our willingness to queue in our cars for ages at any

number of cardboard fast-food outlets, we don’t seem to need the novelty

and excitement that captured first Leicester, and later Epsom – using a

large, purpose-built Drive-In Bank.

Certainly much more than an experiment, banking with Martins by car

is a popular thing to do over the ten-year period 1959-1969, and thanks to

Barclays, it survives until the late 1980s…

|

|

|

|

|

|

1959

Unwaith eto,

diolch yn fawr?

First bank in the UK to issue English/Welsh bilingual stationery…

YOU CAN READ MORE

HERE:

|

With branches in both North and South Wales, Martins

takes an active interest in the culture of Wales, and takes seriously the

matter of employing managers and staff who can speak both Welsh and

English. This poster from 1960 shows

the Bank’s involvement in the annual Eisteddfod, and in 1965, Cardiff

Branch seizes the initiative and produces the Uk’s first bilingual cheques… With branches in both North and South Wales, Martins

takes an active interest in the culture of Wales, and takes seriously the

matter of employing managers and staff who can speak both Welsh and

English. This poster from 1960 shows

the Bank’s involvement in the annual Eisteddfod, and in 1965, Cardiff

Branch seizes the initiative and produces the Uk’s first bilingual cheques…

Through

Cardiff Branch, the Bank has achieved another FIRST with the issue of the

first bilingual cheques in Britain. The cheques, each printed in both

English and Welsh, are drawn on an account opened by the Urdd movement for

the Urdd National Eisteddfod, being held this year in Cardiff. The Movement is a youth organisation,

founded in 1922 to foster, among other things, an interest in Wales and its

culture, and the Urdd National Eisteddfod is to the young people of Wales,

what the National Eisteddfod is to the adults. Among the Movement’s patrons is the Lord

Lieutenant of Glamorgan, Sir Cennydd Traherne, T.D., of

our South Western Board. Through

Cardiff Branch, the Bank has achieved another FIRST with the issue of the

first bilingual cheques in Britain. The cheques, each printed in both

English and Welsh, are drawn on an account opened by the Urdd movement for

the Urdd National Eisteddfod, being held this year in Cardiff. The Movement is a youth organisation,

founded in 1922 to foster, among other things, an interest in Wales and its

culture, and the Urdd National Eisteddfod is to the young people of Wales,

what the National Eisteddfod is to the adults. Among the Movement’s patrons is the Lord

Lieutenant of Glamorgan, Sir Cennydd Traherne, T.D., of

our South Western Board.

|

|

|

|

|

|

1960

First service…

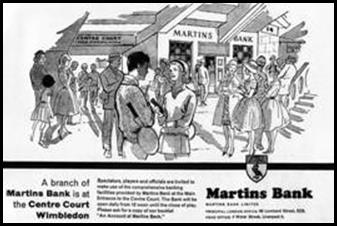

First to operate a sub branch on Centre Court at Wimbledon…

YOU CAN READ MORE HERE:

|

Martins Bank’s Branches can not only be found in

practically every town, but also in a number of RAF stations, a hospital,

the British Wool Marketing Board, the NORGAS Building, an abattoir,

universities and numerous cattle markets. Martins Bank’s Branches can not only be found in

practically every town, but also in a number of RAF stations, a hospital,

the British Wool Marketing Board, the NORGAS Building, an abattoir,

universities and numerous cattle markets.

Taking banking to the workplace

is a popular move, and leads to the building of a permanent branch at the

Great Yorkshire Show Ground. Around the country, Martins serves the workers

at Aylesford Paper Mills near Maidstone, and at many other locations

including, industrial estates, a colliery, a corn exchange, ICI Wilton

Works, and a couple of railway stations. Notwithstanding that, there is

even a branch at the British Wool Marketing Board site at Kew Bridge!

Martins Bank also enjoys many prime sites in

well to do parts of London. None, however, is a more prestigious, or

perhaps strange choice for a branch location than the Centre Court at

Wimbledon – a top prize indeed for any bank. That top prize comes Barclays’

way in 1969, and they waste no time in associating themselves (through

advertising) with the sub branch at least a year before it actually becomes

a branch of Barclays. Banking on Centre Court continues for several years

more, including in that time from a competitor bank that has managed to

open its own sub branch there. Martins Bank also enjoys many prime sites in

well to do parts of London. None, however, is a more prestigious, or

perhaps strange choice for a branch location than the Centre Court at

Wimbledon – a top prize indeed for any bank. That top prize comes Barclays’

way in 1969, and they waste no time in associating themselves (through

advertising) with the sub branch at least a year before it actually becomes

a branch of Barclays. Banking on Centre Court continues for several years

more, including in that time from a competitor bank that has managed to

open its own sub branch there.

|

|

|

|

|

|

1960s

First

to make a splash…

Leading an advertising revolution?

YOU CAN READ MORE

HERE:

|

Martins Bank is quick to recognise – and

take seriously – the potential savings and borrowing powers of young

people. Until the advent of the 1960s teenager with

surplus cash to spend, Martins’ advertising is distinctly – yet beautifully

– plain. In keeping with the Bank’s

tradition of commissioning fine artists, the copy from the 1940s and 1950s

consists almost exclusively of grey images, usually sketch drawings of

British towns, cities and landmarks. Martins Bank is quick to recognise – and

take seriously – the potential savings and borrowing powers of young

people. Until the advent of the 1960s teenager with

surplus cash to spend, Martins’ advertising is distinctly – yet beautifully

– plain. In keeping with the Bank’s

tradition of commissioning fine artists, the copy from the 1940s and 1950s

consists almost exclusively of grey images, usually sketch drawings of

British towns, cities and landmarks.

The idea, is that people will associate the Bank

with the fine traditions of the places where it trades, and is also a

throwback to the times of the many small local banks that eventually came

together to form Martins itself.

Martins realises that young people, particularly those in work, but

importantly those in further and higher education have, or will soon have,

power over their own money, and the ability to save and borrow responsibly.

Almost overnight, the Harold Wilson generation causes a major rethink of

the Bank’s advertising policy, and with it, another first – stylish ads,

evocative of the moment, each with a clear message – the CUSTOMER is king, in control of his or her own finances,

and there is no better bank than Martins to help them achieve what they

wanted in life. Sheer genius.

|

|

|

|

|

|

1918

to 1969

Bucking

the trend…

Operating a full national network of branches from a Head Office OUTSIDE London

YOU CAN READ MORE

HERE:

|

The amalgamation in 1928 of the Bank of Liverpool and Martins with

the Lancashire and Yorkshire Bank sparks the exponential growth of the new

Martins Bank – a bank that is proud to be based in Liverpool, NOT London. The amalgamation in 1928 of the Bank of Liverpool and Martins with

the Lancashire and Yorkshire Bank sparks the exponential growth of the new

Martins Bank – a bank that is proud to be based in Liverpool, NOT London.

Opulence, decadence, and a strong defiance of a

financial system that automatically assumes “London-centric” is the only

option for a financial institution, Martins has these qualities in

abundance, and demonstrates them to the full in the construction of what is

still  one of the most lavish and ostentatious bank buildings ever seen in

this country. one of the most lavish and ostentatious bank buildings ever seen in

this country.

To top it all, Martins’ wonderful and

breath-taking Head Office at 4 Water Street Liverpool, couldn’t be further

away from London, the traditional centre of British Banking.

Although Martins Bank does also operate from

splendid and large premises at 68 Lombard Street London, they are only ever

referred to as London Office, and nothing more. It is therefore a particularly sad

moment, when Martins Bank merges with Barclays whose head office is in

London and Martins’ home city of Liverpool becomes just another outpost of

a larger and more sprawling enterprise with more than 5000 offices around

the world…

|

|

|

|

|

|

1948

The

Bank on Wheels…

… launches an entire FLEET

of

mobile branches!

YOU CAN READ MORE

HERE:

|

Now here’s an idea that’s gone round the block a few times and come

around again: - taking the bank to the customer – “another way” to bank –

“now there’s a thought…” Today’s mobile banks, converted from those

smaller town and city buses, bear little resemblance to their 1948

counterparts, but still fulfil more or less the same role. Today however,

there is also the sheer cheek of expecting customer loyalty from those

whose permanent branch you took away in the first place! Now here’s an idea that’s gone round the block a few times and come

around again: - taking the bank to the customer – “another way” to bank –

“now there’s a thought…” Today’s mobile banks, converted from those

smaller town and city buses, bear little resemblance to their 1948

counterparts, but still fulfil more or less the same role. Today however,

there is also the sheer cheek of expecting customer loyalty from those

whose permanent branch you took away in the first place!

Today’s modern vehicles seem to lack the charm of the originals,

which in Martins’ day have to be towed by land rovers, and evoke the

nostalgic suggestion of a weekend’s caravanning in Snowdonia. At the height of what Martins refers to

as “Show Season”, a fleet of six mobile caravans tours England Wales

Scotland, the Isle of Man and the Channel Islands, attending every kind of

agricultural, sporting and industrial show. A complicated arrangement of

preferred hotels and flower shops means that Martins Bank often wins awards

for the presentation of its mobile caravans at the eighty or shows they

attend each year. There are times

when a mobile branch is not appropriate, so a trade stand is used instead. The mobile caravans are also used to

bring banking to local housing estates, and in the late 1960s a

prefabricated branch is used to attract customers in areas where a new

branch of the Bank is currently being constructed. Today’s modern vehicles seem to lack the charm of the originals,

which in Martins’ day have to be towed by land rovers, and evoke the

nostalgic suggestion of a weekend’s caravanning in Snowdonia. At the height of what Martins refers to

as “Show Season”, a fleet of six mobile caravans tours England Wales

Scotland, the Isle of Man and the Channel Islands, attending every kind of

agricultural, sporting and industrial show. A complicated arrangement of

preferred hotels and flower shops means that Martins Bank often wins awards

for the presentation of its mobile caravans at the eighty or shows they

attend each year. There are times

when a mobile branch is not appropriate, so a trade stand is used instead. The mobile caravans are also used to

bring banking to local housing estates, and in the late 1960s a

prefabricated branch is used to attract customers in areas where a new

branch of the Bank is currently being constructed.

|

|

|

|

|

|

1968

First

to feel the crunch?

YOU CAN READ MORE

HERE:

|

There have been a number of theories as to why

Martins Bank, at the height of its success, merges with Barclays, not least

that the Bank of England is made nervous the rapid expansion of Martins

Bank and by its lavish spending on new branches and services.

It could well be, that Martins’ very success,

has itself become a heavy weight around the Bank’s neck: Servicing the lending requirements of

such major customers as a pools company, an airline and a world-renowned shipping

line, often sends Martins to other banks to borrow money – a

compelling argument, perhaps, for a merger?

By 2024, Barclays has reduced its network of

branches from a once record figure of around 5000, to just 200. Of the 730 or so branches of Martins Bank

taken on by Barclays at the time of the merger in 1969, just 8 remain at

the end of 2024.

|

|

![]()

![]()